RBNZ Preview: Hold now, bigger cuts later?

It is a very close call, and consensus is split between a 25bp cut and a hold by the Reserve Bank of New Zealand on 14 August. However, we are inclined to think the RBNZ may still prefer to wait for the Fed to move first amid lingering non-tradable inflation concerns, and perhaps deliver a 50bp cut in October. The alternative scenario is probably a “hawkish” cut

Non-tradable inflation concerns haven’t abated

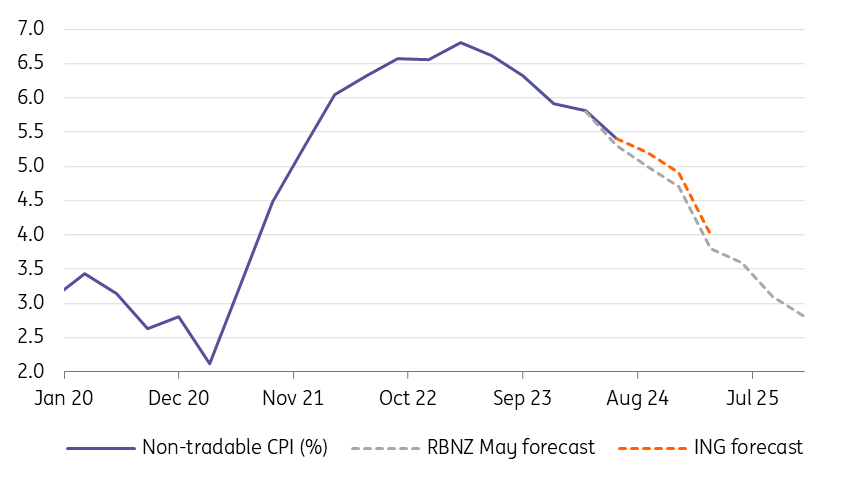

Since the RBNZ's 10 July meeting, second quarter data for inflation and employment have been released in New Zealand. Headline CPI slowed slightly more than expected from 4.0% to 3.3% year-on-year, but non-tradable CPI still grew at an above-consensus 0.9% quarter-on-quarter, translating into a YoY slowdown from 5.8% to 5.4%.

Non-tradable CPI has slowed less than the RBNZ expected

It’s quite useful to compare those figures against the latest RBNZ projections (published in May). Headline inflation was 0.3% below the RBNZ 3.6% projections, but 5.4% for non-tradable CPI was above the RBNZ’s 5.3% estimate for 2Q. We forecast non-tradable inflation at 5.2% in 3Q against the RBNZ’s 5.0%. Remember that as part of those May forecasts the policy rate was expected at the current 5.50% or above until mid-2025.

RBNZ and ING's projections for NZ non-tradable CPI

The jobs market loosened in New Zealand in the second quarter, but at a slower pace than the RBNZ and consensus had expected. Unemployment rose to 4.6% in line with the RBNZ projections, but that was driven entirely by a surprise rise in the participation rate, as employment bounced back from -0.3% to 0.6% QoQ. Average hourly earnings slowed from 4.8% to 4.0% YoY, above the RBNZ’s 3.8% estimate.

But markets have swung to the dovish side

The NZD OIS curve prices in 91bp of easing over the last three meetings of 2024, with 20bp for the August meeting. That appears too dovish when only considering the inflation and jobs picture, but is explained by three other factors:

- Fed pricing. Markets are cementing bets that the Fed will cut by at least 100bp by year-end, adding pressure across most developed central banks to follow suit.

- July’s dovish turn. The RBNZ surprised with a dovish tilt at the July meeting. No new projections were published then, but policymakers sounded significantly more optimistic on disinflation and hinted the policy rate would be lowered in line with the expected decline in inflation.

- Growth concerns. Markets are expecting the RBNZ to frontload easing as the domestic and external growth outlook deteriorates after NZ emerged from recession in 1Q24. The risks associated with a potential Trump presidency and hard-line protectionism are particularly acute for New Zealand.

We narrowly favour a hold

The RBNZ has a lower frequency of policy meetings (seven a year) compared to the Fed and the RBA (eight) and New Zealand is the only G10 country that does not publish monthly, but only quarterly inflation and jobs market figures. Incidentally, RBNZ members rarely discuss policy outside of meetings, making it hard to gauge the evolution of internal consensus on policy.

Some analysts see the fact that the next RBNZ meeting is only on 9 October as an incentive to start cutting now, before the Fed delivers its largely anticipated first cut in September. Should this be the case, the RBNZ may however be quite cautious in signalling more cuts ahead. The new rate projections may signal somewhere between one and two more cuts by year-end.

New rate projections may show 1-2 cuts by year-end

While admitting it is a very close call, we continue to see a hold as slightly more likely. The RBNZ’s remit was recently changed to focus solely on inflation, and while headline CPI is seen reaching the 1-3% target by year-end, non-tradable CPI and wage growth both came in above the RBNZ’s latest estimates. Policymakers may not be enthusiastic about the loosening in domestic financial conditions and since a big deal of pressure to cut comes from Fed’s rate expectations, they can hold for another couple of months while awaiting US data inputs and the September FOMC meeting.

The RBNZ can hold now and perhaps cut 50bp in October, achieving a similar result but without the risk of jumping the gun on easing. NZ CPI and employment figures for 3Q won’t be available before the 9 October RBNZ meeting, but other soft data will allow to make a more educated guess on inflationary developments.

Our call is a hold in August, accompanied by a dovish statement signalling easing by year-end. The policy rate forecast may include one or two rate cuts in second half 2024. That can cause markets to trim the aggressive (91bp) easing bets for the year-end. We forecast a 50bp cut in September and a 25bp in November by the RBNZ, although sticky non-tradable inflation means risks are skewed to 50bp in total by year-end, rather than 100bp.

NZD/USD has upside potential

The Kiwi dollar has depreciated over 2% vs USD in the past month on the back of the equity market turmoil, some positioning ahead of the US election risk and the dovish repricing in RBNZ rate expectations.

However, the two-year NZD:USD swap rate gap has rebounded around 25bp since late July, and is now at +22bp. Our fair value model, which includes global equity markets as an explanatory variable, places the short-term equilibrium level for NZD/USD at 0.650.

NZD/USD is undervalued in the short term

If we are right with our call on the RBNZ, and markets price out some easing in the NZD swap curve, that short-term fair value may get to 0.610, which is our target for NZD/USD for the latter part of the summer. Risks related to the US election may keep a lid on the pair from October on, but until then, Fed easing and a stabilisation in sentiment will favour high-beta currencies like NZD, in our view.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article