RBNZ Preview: 50bp hike but risk of a dovish tilt

The Reserve Bank of New Zealand is likely to hike by another 50bp in August. However, a worsening economic picture and rapidly falling house prices suggest we could see a revision lower in the rate path projections. With the RBNZ increasingly seen as a test case for other central banks, global markets will keep a close eye on any dovish tilt

Time to turn less hawkish?

On 17 August, the Reserve Bank of New Zealand will announce monetary policy and will release its updated economic and policy rate forecasts. May’s projections suggest that we should see another 50bp hike (bringing the OCR to 3.0%) in August, and this is both our base-case scenario and what markets/consensus are expecting.

CPI figures for 2Q – released shortly after the latest RBNZ 50bp hike in July – showed another above-consensus acceleration in headline inflation (from 6.9% to 7.3%), and we also witnessed an unexpected jump in wage growth in the same quarter (2.3% quarter-on-quarter). Since the RBNZ narrative has so far been firmly centred on fighting inflation, another half-point move in line with the latest rate guidance seems all but appropriate.

However, the case for a re-tuning of the current hawkish stance by the RBNZ is growing stronger, with the two main causes for concern being the growth outlook and the housing market: we discuss them in detail below.

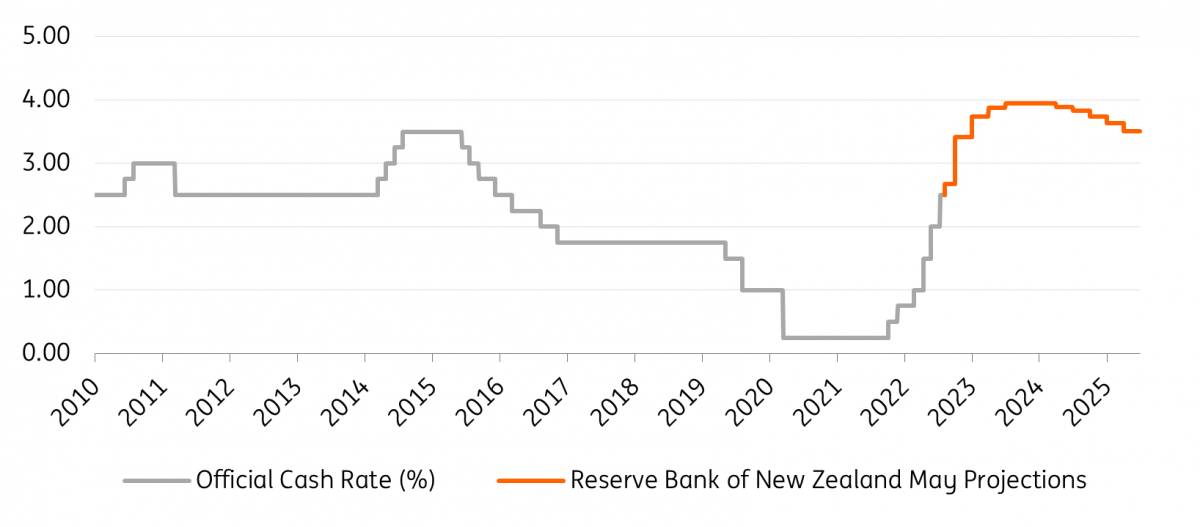

In our view, the risk of a revision lower in the rate projections at the August meeting is elevated. The RBNZ is currently forecasting a terminal rate of around 4.0% by mid-2023 (chart below), which is starting to look less realistic. We may see 25bp or 50bp being trimmed off the terminal rate projections and/or rate cuts being added sometime in 2023, in what would be a de-facto dovish shift. Alternatively, the Bank may keep rate projections unchanged (at the risk of losing some credibility) to avoid an unwanted impact on inflation expectations. A revision of the rate path later in the year would at that point be quite likely.

RBNZ projects a terminal rate close to 4%

Growth outlook getting grimmer

New Zealand’s economic outlook has indeed deteriorated in recent months. Despite not having many high-frequency indicators like other developed economies, consumer confidence indicators are all below the 2008 lows, employment growth was zero in 2Q, and the unemployment rate has inched up from 3.2% to 3.3%.

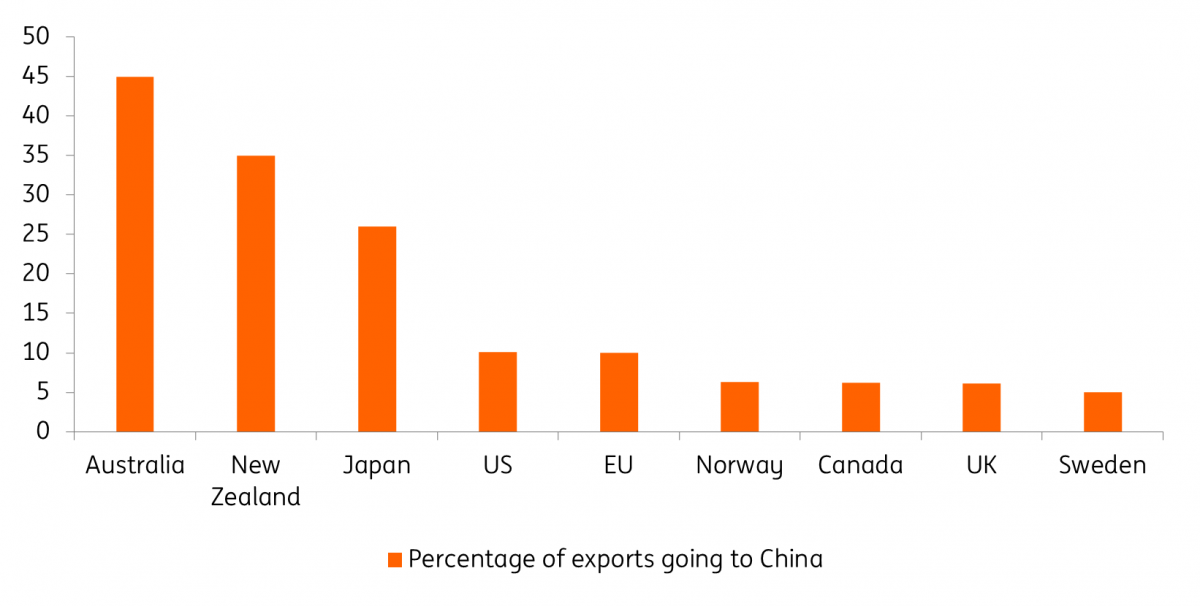

The external environment is looking quite challenging too, as China’s economic slowdown after periods of Covid restrictions is set to have significant implications for New Zealand, which is second most dependent on China for exports in the G10.

High exposure to a China slowdown

We think the RBNZ's assessment of the economic outlook – and consequent policy adjustments – will take into consideration the worsening global picture and risks of weaker Chinese demand. However, should the Bank decide to stick to a more hawkish tone to fight inflation and hold a more optimistic stance on the economy for now, policymakers could point to the reopening of New Zealand’s borders as a key factor that could help to avert a recession.

After all, tourism accounted for around 9-10% of GDP before the pandemic, and that number shrank to 5% in 2020-2021 as foreign visitors were banned, leaving some sizeable room for recovery. Foreign students’ education is also a major contributor to the New Zealand economy and may start to rebound.

The housing dilemma

It’s hard to see many silver linings in the housing situation in New Zealand. The RBNZ was probably pushed to start tightening earlier to curb ballooning house prices (housing affordability was added to the remit last year), but the Bank is now facing the risk of an excessively fast contraction in prices and the implications for the broader economy are obviously very significant.

New Zealand’s house price index had fallen 2.5% over the last three months to July 2022 – the largest quarterly fall since October 2008. This was partially due to new government policies increasing the flow of housing stock and the decrease in demand for properties.

On the supply side, residential building consents have continued to rise steadily in recent months. Recent government measures are strongly favouring new builds by only allowing these properties to offset interest costs against rental income and tightening loan-to-value ratios for all other property types. As of 2Q22, new building consents were rising by 19% year-on-year.

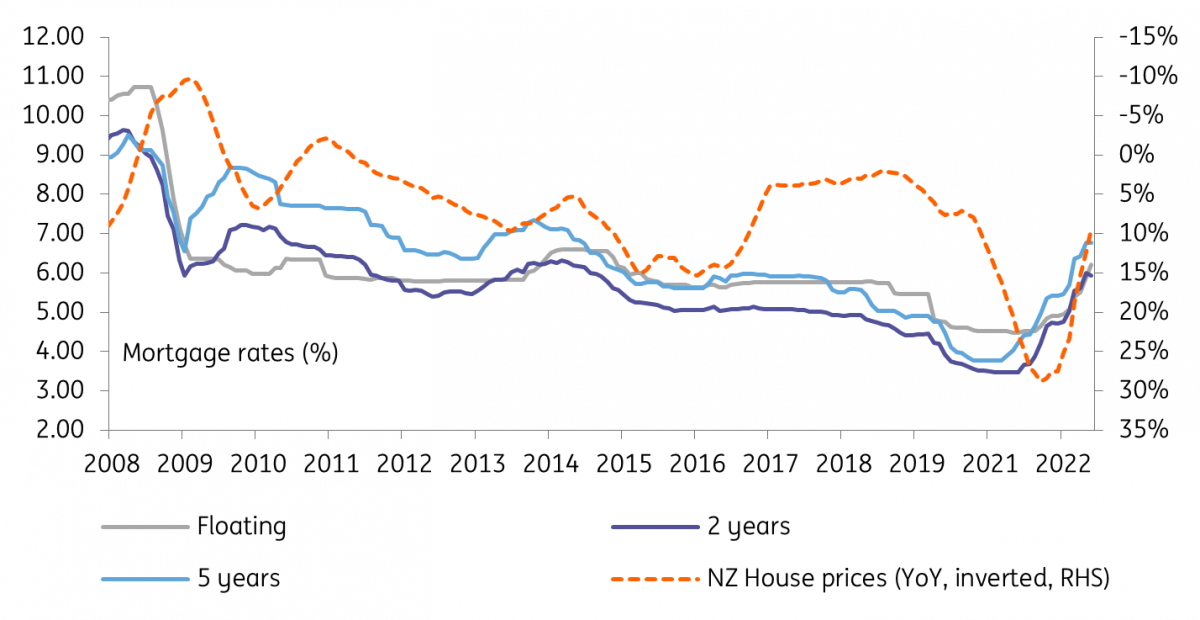

On the demand side, consumer appetite for housing is decreasing as consumer confidence remains weak. According to the Bank Balance Sheet Survey by the RBNZ this April, currently, about 48% of existing loans are fixed and due to re-price within the next 12 months. 2-year and 5-year fixed mortgage rates have risen by 120-130bp since December, suggesting great cost pressure on households.

Mortgage rates on the rise

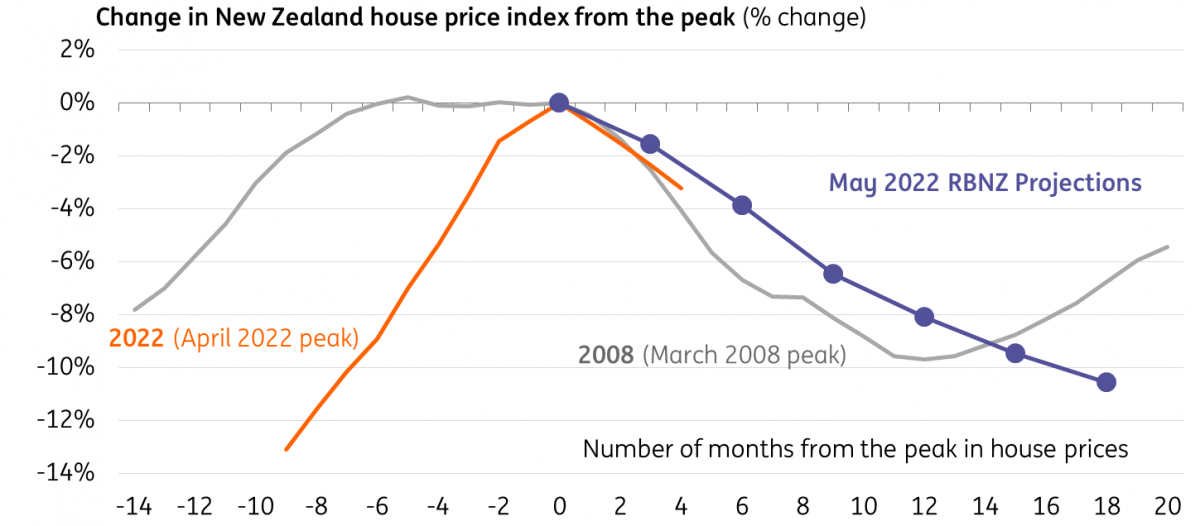

A major question for monetary policy purposes is whether housing prices are falling too fast. The latest data for July suggests that the ongoing contraction from the peak is slightly faster than what was expected by the RBNZ in the May Monetary Policy statement projections. Back then, the RBNZ stated an additional 16% decrease would be needed to bring housing prices back to pre-pandemic levels. This would mirror what had happened during the Global Financial Crisis – housing prices at the trough in 1Q of 2009 were equivalent to the 3Q 2006 level.

House price drop: too fast for comfort?

FX impact may go beyond NZD

With the RBNZ seen increasingly as a test case for other central banks that are facing a similar growth-inflation dilemma, expect a greater deal of focus on this meeting from markets, and we wouldn’t exclude some potential implications beyond the New Zealand or Australian markets if the RBNZ turns less hawkish.

Looking at NZD/USD, we think it may come under renewed downside pressure ahead of the August RBNZ meeting, with most of the market reaction likely to be triggered by any tweaks to the rate path projections given that 50bp is fully priced in. While the Kiwi dollar can continue to count on the most attractive carry in the G10, we suspect more instability in global risk sentiment may delay any benefits for high-yielding currencies to 4Q or the start of 2023.

We think NZD/USD could sink back to 0.62 by the end of this quarter, before starting to turn higher later this year and touch 0.64 by year-end.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article