RBA’s March minutes reinforce “Lower for longer” view

Reserve Bank of Australia (RBA) minutes for the March rate meeting echo recent remarks by Governor Lowe, suggesting that there will be no rate increases for a considerable time, at least, not until wages reach 3%, and that is not expected until 2024. Bond yields have fallen in response to these minutes and comments, but we don't expect this to last

| 3% |

Wages growthRequired for rates to rise |

Minutes reinforce lower for longer

Following a bond-bashing speech on March 10 by Reserve Bank of Australia Governor Philip Lowe, the minutes of the March RBA meeting reinforce his recent message of "lower for longer".

The minutes dismissed ideas that rising commodity prices might translate into sustained higher prices as long as there remained substantial slack in the rest of the economy, in particular labour markets and wages. Perhaps the key phrase from the minutes is this "The international experience prior to the pandemic had underscored that a sustained period of tightness in labour markets would be needed in order to generate increases in wages growth, and, even then, would put only limited upward pressure on consumer price inflation". Even this was seen as a necessary but not sufficient condition for a sustained increase in inflation, as "Even if wages growth did pick up, it was also possible that corporate profit margins in some economies could absorb an increase in labour costs before firms passed such costs through to final consumer prices".

In his speech on March 10th, Philip Lowe put further meat on the bones of this economic slack idea, noting that to see inflation rising to the RBA's inflation target (mid-point of 2-3% range) would likely require wages growth of 3%, and the current rate was only 1.4% and remained close to historical lows in many industries. This 3% level for wages was repeated in the March minutes and was thought to be unlikely to occur until 2024.

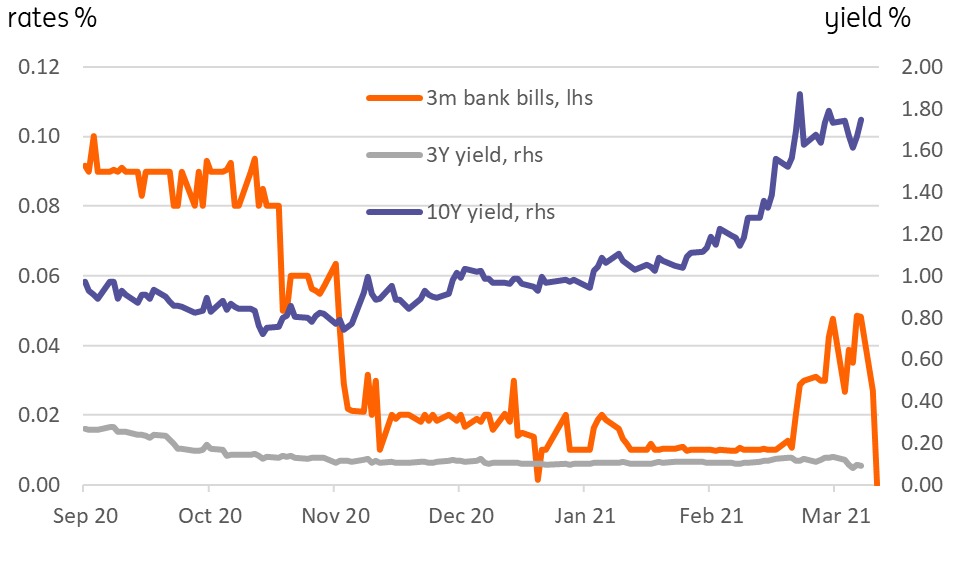

Australian rates and bond yields (%)

Bond response

What is very clear is that the RBA does not intend to change the cash rate target in the near term, or even by the end of 2022, as they allege some markets have been recently pricing. It is also very clear that they are unhappy both with the pressure on the 3Y government bond yield which they stepped in recently to lower back below its 0.1% target and also with longer-dated bond yield increases, which they view as exerting an unwelcome tightening of financial conditions.

What is less clear is whether there is much they can do about the increase at the longer end of the yield curve (anything above 3Y) without resorting to more aggressive measures, such as extending their current yield curve control policy for no more than 0.1% yield on 3Y government bonds.

That is because, like most bond markets, the Australian government bond market takes its cues from the world's deepest and most liquid capital market - that of US Treasuries. And ahead of this week's FOMC meeting, the US Federal Reserve has indicated fairly clearly that they are not that bothered by recent yield increases. Here, we don't think bond yields of 10Y US Treasuries have yet seen their peak, and are forecasting 1.75% by the end of 2Q21 and 2% by the end of 3Q2021.

Our US Treasury forecasts would only restore US bond yields to roughly what they were yielding pre-Covid, and also like Australia, against a backdrop of rising inflation (mostly, though perhaps not entirely transitory) plus a big boost from fiscal policy, with more probably on its way later in the year related to US infrastructure spending.

We doubt that the RBA can do much beyond inject a little 2-way risk into the Australian government bond market by their regular verbal interventions, and even active asset purchase policies unless they change the rules of the game and expand their yield curve control actions. We don't expect that to happen.

So in short, yes, we agree, there is nothing likely on cash rates, though we would not rule out a 2023 hike, because we would also not rule out the Fed hiking by 2023 either, and not being ahead of the Fed seems important to the RBA. But this doesn't mean that Australian bond yields can not rise further. By maintaining a slight positive spread over US treasuries (currrent spread is about +11bp), we can see the Australian 10Y at 2.25% by the year-end.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article