Rates: Why the core rates are being slowly released

Some of the factors holding core rates down have subsided, and there has been a clear shift in central bank thinking. There are a number of things at play pointing to high rates, but it’s never straightforward. However, it does seem that the waters are finally parting in the direction of a further nudge higher in rates

Some of the factors that had been holding core rates down have subsided.

Ever since Turkey hiked rates, a few weeks back, sentiment has turned more positive there, and slowly investors have uncoiled extreme risk hedges. This has coincided with a more positive tone across emerging markets, meaning less need to park cash in the core markets like Treasuries.

After a run of troubling weeks for Italy which peaked with the posting of a 2.4% deficit target (should have been sub-2%) alongside blasé and sometimes provocative commentary, finally the choice of words from Rome turned more constructive and conciliatory. Hence Bunds have lost a residual bid too.

On top of that there has been a shift in central bank thinking:

Following the latest Federal Reserve hike, Fed chair Jerome Powell has asserted that policy is no longer ‘accommodative’. Initial reaction to this was bullish for bonds, but on reflection, it is clear that Powell has simply stated that rates are now neutral. But the brakes still need to be applied, so the rate hike cycle continues.

A week before that, ECB president Mario Draghi surprised everybody with his observation that core inflation was seeing a ‘vigorous’ pickup. This has been partly walked back by other ECB members, but it’s out there now. Draghi appears to be preparing for a step away from extreme dovishness, even if not ready to be outright hawkish just yet.

Investors are paring duration risk and positioning for higher rates

Then on a technical front, there are a number of items in play that point to higher rates.

Latest fund flows show that investors have been reducing risk, at least as far as their core bond holdings are concerned. They’ve been nibbling in emerging markets, but have been selling belly and long end investment-grade funds. They are effectively positioning for higher rates.

Change in developed markets assets under management (%)

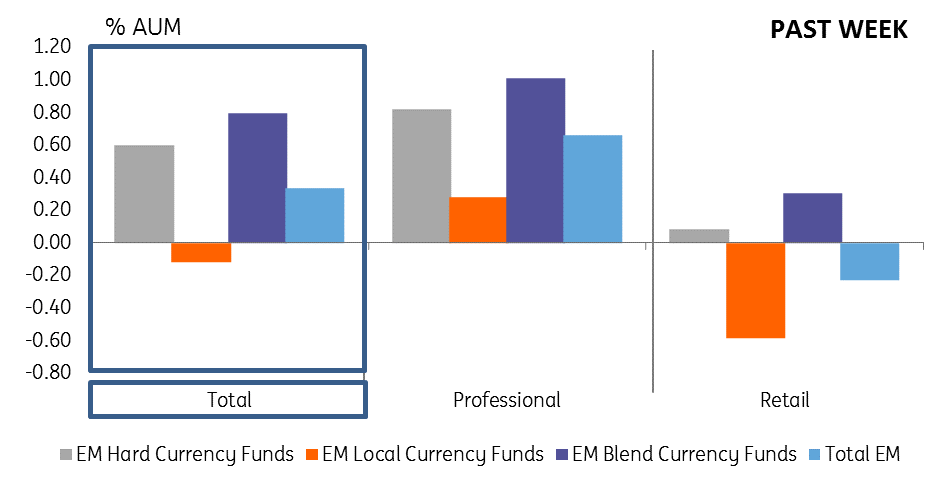

Change in emerging markets assets under management (%)

QE paring narrative should result in rates testing higher

On top of all that, let’s not forget that the Fed is allowing between $10 billion to $30 billion per month of its quantitative easing holdings of bonds to roll off the front end. And the ECB, once a €80bn per month buyer, is heading to being a pure balance sheet reinvestment play of €10bn per month.

It’s never straightforward, but it does seem that the waters are parting in the direction of a further nudge higher in rates.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 October 2018

Global Economic Update: Looking for a silver lining This bundle contains 8 Articles