Rates Spark: Waiting for that smoking gun

Banking tensions are adding to outlook concerns again, with curves re-steepeing even if that definitive smoking gun to turn the outlook remains elusive. EUR markets are not insulated from the flare-up in financial tensions. 2y Bund ASWs have widened more noticeably, but also on the back of returning collateral scarcity fears

Notable curve re-steepening on outlook concerns

Longer dated yields are a tad higher on the day, but this masks an early bull steepening of curves as shorter dated rates plunged again as worries turned to the broader outlook again. In the current state of play there is the macro data that tracks the state of the economy and the contemporaneous data and news about the financial sector, where it is assumed that tensions will only feed through to the wider economy with some lag – to what extent still uncertain. In short, none have delivered the definitive smoking gun as of yet, but there are plenty of developments to ponder again.

Curves re-steepening suggest that markets are on high alert for more financial contagion

Economic data yesterday included a mixed set of releases. Most notable was the poor durable goods orders when looking beyond the headline figure. As our economists note, the larger than anticipated drop in non-defence capital goods orders excluding aircraft - which the Fed follows as a decent lead indicator for general US capital expenditures - alongside revisions lower for the previous month don’t augur well for growth in second quarter.

First Republic Bank has again crystalized lingering concerns over the wider financial sector

But it was again the financial sector that grabbed the headlines. First Republic Bank has again crystalized lingering concerns over the wider sector. In recent days such headlines may have fallen on more fertile ground as Fed balance sheet data had shown that emergency lending had even increased slightly with the latest report – dashing some hopes that we would see an ongoing recovery, if only very gradual. Tonight will see the next release of this weekly data set.

EUR rates markets not fully insulated from financial concerns

EUR markets cannot fully insulate themselves from the banking sector concerns in the US. The 2s10s Bund curve steepened by more than 8bp, breaking the re-flattening trend we saw after the financial sector first hit in early March - as the ECB’s hawks become more vocal again ahead of the May meeting.

Bund ASWs reflect more than just risk sentiment

Notable was also the widening of 2y Bund swap spreads to above 80bp, the widest since late March when still very much under the spell of acute banking stress. However, the Bund ASW is not just an indicator of risk sentiment, but technical factors such as collateral scarcity have also been important technical driver of the spread. With some success the ECB and debt agencies curbed the collateral impact already last year, but tracking the spread of 3m Bubills versus OIS shows that scarcity fears have not been fully alleviated and have indeed staged a more prominent return more recently.

2Y Bund ASW rewidens as collateral scarcity fears are also on the rise

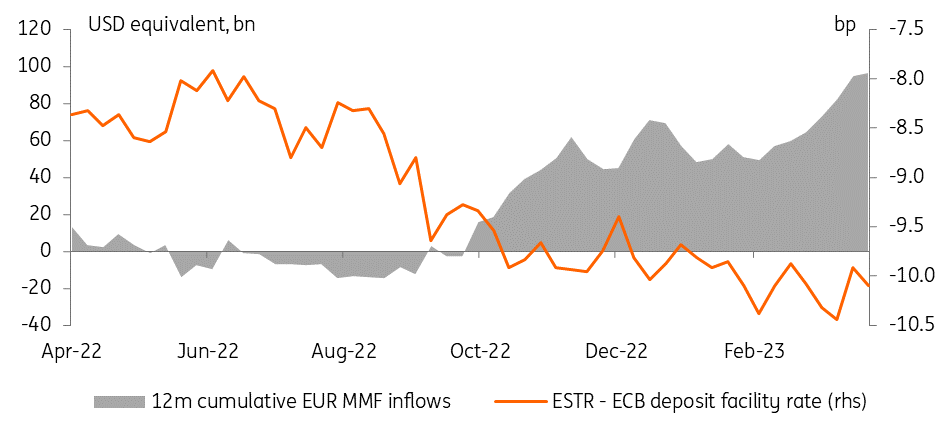

As money pours into the short end, there are other related effects that have also been highlighted by the latest ECB money market study. The inflows into money market funds which had accelerated with the financial turmoil coincide with the ESTR overnight rate falling deeper below the ECB’s deposit facility rate. Overall excess liquidity in the banking system declined as the TLTROs were repaid, but what the money market fund inflows imply is increasing pricing power of banks - they are the final intermediary before liquidity finds its way back to the ECB’s balance sheet in the deposit facility (side note: this is a key difference to the US, where money market funds have direct access to the Fed’s balance sheet via the RRP).

Short end skew of flows impacts money market spreads

In the unsecured funding markets that impact of banks' market power is largest in shorter tenors. As such, deposits impact banks’ Liquidity Coverage Ratio and do not have Net Stable Funding Ratio regulatory value while still increasing regulatory costs as the balance sheet grows. Beyond the shorter tenor we still see the effect in the 3m Euribor/OIS spread which remains slightly negative, but credit considerations gain importance. Forwards pricing shows market expectations of gradually rewidening spread, more recently at a more accelerated pace again, with the December forward spread widening to above 11bp. That remains well below the early March wides of around 18bp.

Today’s events and market view

Key data looms in the days ahead before central banks decide on their next policy steps. Latest developments and headlines have brought also systemic financial risks to the fore, putting the Fed’s weekly balance sheet data back into focus. Still, the main channel through which these tensions are expected to show their impact is through credit conditions.

On the macro side the main focus in on the US Q1 GDP data today where our economists were looking for a slightly sub consensus 1.5% rate of annualised growth, although they note that yesterday’s better trade and inventory data point to some upside risk. We will also get the Initial jobless claims.

Late in the night it will be the first Bank of Japan meeting under Governor Kazuo Ueda, though it is likely the bank will keep all settings untouched so soon after the banking sector jitters in the US and Europe.

In primary markets Italy will auction a new 10Y bond alongside 5Y bond taps. The US Treasury will auction US$35bn in a new 7Y note.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Rates DailyDownload

Download article