Rates Spark: US resilience persists

Inflation is what central banks are focused on, but resilient data is lending their hawkish positions more credibility. 10Y UST yields are testing the top of recent ranges after yesterday's data, and it also looks like front-end yields want to reclaim their pre-SVB highs soon. Key to achieving this will be data, and next week holds another busy slate

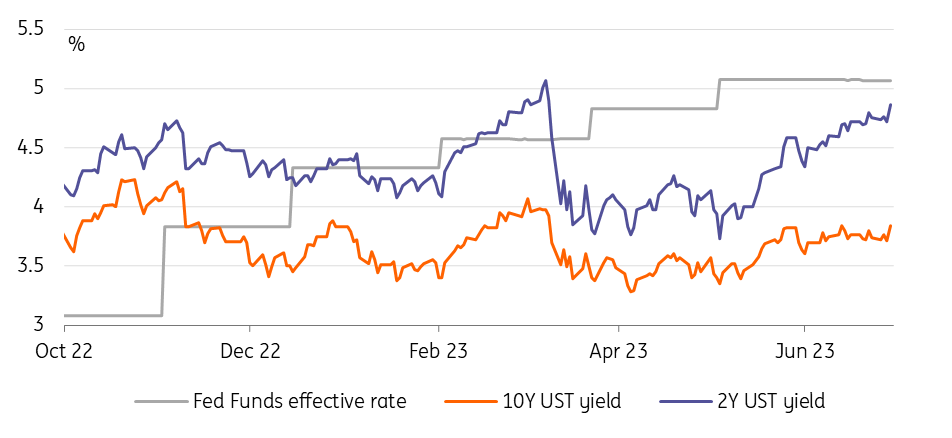

US rates on their way to pre-SVB levels

As much as inflation is in the spotlight these days, it was the revision to the US first quarter GDP data that elicited the larger reaction from markets yesterday. They were quick to price in a greater chance for a second hike from the Federal Reserve. It had been flagged as a possibility by Fed Chair Jerome Powell only recently in Sintra, but markets were previously reluctant to price it in. Now they see a 40% chance of it happening, even if not as back-to-back increases.

The overall US yield curve shifted higher and the curve inversion has deepened further. The 10Y US Treasury yield is now effectively at 3.85%, and the 2Y is back above 4.8%, stretching the 2-10Y inversion back above 100bp. There's room for the 2Y to rise back to 5%, based on the likelihood that the market prices out the rate cut bias just about discounted for the December 2023 meeting and certainly beyond. Through the end of 2024, markets are more than fully discounting five 25bp rate cuts from the peak.

We can still see the 10Y getting back up to the 4% area

Remember the 2Y was above 5% just before the banking turmoil around Silicon Valley Bank ensued. We can still see the 10Y getting back up to the 4% area. Again, back to where it was before the SVB-induced rally in bonds and sell-off in risk. A lot of this has reversed in the past months or so as risk has been bought and market rates have managed to march higher. There had been some flatlining in the past week or so, but data like yesterday’s maintain the upward pressure.

Looking ahead at today’s monthly core PCE reading seen coming in at 4.7%, it reminds us that the US is still closer to a 5% inflation economy. We do think inflation will eventually ease, but for now, it is what it is until proven otherwise.

10Y UST yields are testing the upper end of their recent range

A US focused week ahead

While the 4th of July holiday has come to mark the beginning of usually quieter summer conditions, the data calendar is still packed with key releases. Yesterday has highlighted the degree to which the credibility of the Fed’s higher-for-longer narrative hinges on the data. If activity refuses to lie down yields can only rise further.

The credibility of the Fed’s higher-for-longer narrative hinges on data

The first key data set will be the ISMs, in particular the services report on Thursday. Recall that the May report had seen a big downward surprise falling to 50.3 from 51.9, with weaker readings in the past 14 years only seen during the pandemic in 2020. Even the employment sub-component had dropped to below 50, contradicting the earlier strong payrolls report. All eyes will be on whether the services sector joins the manufacturing sector, which looks like it is already in recession with its seven consecutive sub-50 readings. For now, the consensus is for the services report to increase to 51.1. The manufacturing report for June will be out on Monday.

The final data highlight is the June employment report. May had seen an extraordinarily strong report with a non-farm payrolls increase of 339k – but it was also a mixed report, with the employment rate jumping to 3.7% and moderating wage growth. For June, the consensus is eyeing a 213k payroll increase and unemployment easing back to 3.6%.

Today’s events and market views

Inflation data is today’s main focus, both in the eurozone and in the US. As far as the eurozone flash CPI is concerned – where consensus is looking for a 5.6% year-on-year headline and a higher 5.5% core reading – country data over the past days has already provided some indication, with German inflation coming in higher than consensus for instance. In the US, the Fed's favoured inflation measure, the core PCE reading, is expected to stay at 4.7% YoY. The headline rate is expected to drop to 3.8% from 4.4% previously.

The upshot from both US and eurozone data should be that the central banks' jobs are far from over, although the backdrop for the Fed does look comparatively more encouraging than for the European Central Bank.

In primary markets, we will only see Italy being active today with 5Y, 10Y and 30Y bond taps of up to €7.5bn in total.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Rates DailyDownload

Download article