Rates Spark: This market’s not for turning, yet

The market is bracing for even higher core market rates. The structure of the US curve remains one that is typical when market rates are on the rise, and a 3% handle on the 10yr looks practically inevitable in the next few weeks. Europe will follow to an extent but feels that bit heavier

The US 10yr yield hits a cycle high, and continues to look up

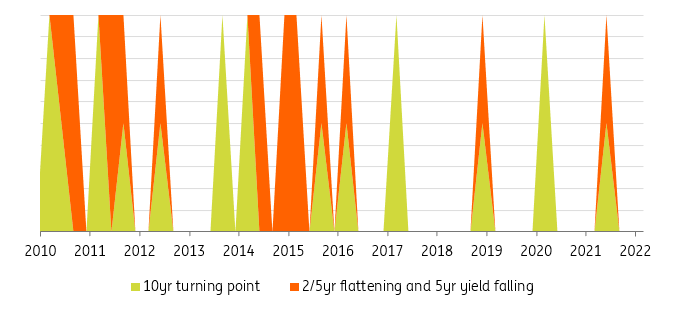

The US 10yr yield hit a cycle high late last week ahead of the long weekend, and that was solidified during quiet trading on Monday. The behaviour of the curve does not suggest we are at a turning point just yet. Despite the 2/10yr inversion seen a couple of weeks back, the curve has since re-steepened. For the US, an inversion of the 2/5yr is what matters in terms of signalling a turning point, and crucially, with the 5yr yield falling. So far, the 2/5yr has not inverted at all in this cycle. The bulk of the inversion has been on the 5/10yr segment, with the 5yr pulling yields higher. The chart below shows that a flatter 2/5yr combined with a falling 5yr yield correlates well with turning points, and we're not there yet.

Give me a flattening 2/5yr and a falling 5yr yield and I'll show you a turning point

Given that, market rates are still on the rise. The notion of a 3% 10yr yield fits with a real yield of about 50bp and inflation expectations of 2.5%. Or it fits with a zero real yield and a 3% inflation expectation. That’s broadly where we are now. There is a live debate as to whether the 10yr breaks well above 3%. It could. A move towards 4% is possible. But if this happens it is more likely to have a bigger fall from there. Our central view is it does not go too far above 3%, and ultimately the curve flattens out in the 3% area (as the Fed gets there, too).

Our central view is the 10Y does not go too far above 3%

On timing, a 3% handle for the 10yr is likely in the current quarter. If there is an overshoot it would be in the third quarter. But by the fourth, the idea is that the funds rate is fast approaching 2.5% and rising, and the market is sensing a top to be hit in the first quarter of 2023. As a result, longer tenors would start to discount the likelihood of a rate cut later in 2023 (remember that when the Fed peaks it's typically only six to eight months before they cut again). That should see the US 10yr back below 3% and likely pass through the fed funds rate.

That's then though. For now, the job is to get to that 3% handle and decide whether the peak is around there. Watch the 2/5yr segment in particular for guidance.

The rise in US 10Y yields has been driven by real rates

There is a heavier feel generally to the European backdrop, depite elevated market rates

Geopolitics remains front and centre as an issue for Europe, as the wider ramifications of the Russian war in Ukraine are assessed. The immediate effect is the mass migration out of Ukraine into surrounding countries, and this continues. Although technically growth advantageous for Central Europe, there is also a large cost to this, currently being borne by recipient countries.

The outcome of the French presidential elections also needs to be monitored. A Macron victory is expected. But a Le Pen victory would have much wider regional ramifications, as it would lift the profile of the extreme right in European politics generally, and would be detrimental to the European Union project. But even with that outcome side-stepped, the energy deficit leaves Europe at a point of vulnerability, and tighter financial conditions add to the tense tradeoff here against an elevated inflation backdrop.

The European Central Bank is acknowledging many of these issues verbally, but the market discount remains resolutely of the opinion that the ECB will engage in significant tightening over the next 12-18 months. The steep yield curve tells the same story, which is also reflected in the forward profile. Something must give here. Either market rates have gone too far, or the ECB will find itself delivering more than it is currently suggesting.

There is more upside to US market rates than for euro market rates

Eurozone core rates now discount that the ECB will raise the refi rate to comfortably over 1%, with the 10yr euro swap rate already in the 1.5% area. We’d suggest there is more upside to US market rates than to euro market rates from here, as we doubt the ECB will be quite as forthcoming with hikes as the market is discounting.

French bonds have one more week of presidential campaign to go through

Today’s events and market view

German and Finland kick off a busy week in core euro supply, with sales in the 5Y and 10Y/30Y, respectively.

US housing starts and building permits will give the market a better picture of the health of the housing market after the spectacular rise in mortgage rates.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article