Rates: Pivot and turn

The recent downturn in bond yields, prompted by political worries, may continue in the near term. However, we expect US yields to shift back towards the upper end of their current range as concerns about core US inflation and rising issuance reassert themselves

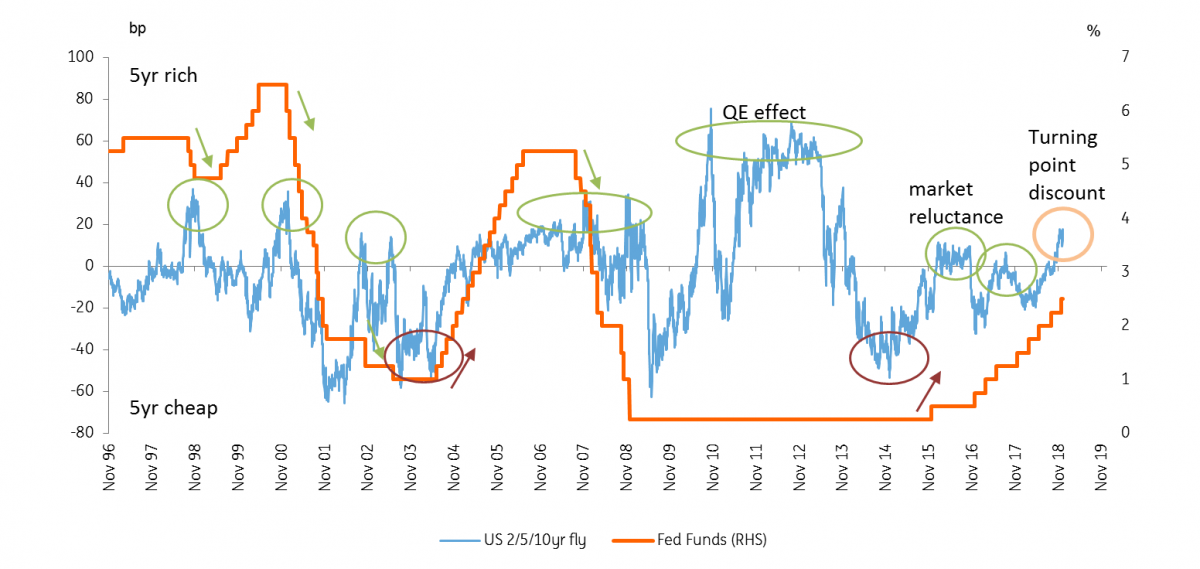

Bond market turning points are best picked up by the positioning of the 5-year bond on the yield curve. The chart below illustrates this by looking at the 5-year yield relative to a combination of the 2-year yield and the 10-year yield. On the very right-hand-side, it is clear that the 5-year has broken out, and is now trading “rich”. History shows that this is not a perfect signal, but more often than not it is bullish for bonds and can signal a turning point for the Fed.

Fed fund rates alongside the 2/5/10-year fly (modelled as long the wings and short the belly)

The chart below then shows the effect of this; market yields have been pulled back down towards the Fed funds ceiling at 2.5%. History shows when the Fed peaks, market yields trade through the funds rate. We are at that critical juncture right now.

Fed funds rates alongside the 2-year yield and 10-year yield

That said, just because market yields have fallen back to the level of the funds rate doesn’t necessarily mean that they can’t back up again. In the last two rate hiking cycles, market rates broke below the fed funds rate prematurely, in the sense that the Fed continued to hike and market rates subsequently saw new highs.

A pause may be a logical outcome given the confluence of negatives in play right now

Certainly, a glance at the above two charts would give the Fed pause for thought, which is why we argue that a pause may be a logical outcome given the confluence of negatives in play right now. We had anticipated that some of these would have faded by now. But as Italy has melted as an issue, a renewed focus on China has taken centre stage, underpinning the slowdown narrative.

This keeps market rates in check, and if circumstances deteriorate further, the fall in market rates is not complete. Stock market performance will be as good a barometer as any in the coming weeks, but bond markets rarely remain slavish to equity markets for long, and will typically pan an often wider panoramic view of domestic and global circumstances.

Plus, there are two key undiscounted issues. First, US bond yields will react to US fundamentals, and in particular to core inflation, which we see in the 2.25% area. This should act as a floor for market yields, as negative real yields are a step too far. Second, there is a growing net supply issue ahead. A Treasury deficit in the 5% to 6% area plus a Fed continuing to unwind QE implies a heavier feel for bond markets.

For now, the focus seems to be less on the known (e.g. still firm US macro underpinning and higher net supply prognosis) and more on the unknown (e.g. trade war risks being stoked by a China slowdown narrative). The thing is that the known is in play with relative certainty, while the unknowns could fade into something less sinister than currently discounted - the glass half full prognosis.

The bottom line is that market yields are now testing the lower end of a 100 basis point range that we identify between the core inflation floor of 2.25% and the cycle high seen for the 10-year yield at 3.25%. If the glass half empty attitude is realised, we stay down here. But more than likely, we will re-visit the upper half of that range at the very least, which by definition brings the 2.75% to 3.0% area into play; and that’s a whole different dimension.

We reiterate that market yields went on to take out higher highs in previous rate hike cycles, as the Fed continued to hike despite its convergence with market yields. It could be different this time if a risk case scenario materialises, and e.g. Brexit will help to sustain angst through 1Q. But if we get through 1Q, the case for US market yields to test the other end of the current trading range strengthens.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 January 2019

January Economic Update: Overdoing the gloom This bundle contains 8 Articles