USD: Ultra-low Libor must rise

Libor rates are trading in very close proximity to risk-free rates, which suggests a minimal credit risk premium in the rate. There is a clear risk that Libor comes under rising pressure through 2021. This will in part be a relative valuation move, but it can also reflect residual stress as Covid-19 induced sticking plasters come off

Libor rates are ultra low. Great, but can that last? Unlikely we think

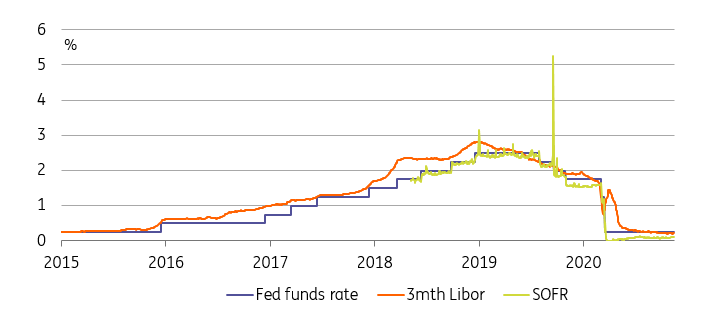

Libor will live out its final days in market centres through 2021, but it is strutting through 2020 with quite a bit of attitude. One of the issues with Libor is the implied bank risk that it contains, which proved exceptionally volatile during crises (most notably through the great financial one). But as we head towards the end of 2020, Libor is on the floor. USD Libor at 20bp is some 5bp below the Fed funds ceiling - not much implied bank credit risk there. Libor is trading like a premium product here, sitting adjacent to risk-free rates.

Fed Funds rates, 3m Libor and SOFR

The likelihood in 2021 is that this changes. We think that USD Libor should be some 10bp higher than it is currently, and we'd assert similar for Ibors in most other centres. For example and remarkably, 3mth Euribor is currently flat to the ultra-safe ECB's deposit rate. While this can be rationalised on account of advantageous bank funding conditions, it still looks anomalous. The low valuation attached to Libor is reflective of a lack of systemic stresses, which is a good thing. And by extension, there is an implied positivity imputed on the banking system. This is a valid point of positivity, but the question is whether it can persist.

A rise in Libor could also come from rising defaults as they impact the system negatively

So while central banks may not do an awful lot in 2021 in terms of policy changes, we would expect to see Ibor rates drift higher from current levels. An important ancillary rationale here centres on the likelihood that risk attributed to banks and the system ratchet higher again, especially as default risk gets re-elevated.

The end of Covid is a clear positive but it also means the Band-Aids come off

The end of Covid is a clear positive for humanity and future growth, but it also means the Band-Aids come off. This in many cases will leave ghastly unhealed wounds that will result in numerous uncomfortable shutdown stories, even as economies begin to structurally rebound.

We feel that Libor bottoms out here, and the most likely move in the period ahead would be to test higher, we think by 10bp. And that is without any change in central bank policy. A nudge higher in Libor would not be a bad thing by the way for transition away from Libor, as it would bring the spread from SOFR to Libor back up to a more normalized level, and in fact closer to the 5yr median being employed by ISDA for transition to fall back rates (see the next section for more on this).

Tags

Rates outlookDownload

Download article19 November 2020

Rates Outlook 2021: Money for nothing This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more