The impact of the ECB’s framework review

2023 has been a year of ECB balance sheet reduction, and 2024 could see the central bank accelerate the shrinking of its bond portfolio. Many further adjustments have been floated this year but postponed ahead of the outcome of the operational framework review. This could give markets a sense of how far the ECB will take policy normalisation

The ECB’s operational framework review – it is all integrally interlinked

2023 has already been a year of balance sheet reduction. The largest part of the targeted longer-term refinancing operations (TLTROs) has now matured and reinvestments from the Asset Purchase Programme (APP) portfolio have been phased out, with the focus now turning to the Pandemic Emergency Purchase Programme (PEPP). But the European Central Bank has also tweaked other parameters surrounding its policy implementation. The remuneration of minimum reserves was dropped to zero, as was the remuneration of government deposits at some central banks, foremost the Bundesbank. Over the past few months, the ECB had been expected to further adjust these and other policy parameters aside from key rates.

However, many of these decisions have now been pushed to the end of the year and into the early part of next year. One important reason being that the ECB does not want to pre-empt any decisions coming out of its review of the operational framework, which it still plans to complete next spring.

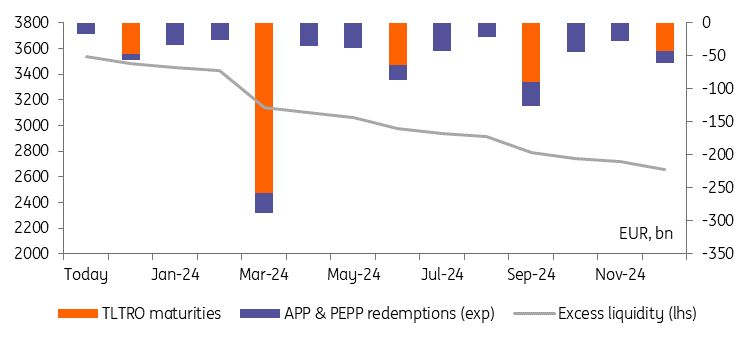

Excess liquidity is already set on a declining trend

The desired size of the balance sheet and level of excess liquidity

One important outcome will be the size and makeup of the balance sheet that the ECB wants to operate in the future. The balance sheet is already set to shrink, but the choice of the future framework could give us an idea of how far the ECB will take the decline in the resulting level of excess liquidity in the system.

Considering the current level of excess liquidity, €3.5tr, there should still be some distance from the point where the level of short-term interest rates is actually impacted by changes in liquidity supply. Historically, that level has been somewhere below €1tr. However, past relationships that pre-date regulatory changes at the bank level may no longer hold, which could argue for a more cautious approach from the ECB.

The consensus is that the ECB will stick with a so-called “demand-driven floor system”, where the short-term rate remains tied to the ECB’s deposit facility rate rather than to the main refinancing rate. This would mean the ECB will operate with excess liquidity high enough to keep short-end rates pinned to the deposit rate.

Excess reserves are still some distance away from levels where rates and spreads are more directly affected

Possible implications of a demand driven floor system

A “demand-driven” system also implies that banks will still have to bid for part of the liquidity via open market operations – think of the one-week main refinancing and 3-month or longer-term liquidity operations. This is to distribute liquidity further than just via asset purchases, which has kept liquidity more concentrated in certain jurisdictions and/or larger banks. To facilitate this, the ECB would likely have to narrow its interest rate corridor. Currently, the more than 50bp difference between the refinancing rate of the ECB operations and the market rates which are tied to the depo floor, means that there is a penalty and implied stigma attached to getting liquidity from the central bank.

Furthermore, an overall higher level of excess reserves with some buffer to guard against unwanted volatility would lessen the need to materially accelerate the current pace of liquidity reductions. Considering that €491bn in TLTROs will mature by the end of 2024 and that €300bn will roll off from the APP alone, the prospect of having to remove even more liquidity by raising, for instance, the minimum reserve ratio to 10% as some policy hawks have floated, would look remote (not even considering other negative side effects).

Also, the ECB could consider injecting a base stock of liquidity via a structural bond portfolio, something that the ECB’s Chief Economist Philip Lane hinted at during a recent money market conference. This could also offer the ECB an avenue to retain some of the ability to intervene in bond markets via reinvestments – a successor to the PEPP reinvestments that currently still serve as the first line of defence against market turmoil in sovereign bond markets.

Lane was the latest official to touch upon the deliberations over the ECB’s policy framework and the potential size of the balance sheet going forward. His speech highlighted how choices are interlinked with many of the policy parameters that the market had become concerned about in recent months. It also suggests that there will likely be a longer transition towards a new framework.

All that argues for a rather benign market impact from the review, if not even supportive for wider bond markets and bond spreads in the longer run. That might offset some of the fears surrounding the prospect of the ECB slowing and eventually ending PEPP reinvestments. And it also does not fully exclude “minor” changes as the ECB considers its costs of conducting monetary policy such as raising minimum reserves to 2%, which could still have a negative impact on bond market sentiment via its effect on banks.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 November 2023

Rates Outlook 2024: Fair winds and following seas This bundle contains 8 Articles