Rates: EM eyes the dollar

As the dollar whipped into a strengthening mode, emerging markets have been spooked

Many moving parts make for tough interpretation, but one theme runs through the middle, and that has been the path of the dollar. And moreover, the speed at which it flipped from a gradual weakening trend that had an inevitability about it, to showing a wicked strengthening streak. It is one that has in a flash exposed vulnerabilities stretching from the likes of Argentina to Turkey to Indonesia. Emerging markets (EM) have been spooked.

But at the same time, there is no contagion in play. Some correlation yes, but there is enough collective calm to ensure that sensible relative valuation is still ‘a thing’. Also, there has been no mass exodus from emerging markets. Inflows to EM may have slowed to a trickle, but this is no tantrum, at least not yet. The next leg for both the dollar FX and market rates will be crucial though, and we, of course, have views on both.

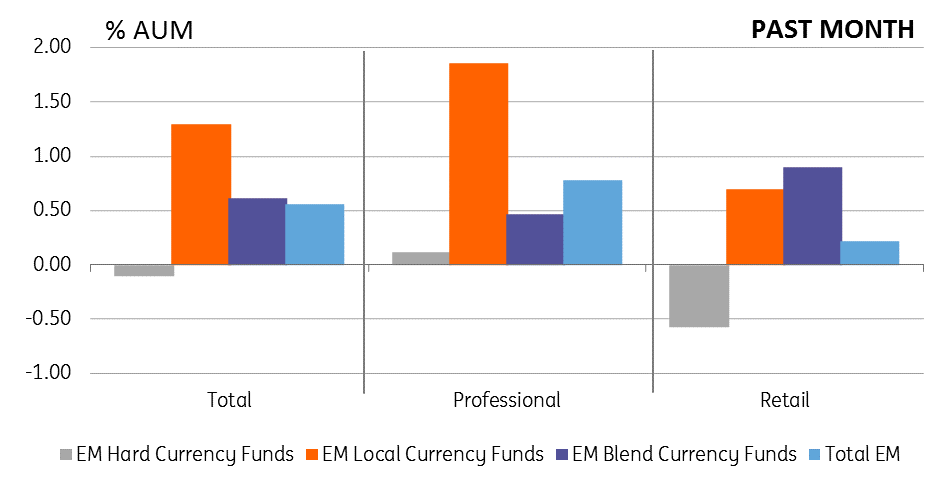

Changes in EM assets under management

A double whammy that EM always fears

One of the things that calmed emerging markets in previous months was that the uplift in the Fed funds and market rates was coinciding with quite a benign dollar. When the dollar turned on a sixpence and rallied, that changed, and EM was dealing with a classic double whammy. Higher rates make re-funding more expensive and a firmer dollar then super-exposes the more leveraged (typically high yielding) economies.

We also believe there is a feedback loop here to core rates too, as a firmer dollar acts as a stand-alone monetary tightening, which facilitates less need for rates to head higher. In consequence, one of the reasons the US 10yr yield has not managed to cleanly break free of 3% to the upside is down to dollar strength. This is why we think that the sustained break above 3% will happen as the dollar finally comes off the boil.

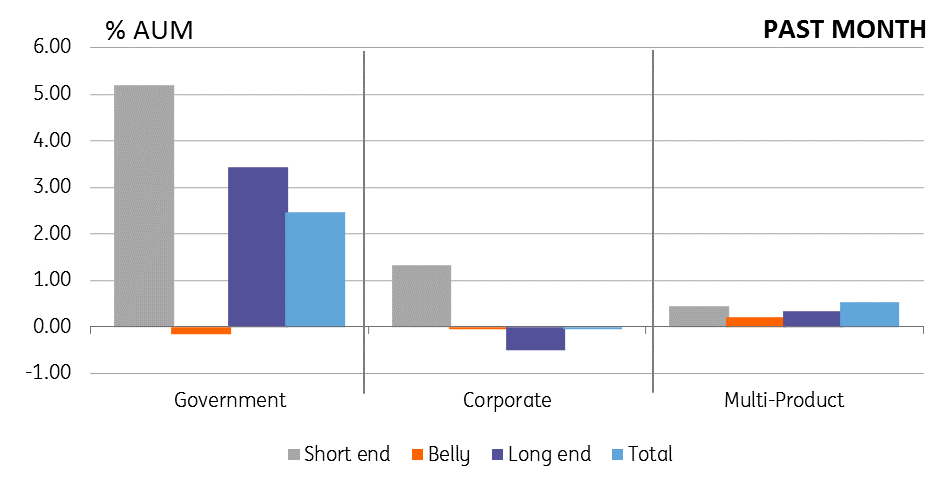

Changes in DM assets under management

The markets positions

We identify positioning as still pointing towards upward pressure for market rates. We continue to see evidence from flows data of investors liquidating the belly of the yield curve and moving in the front end, to leave the marketplace both short duration and barbelled. A mild build in exposure to long end funds has amplified this, but it still leaves the path of least resistance on a test for higher rates.

The curve structure is also pointing in the same direction, as the 5yr is trading cheap to the curve (2/5/10yr fly). A cheap 5yr is typical of a marketplace that believes there are a run of rate hikes ahead, and usually, this is consistent with market rates rising and the term structure flattening. No imminent fear for inversion though, as long end rates are growing too. The 10/30yr could well invert, but the benchmark 2/10yr won’t in 2018

Barring a collapse, bottom line rates should still rise

This process of a gradual probe higher for rates likely continues. An abrupt further dollar appreciation leading to a broader emerging market tantrum would abort this. The central view sees the dollar ultimately reversing course. But the alternative risk case is real and present.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 May 2018

ING’s May Economic Update This bundle contains 8 Articles