Puma Energy insulated from oil-price volatility

A well-run downstream oil company with a robust business model and a decent track record that we see no imminent signs of being disrupted

PUMA Energy was founded in 1997 and was established as an independent company after splitting out from the commodities trader Trafigura in 2007.

The unique business model involves building up retail, and B2B fuel distribution in emerging markets where market penetration is still comparatively low and demographic trends offer higher growth rates. Its strategy is focused on markets that lack storage and distribution infrastructure, where it can establish a leading market share and build regional hubs. In most of its markets, PUMA, therefore, benefits from economies of scale in supply. To ensure product supply into these countries, PUMA builds/acquires storage facilities for itself as well as renting them out to third parties. This vertical integration gives PUMA strong control over the whole supply chain.

PUMA's distribution and fuel retail activities are located in 49 countries, with a large proportion concentrated in emerging markets in Africa and Latin America. PUMA's is highly diversified across geographic regions, which reduces its dependency on any single country. Also, PUMA's role in developing and improving energy infrastructure and fuel supply reliability gives host governments a strong incentive to promote and maintain supportive regulatory regimes.

Business profile

Headquartered in Singapore, Puma Energy is a vertically integrated midstream and downstream oil group which stores, supplies and distributes refined oil products largely in emerging markets with revenues of $15.2bn in 2017.

The midstream segment, which accounts for 18% of $740mn EBITDA, mainly consists of storage facilities (also rented out to third parties), two refineries in Nicaragua and Papa New Guinea and transportation and marine mooring systems.

The vast majority of Puma Energy's storage capacity is used to support downstream business. The company owns and operates approximately 8.3m m3 of storage capacity. The downstream segment, which accounted for 82% of EBITDA, consists of distinct business lines including retail petrol stations, business-to-business (B2B), aviation, wholesale, bitumen, lubricants, bunkering and LPG, with retail and B2B business lines being the significant contributors to downstream segment profits. The company operates 3,064 retail service stations and serves 71 airports.

Ownership structure

PUMA is a privately owned company. The largest shareholder is Trafigura, a global commodities trader, which owns 49.49% of the firm. Sonangol, the state oil company of Angola, is the second largest shareholder with a 27.92% stake. Cochan Holdings LLC, which with PUMA has had a relationship since 2005, owns 15.45%. The balance is owned by private investors.

FY17 earning summary

Puma posted FY17 results that were decent but, as expected, slightly weaker than the very high levels achieved in FY16. EBITDA declined 22% YoY to $740mn despite a 4% increase in sales volumes, as Downstream unit margins came under pressure early in the year before rebounding (overall flat YoY) and Midstream volumes fell 16% due to weak activity in Africa, though margins here rose 18% YoY.

Overall, the consequent fall in Downstream EBITDA of 3% to $607mn unsurprisingly overcame the 4% rise in Midstream EBITDA to $133mn. Looking at cashflows and the balance sheet, operating cash flows declined from $838mn to $477mn on the year due to an increase in working capital linked to the start-up of new activities, increased inventories and reduced payables.

However, PUMA reduced capex substantially from $561mn to $298mn (83% weighted towards organic growth). Cash from financing normalised to $89mn in FY17, reflecting drawings on loans as well as interest and dividend payments. The result was that cash on the balance sheet increased 54% YoY to $519mn, while leverage declined slightly to 2.7x (including inventories, without which it stands at 4.0x).

- Puma reported decent stable sales volumes in FY17 (+4% to 22.8mn m3), with growth strongest in Asia and the UK, while throughput declined 16% YoY to 16.6mn m3. Gross profit increased 4% to $1.7bn thanks to higher volumes and stable unit margins, while EBITDA declined 2% to $740mn as it was affected by additional personnel and rental costs as well as provisions for local taxes. Capex declined 47% YoY to $298mn while operating cash flows fell 43% to $477mn for reasons cited above. Capex remains fully financed by operating cash flows.

- Looking across the segments, Downstream posted reasonable volume growth (+5% to 21.9mn m3) driven by retail, aviation and the UK business. Gross profit (+5% to $1.4bn) increased in line with volumes as unit margins remained stable, while EBITDA (-3% to $607mn) was impacted by higher opex. Meanwhile, Midstream showed reduced throughput volumes (-16% YoY), mainly in Africa. These were partially offset by an 18% increase in unit margins to $13/m3, meaning that gross profits were actually flat YoY at $227mn. More positively, EBITDA rose 4% to $133mn.

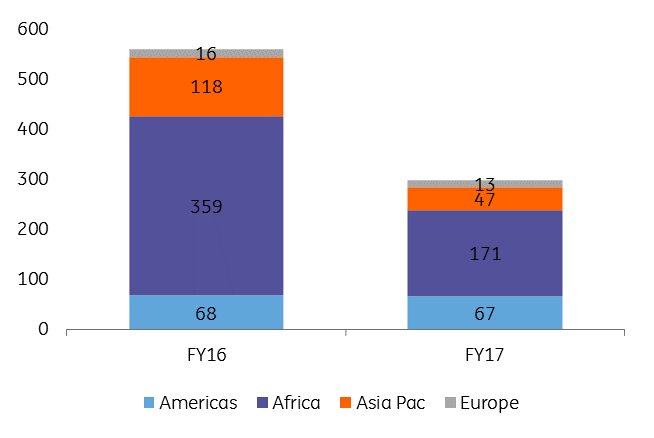

- In terms of geographic segmentation, all areas posted growth in EBITDA except Europe and Africa, which saw a notable decline. However, the effect on free cash flow was cushioned by the sharp reduction in capex from $561mn in FY16 to $298mn in FY17. 57% of capex occurred in Africa and involved organic growth rather than acquisitions.

- FY17 operating cash flows fell from $838mn in FY16 to $477mn as working capital increased due to the ramp-up of new activities and reduced payables. Investing cash flows of $359mn, which were fully financed by operating cash flows, declined from $733mn due to reduced capex and acquisition spending, while financing cashflows improved from ($14mn) to $99mn on loan drawings, interest payments and dividend payments.

- Leverage improved slightly from 2.8x to 2.7x over the period (including inventories), during which PUMA refinanced $600mn of Senior Notes. We note that unsecured HoldCo debt now represents 87% of the Group’s debt, while 47% of PUMA’s debt matures in 2021 or beyond.

Given steady leverage, capex financed by operating cash and steady (though admittedly low) margins, we find Puma Energy attractive. Its unique business model gives it the necessary scale in its chosen markets and insulates it from the effects of oil-price volatility.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article