Price pressures to keep the Fed hiking as 2Q US outlook improves

Elevated readings for two of the Fed's most watched inflation barometers, the employment cost index and PCE deflator, are certain to keep the Fed minded to tighten monetary policy swiftly in coming months. Meanwhile, monthly household spending numbers suggest strengthening economic momentum into 2Q

Soaring employment costs to keep inflation sticky

Out of today’s indicators we would place most importance on the 1Q employment cost index. It was former Fed Chair Alan Greenspan’s favourite indicator and is regaining prominence once more given it is clearly signally deeper, more ingrained inflation pressures in the economy. We have seen yet another really big increase of 1.4% quarter-on-quarter, above the 1.1% consensus and the third consecutive 1%+ QoQ reading. For the private sector we have had the fourth 1%+ reading in the past five quarters, which shows that there is real momentum here.

This is a broad measure of overall labour market pressures and shows that benefit costs (1.8% QoQ) are rising at an even faster rate than wages and salaries (1.2%). In a service sector economy labour is the biggest business cost and in an environment where companies have pricing power (they can pass cost increases onto customers), this report indicates inflation pressures are going to remain very sticky. Remember that while oil prices and food prices can always fall outright, wages rarely do. These strong labour cost increases really helps to anchors overall inflation at a high level and confirms in our minds that CPI and the PCE deflator will be very slow to drop back to the 2% target.

Employment costs in the private sector are surging (1984-2022)

Fed's favoured inflation measure won't get below 4% this year

In this regard we have also had the Fed's favoured measure of inflation – the core personal consumer expenditure deflator – and it posted a 0.3% month-on-month increase as expected, but the year-on-year rate dropped to 5.2% from 5.3%. Even if supply chains improve and we see geopolitical tensions ease a little, we doubt this inflation measure will be below 4% before early next year.

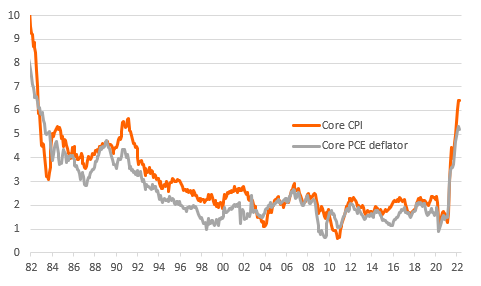

Annual inflation excluding food and energy

Spending revisions offer hope of 3% 2Q GDP rebound

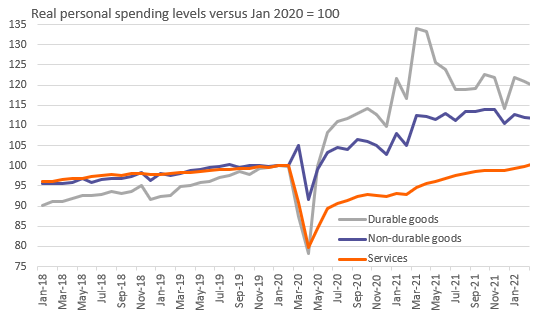

Rounding out the numbers, the March personal spending and income numbers are good. Personal income is above expectations (0.5% MoM versus 0.4% predictions while February was revised up 0.2 percentage points). The profile of personal spending is also encouraging with real spending rising 0.2% rather than falling 0.1% as consensus predicted while February was revised up with service sector spending finally having fully recovered back to pre-pandemic levels. There were downward revisions to earlier months reflecting a more pronounced hit to activity from the Omicron wave.

Personal spending levels

Consequently we have a stronger bounce-back in the data, which implies good momentum heading into 2Q. With wages and employment both rising strongly this gives us a bit more confidence that we will get a decent rebound in 2Q GDP after yesterday's surprise 1.4% decline. That was caused by a huge hit from net trade and an inventory run down, which should reverse somewhat. Early indications are now pointing to 2Q GDP likely in the 2.5-3.0% range, which combined with the elevated inflation pressures should ensure a 50bp rate hike next week from the Federal Reserve and a further 50bp in June and July as a minimum.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more