Portugal: Some weakening after a strong cyclical push

Most indicators are moving in the right direction but burdens of the past are still a drag. We expect the Portuguese economy to slow down towards the end of the year and forecast an annual growth rate of 2.1% in 2018

Strong labour market

The strength of the Portuguese labour market in 2017 surprised us.

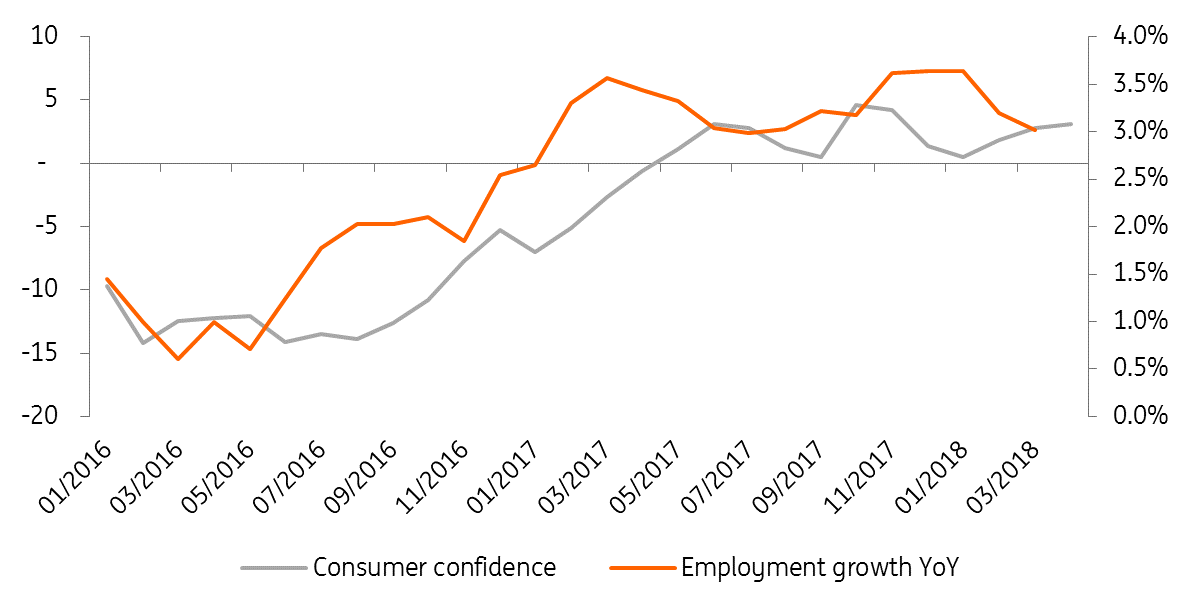

The unemployment rate fell below the Eurozone's and employment grew at a record rate of 3.3%. This strength continued in the first quarter of 2018 as the unemployment rate declined further and employment growth continued to be above the 3%-level. It's, therefore, no surprise there are now more optimistic consumers than pessimistic ones, and so private consumption remains a strong growth contributor.

Strong employment growth with happy consumers as a result

Even though the strength of the labour market improved sharply during the recovery, there are still some structural weaknesses.

Broader measures of the labour supply have not fully recovered and are still higher compared to pre-crisis levels. Moreover, temporary employment remains at the highest level in the Eurozone (18.5% in 2017 compared to 12.7% in the Eurozone). Reducing the duality of the labour market should, therefore, remain an important objective for policymakers. These structural weaknesses could explain why wage growth remains moderate, growing at the same rate as consumer prices.

Even though we think the current labour market strength should weaken a bit by the end of the year, the strong figures might continue in the coming months. For example, employment expectations strengthened in the service sector, construction and retail, while they stabilised in the manufacturing sector.

So private consumption is most likely to continue to be strong in the first half of 2018.

Burdens of the past

Most indicators in Portugal are moving in the right direction. But the burdens of past crises are still a drag for the economy. Public and private debt is still at elevated levels, and so higher nominal interest rates could cause difficulties for firms, households and the government.

Although declining, the share of non-performing loans also remains very high and is the third highest in the EU after Greece and Cyprus.

All in all, we expect the Portuguese economy to slow down towards the end of the year. We forecast an annual growth rate of 2.1% in 2018.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 May 2018

ING’s Eurozone Quarterly: A slower cruising speed This bundle contains 12 Articles