Political stalemate hurts Thailand’s economy

Three months after the General Election, politics still remains a key overhang on the Thai economy. With political logjams slowing the emergence of any fiscal stimulus, monetary policy will have to do all the heavy lifting to prop up growth. We now anticipate two central bank policy rate cuts before year-end

The political scene continues to be confused

The results of the General Election held on 24 March were widely disputed. And more than three months later, there is still no government in place.

The new parliament is comprised of the 250-seat Senate, entirely held by the military appointees, and the 500-seat lower house. Here, the pro-junta Palang Pracharath Party has managed to form a 19-party coalition holding a very slim majority of only four seats. This Parliament formally elected Prayuth Chan-Ocha as prime minister – the former military general’s second term in that office. We thought this had almost ended the long-standing political uncertainty since the 2014 coup. But we were wrong.

Disputed elections - fragile coalition

As the wrangling for cabinet positions and tumult with his own political circle continues to delay formation of the government, PM Prayuth has hinted at a mid-July timeline for instituting his new Cabinet. However, it doesn’t look to be going well, given recent reports of a rift within Prayuth’s Palang Pracharath Party, as well as the Constitutional Court’s order for investigation of 32 lawmakers from the ruling coalition for violating the constitutional prohibition of shareholdings in media companies.

The Court has allowed all 32 embattled lawmakers to keep their seats until the final ruling, an implied leaning towards the junta which faced criticism from the opposition, given the Court’s earlier suspension of a main opposition party leader for the same allegations. Thanathorn Juangroongruangkit, the leader of the Future Forward Party, is currently being investigated by the court for his media holdings.

I hope that everything will move forward to respond to peoples’ needs as the government of all Thais. This will be a beginning for a political reform by the government and its coalition so that politics will not get back to its old problem that might require the old, unwanted solutions – PM Prayuth Chan-Ocha

These recent developments could potentially destabilise the coalition, reducing it to a minority and thus paving the way for more uncertainty ahead. The additional risk stems from factions within the military, the imminent shift of power away from the Queen’s Guards, from which PM Prayuth hails, to the King’s Guards led by military commander-in-chief Apirat Kongsompong. The latest story by Nikkei Asian Review will be a good read on this (may require subscription).

So, where do we go with all this? Prayuth’s mid-July timeline for having the government in place may seem a bit optimistic. We aren’t judging the hopes of a return to the civilian regime as being in vain. but even if it gets there, Prayuth will still be leading a very weak coalition government that would face tests during the passage of key legislation in parliament, e.g. the imminent 2020 budget. After all, with such a fragile coalition, doubts about the new government surviving its entire term will flourish.

On the other hand, if the process is dragged out beyond July, we could be in for quite an unpredictable political future, which would come as a significant dent to investor confidence in the new political machinery. We don’t rule out a further spike in political risk.

Against such a backdrop, the strong rally in local financial assets – government bonds, equities and the Thai baht alike – underway since June, remains at risk of being unwound.

The economy isn’t doing any good either

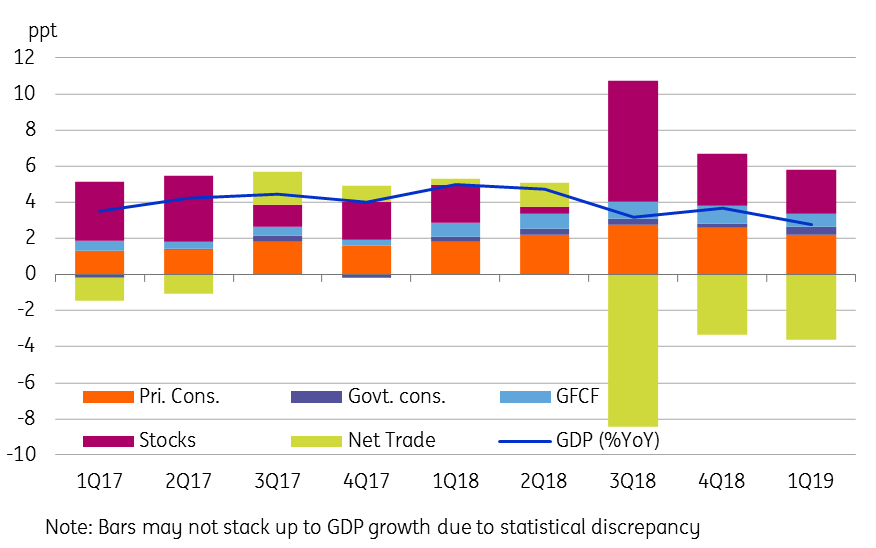

Following on the heels of an exceptionally weak first quarter this year, the economic data continues to unfold on the weaker side. GDP growth slumped to a four-year low of 2.8% in 1Q19. The political jitters during the general elections weighted on domestic demand, while global trade and the technology war continued to depress exports. Indeed, net trade remained a key drag on growth. If it weren’t for a sustained inventory re-stocking, GDP growth would have been even worse.

We read the high-frequency activity data as signalling continued economic weakness in the current quarter, while the forward-looking confidence indicators show no respite from this trend over the rest of the year.

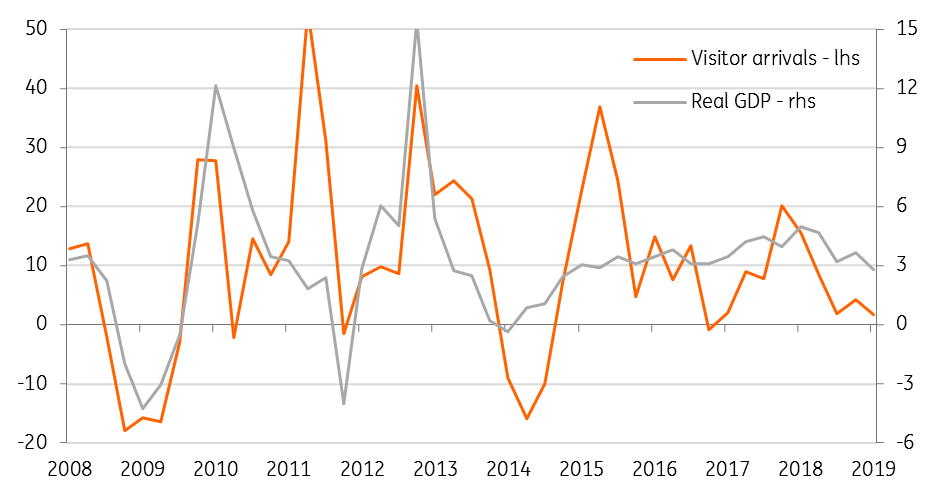

Besides weak exports, a further hit to growth comes from the fallout of the trade war on the tourism sector - the backbone of the Thai economy. This is already evident from the slowdown in Chinese visitors underway since last year. Domestic political jitters also deter tourists and GDP growth.

Sources of GDP growth

Slowing tourism, slowing GDP growth (% year-on-year)

Cloudy prospects ahead

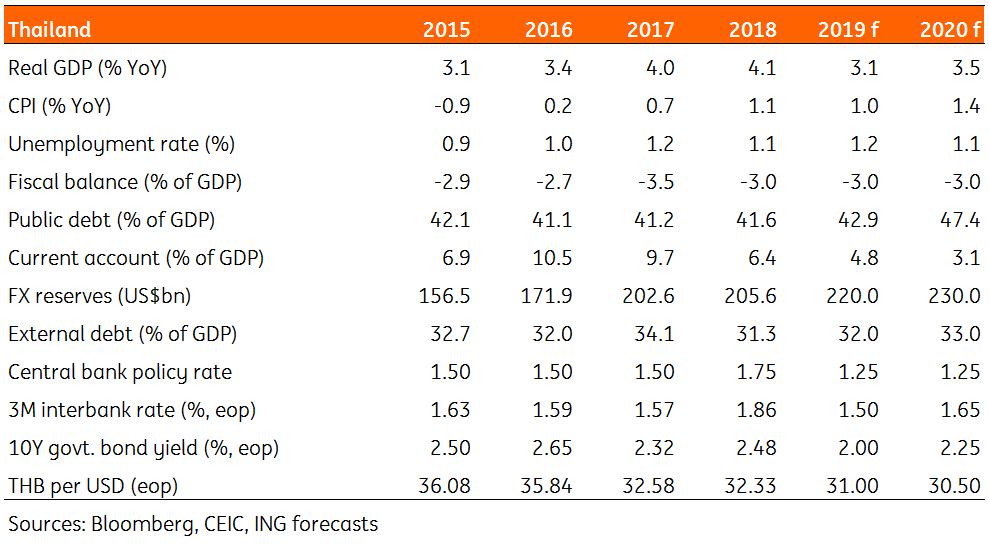

We recently revised our GDP growth forecast for 2019 to 3.1% from 3.8%, putting it below the official 3.3% forecast by both government and the central bank (the Bank of Thailand) which were scaled back from 3.8%.

Meanwhile, inflation has remained subdued, making the last rate hike seem even more unnecessary. Weak growth will sustain the low inflation trend for the foreseeable future. At an average rate of 0.9% in the first half of 2019, consumer price inflation was slightly below the 1% average in the same period last year. A sharp spike in food inflation was more than offset by a slump in housing and transport inflation, while inflation in other consumer products (core inflation) continued to be negligible, about 0.5%.

We expect the inflation outturn for the rest of the year to remain benign, especially with strong currency appreciation this year keeping imported inflation at bay and anaemic domestic demand limiting any upside at home. The Commerce Ministry recently cut its 2019 inflation forecast to 1.0% from 1.2%, putting it on a par with the central bank’s forecast. Our 1% annual inflation forecast maintained since the last revision from 1.3% in January this year, remains on track, though with the risks tilted more to the downside than to the upside.

Subdued inflation

Still, healthy external payments

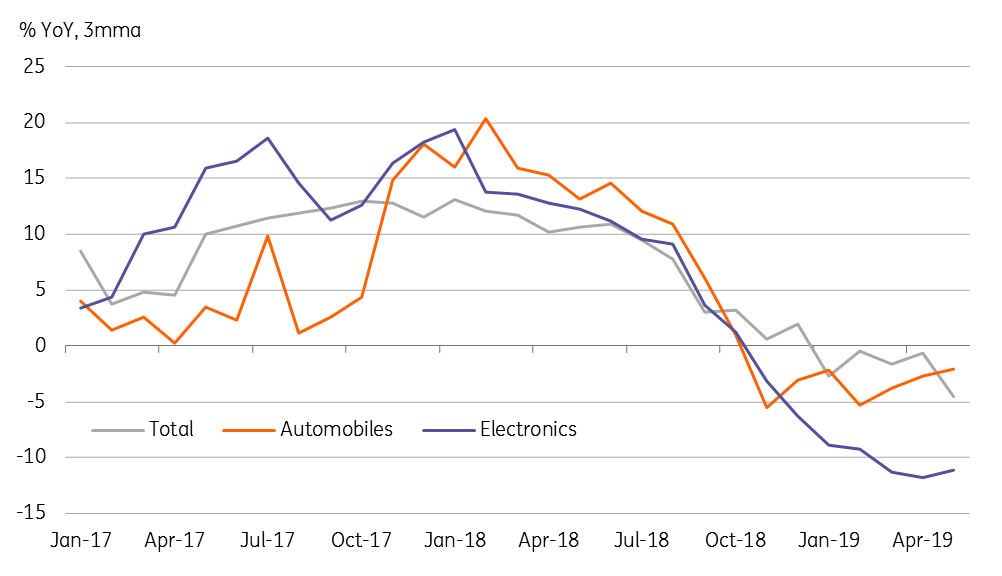

Thailand isn’t spared from the US-China trade and technology war or the global tech slump hanging over the entire region. Exports of automobiles and electronics, together accounting for 30% of total exports, have been on a steady downward grind.

A 2.7% YoY contraction of total exports in the year through May is a significant negative swing from 12% growth a year ago. The swing is much worst for imports, - 1.0% YTD from +16%, which underscores domestic economic weakness. This is associated with a (just slightly) narrower trade and current account surplus than a year ago.

The potential negative impact on the "tourism dollar" could mean that the surplus narrows even further. We foresee the annual current surplus in 2019 to be equivalent to 4.8% of GDP, down from 6.4% in 2018. This is still large relative to most Asian countries and remains a significant support to the currency (Thai baht, or THB).

Slumping automobile and electronics exports

Excessive baht strength hurts more

The THB continues to be among the best performing emerging market currencies so far this year, with a more than 6% appreciation against the US dollar, taking the exchange rate to a six-year high of 30.57, even in the face of heightened global economic and geopolitical uncertainty. Clearly, the THB performance is out of sync with the underlying weak economic trends despite the fact that the currency enjoys a relatively strong backing from the large current surplus, which itself is a by-product of a significant economic imbalance – perennially weak domestic demand.

The BoT attributes recent (fast-paced) appreciation of the THB to a weakening US dollar, short-term capital inflows, and domestic factors. But the central bank also admits to it being inconsistent with economic fundamentals. It's not just inconsistent with prevailing economic fundamentals, the strong currency further dampens the prospects for exports and tourism by making them more expensive for foreigners. Thailand’s status as a cheap tourist destination in Asia and perhaps the world is under threat from rapid currency strength.

Indeed, the authorities are worried about this runaway currency appreciation but there is little action to arrest it just yet, even as Thailand has now moved out of the US Treasury’s radar for currency manipulators. The BoT is only ‘closely’ monitoring the foreign exchange market for speculative interests. We believe a policy rate cut might help in the process while the argument for easing is getting stronger and stronger with every piece of additional data.

Surging portfolio inflows

Lack of fiscal support

The persistent political uncertainty reduces hopes for any fiscal stimulus to revive the economy going forward, while the delayed government formation itself has been hurting routine government spending.

That said, the 4.4% year-on-year revenue growth in the first eight months of fiscal 2019 through May (fiscal year runs from October to September) was moderate but a bit slower than 4.6% in the same period of the previous year while expenditure growth of 5.6% accelerated from 0.1% a year ago.

Such trends will be associated with a significant overshoot of the fiscal deficit in the current financial year, above the government’s target of THB 450 billion, or about 2.6% of GDP target. We see the deficit this year as unchanged from the 3% of GDP level it was in the last financial year.

Without a properly functioning government the fate of big infrastructure projects, like the Eastern Economic Corridor (EEC)- a $45 billion public-private partnership, hangs in the balance.

Fiscal deficit

Heavy-lifting for monetary policy

The BoT’s last policy change was a 25 basis point increase in the one-day repurchase rate, the policy rate, to 1.75% in December 2018. We thought that policy tightening wasn’t required in the first place when the external economic headwinds were already getting stronger, GDP growth was petering out, and inflation was running under the BoT’s 1-4% target. Indeed, Thailand’s economic environment hasn’t got any better since the last policy move. Rather, it has deteriorated.

The lack of fiscal policy support means that monetary policy will have to do all the heavy lifting. Slowly but surely, the authorities are coming to terms with the need for easier monetary policy.

Growth, inflation and policy rate

Just recently the government added its voice to calls for monetary easing, with Deputy Prime Minister Somkid Jatusripitak saying that “It can’t go against the trend if the economic situation continues to be like this”. And a BoT policymaker, Somchai Jitsuchon, signalled that monetary policy would be data-dependent, with the fallout from the US-China trade war on the local economy leaving the bank “open to all possibilities”. This being the case, it’s hard to imagine the BoT ignoring the latest activity data, which offers no hope of recovery in economic growth in the period ahead.

The BoT’s statement after the last meeting was largely dovish and it was also accompanied by a downgrade of the central bank’s growth forecast for 2019 to 3.3% from 3.8%. We take this as a signal that a policy rate cut is just around the corner. We continue to expect a 25bp rate cut in the current quarter, more likely at the next meeting on 7 August rather than the 25 September meeting. However, that would still only be a reversal of the hike in late 2019, and not provide much stimulus to a sagging economy. We are adding one more 25bp rate cut to our policy forecast in the fourth quarter, taking the policy rate to 1.25% by end-2019.

Thailand: Key economic indicators and ING forecasts

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

8 July 2019

What’s happening in Australia and the rest of the world? This bundle contains 9 Articles