Poland’s fiscal space after the October elections

The record-high borrowing needs in the 2024 budget draft leave limited room for additional spending, but the new government plans to deliver its spending pledges. We expect expansionary fiscal policy in the years ahead but see space for c.1% of GDP of additional spending on top of already high borrowing needs (6% of GDP) proposed by the outgoing government

Starting point is relatively low debt, but a high deficit in the last few years

Although Poland is a moderately indebted country by European standards (public debt below 50% of GDP in 2022 vs. EU average of 83.5% of GDP), authorities have been running expansionary policies in the last pandemic and pre-election years as generous spending was accompanied by tax cuts. Some were temporary (VAT rate cuts for energy), but others are here to stay (lower personal income tax rate, higher tax-free allowance). Large fiscal gaps and borrowing needs in an environment of high interest rates should lead to a substantial rise in interest payments as the increased amount of total public debt is rolled over at higher costs. That may force adjustments in other spending in the future.

Some members of the new ruling majority were outraged when the Ministry of Finance disclosed that the state budget deficit (that covers only part of the central budget and is reported on a cash basis), rose to PLN33.5bn cumulatively year-to-date through September compared to PLN16.6bn through August. Given the annual target is set at PLN92bn, in our view in itself it is not a cause for alarm. What is concerning is that spending was substantial in September alone while some tax revenues were surprisingly weak (close to zero from CIT). As the deficit threshold cannot be exceeded, the administration theoretically needs to seek some savings on the expenditure side if revenues indeed fall short of the plan through the end of this year. But we think revenues should improve in the coming months, given that consumption is recovering, offsetting lower dynamics of nominal GDP due to low inflation.

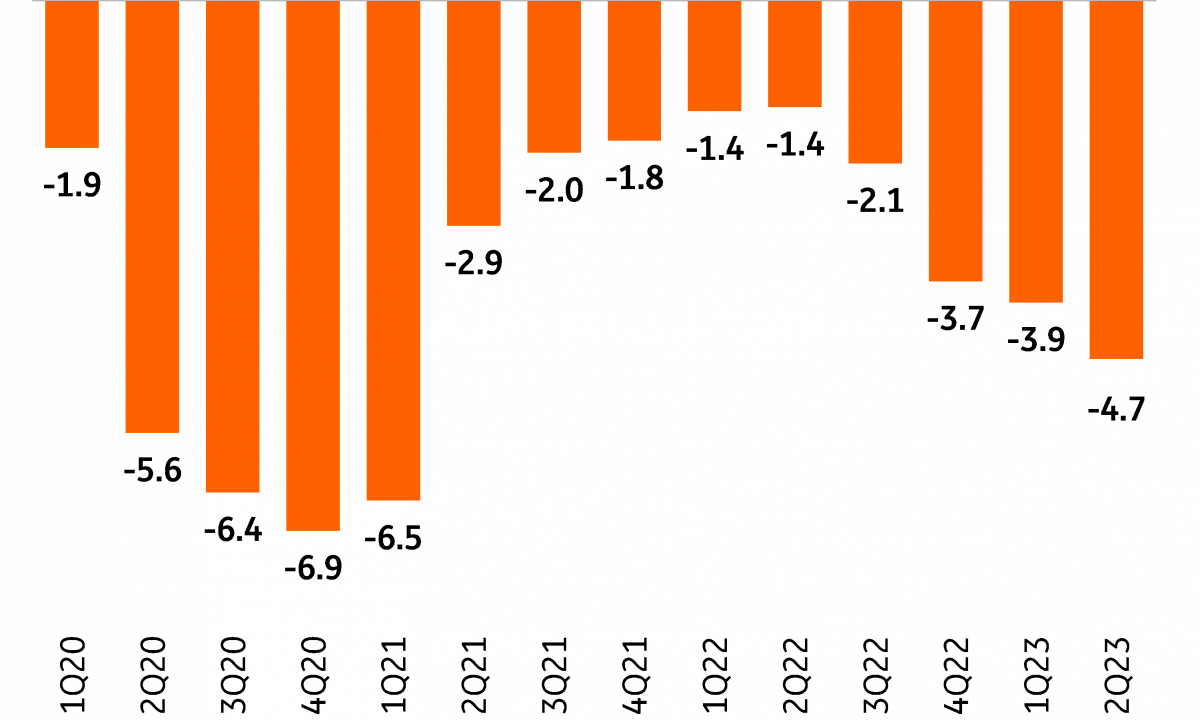

According to the Eurostat data, which gives the full picture of public finances, the general government gap is indeed already sizable. In 2Q23, the general government deficit amounted to PLN36.6bn compared to PLN5.4bn in 2Q22. On a 4-quarter rolling basis, it increased to 4.7% of GDP from 3.9% of GDP after 1Q23. The Autumn fiscal notification points to above 5% of GDP fiscal gap in 2024, which is roughly 1% of GDP more than envisaged in the spring notification.

On the other hand, since the EU general exit clause regarding fiscal governance expires in 2023, the EC may impose an excessive deficit procedure on Poland already in 2024. Still, with the rules guiding the Stability and Growth Pact execution in 2024 subject to reform (leading to new approach based on debt sustainability rather than arbitrary 3% and 60% of GDP thresholds), Poland may not necessarily be obliged to comply quickly.

Poland is a moderately indebted country by European standards

Public debt in % of GDP in 2022, Poland vs. EU

The fast rise of general government deficit in 2023 due to elections and post inflation revenue slowdown

General government balance, % of GDP (last 4 quarters rolling)

2024 budget draft already assumed record-high net borrowing needs

The 2024 budget draft bill envisaged record-high net borrowing needs next year of PLN225bn (6.1% of GDP) and this is not the entire picture as the incumbent government planned to draw an additional 2.0% of GDP of debt via off-budget funds (mainly outside the govies market). The latter were to cover mainly for defence spending, largely in the form of trade loans and vendor funding from military equipment suppliers.

Given the size of central budget net borrowing needs, the Morawiecki government planned to tap all potential sources of funding in 2024, including loans from the EU’s Recovery and Resilience Facility (RRF), which remained locked due to the conflict over the rule of law (but should be unlocked under the new government).

The 2024 financing plan assumed net issuance of nearly PLN40bn in hard currency Eurobonds, nearly PLN55bn in short-term T-bills, mainly purchased by domestic banks and nearly PLN100bn in Polish government bonds. Given the depth and the expected liquidity of the domestic market, in our view 50-60% of the PLN denominated Bonds and T-bills would need to be purchased by foreign investors, which in recent years have generally stayed underweight in Polish debt. However, a stronger reliance of foreign financing requires a solid growth outlook and stable or even appreciating PLN, which is much more likely under a new government.

The net borrowing needs rises strongly in the last two years, to a record high in 2024 reaching 6% of GDP

Net borrowing needs and financing, PLNbn

MinFin rises more off budget debt during the pandemic but also recently for defence and other non-transparent spending

Off-budget debt, PLNbn cumulative

More fiscal spending in the pipeline as the opposition takes over; incoming government to add c.1% of GDP

In the election campaign, all parties went large with additional spending and tax relief. Also, the parties from the new majority made fiscally costly pledges during the campaign and will search to deliver them. They are on top of already costly measures pledged by the incumbent government, such as indexation of child benefits from PLN500 per child to PLN800. The new finance minister will need to seek adjustments elsewhere.

We estimate that the new fiscal measures proposed by the opposition parties may cost about PLN120-150bn i.e. 3-4% of GDP, but are unlikely to be all implemented in 2024 already as some require lengthy legislative work and public consultations.

We analysed the election programme of opposition parties and selected common elements in Civic Coalition (KO), Third Way (TD) and Left (Lewica) promises, that seems possible to implement in the short time slot between the appointment of the new government and the 30 January 2024 deadline for passing the budget (if broken President may dissolve parliament and call new elections). They are:

- 20% wage increase in public administration,

- 30% wage increase for teachers

- social benefit for mothers returning after maternity (granny's benefit)

- subsidies for local governments’ housing policy

- new benefit for individuals renting flats

- freezing natural gas prices.

We estimate that without additional savings in other areas it could potentially boost 2024 deficit by PLN35bn (1% of GDP).The most costly programme, ie, higher tax allowance in personal income taxes, may be phased-in gradually as it requires more preparation from the tax administration and is very costly (1.2% of GDP).

New spending should lift the general government deficit to about 5.5-6% of GDP and net borrowing needs to 7% of GDP

The incumbent government planned net borrowing needs at a record-high level of PLN225bn (6.1% of GDP) in 2024. We forecast the 2024 general government deficit at about 4.8% of GDP. We estimate the common spending promises of election winners should add 1% of GDP extra spending in 2024, lifting borrowing needs to 7% of GDP and general government deficit to 5.5-6% of GDP vs 5.6% of GDP the Ministry of Finance expects for 2023.

High government bond supply; elections bring positive game changers

We find the general government deficit of 5.5-6% of GDP is the maximum the European Commission may accept in 2024 given that the Growth and Stability Pact will be restored to work. The Pact is subject to reform leading to a new approach based on debt sustainability rather than arbitrary 3% and 60% of GDP thresholds for deficit and debt. But before the reform will be agreed by member states, the EC should assess countries fiscal stance based on the old approach. Poland with 5.5-6% of GDP should have the highest deficit in the EU. Other countries with high deficits in 2024 should be Belgium, France and Italy, but their fiscal imbalance should reach 4-5% of GDP. Poland may potentially negotiate a waiver with the EC due to high military spending and its role as the Eastern NATO border.

In our view, extra borrowing needs of this scale (PLN260bn, ie, 7% of GDP) may be funded without an increase in Polish government bond yields should few supporting assumptions work: (a) the core market yields decreases, (b) foreign investors return to the Polish market today so the foreign holding of POLGBs is about 15% vs. 25-30% in the region, the rise of foreign holding by 12.5pp should bring PLN120bn of new demand for POLGBs covering 46% of 2024 borrowing needs, and (c) securing alternatives to POLGBs in the form of advances/loans from the RRF, very likely in our view.

The main game changers after the October 2023 elections, which are POLGBs positive, is the new government's ability to unlock private investments, FDI’s and EU funds and restore higher GDP growth with a less inflationary structure. All of the above is positive for the country debt sustainability position and calls for stronger PLN at the same time should cause foreign investors to cut a significant underweight positon they hold in POLGBs for many years. We also think that domestic banks should stay as important POLGBs buyers (up to 30-40% of borrowing needs) and the MinFin still has a record high cash buffer it can utilise and will try to prefund as much as possible in 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 October 2023

How Poland is back on a pro-European course This bundle contains 3 Articles