Poland: Raising capital requirements instead of raising rates

Raising capital requirements for Polish banks may constrain their credit expansion in 2019 and delay the need for interest rate hikes

Macro-prudential measures versus rate hikes

As the inflationary pressures in the Polish economy rise, financial markets are looking for signs of tightening monetary policy. They are focusing on interest rates, but it seems that the Monetary Policy Council (MPC) has no intention of raising rates.

The central bank chief A.Glapiński has recently extended his forecast of stable interest rates into 2019, and many of the MPC members seem to agree. This, however, doesn’t mean that monetary policy is loose and the inflation is destined to escalate. The MPC have other instruments to prevent that, namely macro-prudential measures affecting mostly banking sector via:

- Capital requirements, including countercyclical and discretionary buffers

- Limit on leverage and liquidity risk

- Limits on credit risk concentration and underwriting standards

- Loans-to-Value and Debt-to-Income ratio caps

As a result, central banks can better tackle individual economic imbalances (such as asset bubbles) and even manage the broad monetary supply without moving interest rates.

The tightening cycle has already begun

Even though rates have not been raised, the tightening cycle has already begun.

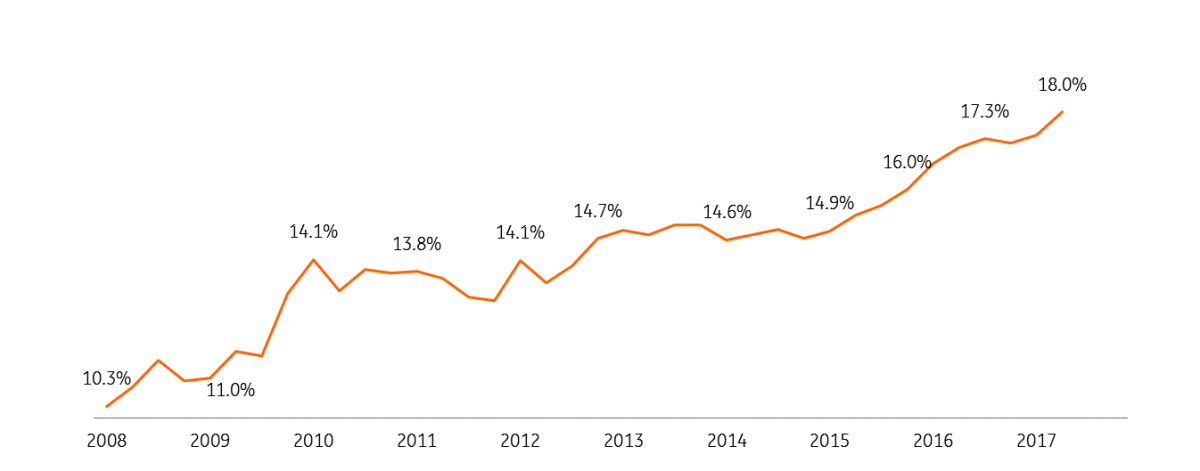

Since 2015, the cost of credit has constantly been on the rise due to increased capital requirements of banks (reflected in the rising TCR of the Polish banking sector) and the introduction of the banking tax (which limits the retained profits of banks).

So far - in our opinion - these requirements don’t limit credit expansion in 2018 in a significant way due to relatively high capitalisation of banks. However, if they are raised any further, they might take their toll on the lending in the years to come.

Total Capital Ratio of Polish banks

Translation of capital requirements into borrowing costs - an example

Capital requirements state that banks must maintain a certain minimum ratio between their capital (of different quality) and risk-weighted assets.

So imagine that the bank wants to sell a corporate investment loan (70% risk-weight) of PLN100mn. If it wants to maintain the unchanged capital adequacy of 18% (for Total Capital Ratio), it needs to put aside capital worth of PLN12.6mn[1] (70%*18%*PLN100mn). Cost of such move is to some extent arbitrary but should be commensurate to the expected return on equity, let’s say 10% per year. Therefore, the cost of the loan is PLN1.3mn or 1.3% per annum.

To put that into perspective, each percentage point of additional capital requirements increases the cost of the loan in question by 7bp. So if the minimum TCR were raised by 3.5pp, the impact on borrowing costs would similar in size to one interest rate hike.

[1] The product of 70%*18%*PLN100mn

What are the options for Polish MPC?

If the inflationary pressure accelerates in 2018, and we believe it will, the MPC will have two options to choose from:

- It can start communicating in a more hawkish way and eventually the raise interest rates to constrain banking credit. However, such move would generate unwelcomed media publicity on rising costs of loans for Polish families – mortgage-owners in particular.

- It can encourage Financial Stability Committee[1] to raise capital requirements of Polish banks. That could be easily achieved within the framework of EU banking regulations, i.e. via raising countercyclical buffer rate (currently set to 0%, but could be raised up to 2.5%) or increasing discretionary capital buffers for Polish banks. Such move would essentially achieve the same goal as rates hike but in more circumspect and implicit way.

How long could the MPC delay interest rate hikes?

Various macro-prudential measures offer plenty of opportunities to tighten monetary policy, but they are not without limits. Recent comments from MPC suggest that ECB decisions might serve as an important benchmark. When the interest rates start to rise in the Eurozone, it would be certainly difficult to delay them in Poland any longer.

[1] The Financial Stability Committee consists of representatives of National Bank of Poland, Polish Financial Supervison Authority and Ministry of Finance that collaborate closely.

Bottom line

We no longer expect interest rate hike in 2018. We expect two moves in 2019 (by 25bp each) with risk on the dovish side with a higher probability for less than for more.

The Polish Monetary Policy Committee will use macro-prudential measures to keep inflation at bay. It might, for instance, raise countercyclical and discretionary capital buffers or use other targeted measures to constrain credit expansion.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article