Poland launches public consultations on the national recovery plan

The Polish government has just launched public consultations on the National Recovery Plan. The document is a key conditionality for disbursements of sizeable EU grants and proceeds from preferential loans from the new EU Recovery Fund. The combined amount of available EU funds through 2026 is an equvalent of 12% of Poland's GDP

Poland’s envelope of nearly 12% of GDP, of which about 5% of GDP in grants

In the pandemic year 2020, Poland mobilized a sizeable fiscal stimulus in comparison with other EU countries, but it was rather universal with the main goal to protect jobs and firms while hardly addressing any long-term investments goals. However, the adoption of the new EU’s multi-year budget 2021-27, together with the new €750bn Recovery Fund in December 2020, offers new EU funding of 12% of GDP to Poland, which should better target economy investment needs.

The adoption of the National Recovery Fund, which a draft has been just launched for public consultations by PM Mateusz Morawiecki, is a pre-condition to tap the EU money from the new instrument. The disbursements from the nearly €60bn envelope to Poland could be made from both grants and preferential loans in roughly 40:60 proportions. These proportions may change slightly in favour of grants as a new pool of money will be mobilized and distributed at the EU level in mid-2022.

The EC advised Poland to focus on green and digital transformation and mature projects

According to the EU guidelines to Poland, the funds from the Recovery Fund are to support investments and reforms advancing green (in 37%) and digital (in 20%) transitions. On the green agenda, the EU's guidelines to Poland suggested renewable energy, energy efficiency, and sustainable transport as key areas for public intervention.

However, the funds from the new EU instrument are not only to support the green and digital agenda, but also to enhance recovery prospects relatively quickly. The timing matters in the current difficult pandemic reality. The EU suggested its members to focus their strategic choices on mature projects, ready for a relatively quick absorption of EU funds during the next 2-3 years.

The main grant instrument is a Recovery and Resilience Facility offers Poland access to €23.9bn in grants and €34.2bn in loans, in 2018 prices, to be utilized through 2026 (within 7 years). It corresponds to an equivalent of 4.8% of GDP and 6.9% of GDP, accordingly (11.7% of GDP altogether).

Five pillars of Poland’s National Recovery Plan

Five pillars of Poland’s NRP

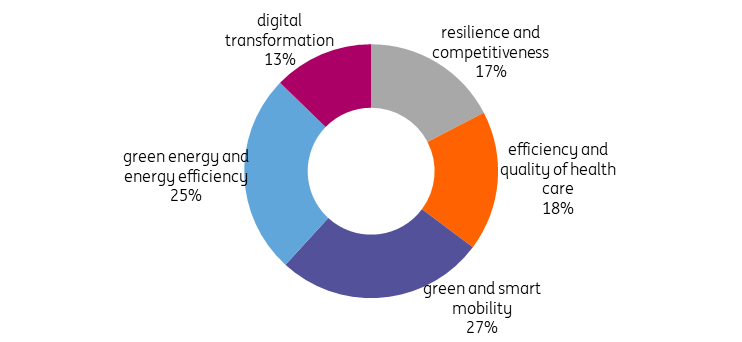

The government provided a breakout of the PLN108bn (approximately 5% of GDP), starting from:

- resilience and competitiveness (PLN18.7bn), through

- health care (PLN19.2bn)

- sustainable transport (PLN28.6bn)

- green energy (PLN27.4bn), and

- digital transformation (PLN13.7bn).

The mobility component is the largest and constitutes 27% of the total envelope. The digitalization component is the smallest with a 13% share in the total envelope. However, this breakdown refers to the grant financing only. The government has not provided any insights on the loan part, which is actually much bigger than the grant component.

Breakdown of the grant EU funds in the draft Poland’s National Recovery Programme, as a % of the total envelope of PLN108bn

No acceleration to swiftly support the economy, which is just facing the third wave of the pandemic

The Government assumes the Plan will be approved by the European Commission by July. The final draft is to be sent to Brussels in late April, just a few days before the deadline of 30 April. In our earlier public reports, we pointed out delays in the preparatory process of this plan caused by political conflicts within the coalition government and associated with the threat of the Polish veto to the EU’s next financial perspective.

Although Poland plans is to start disbursements this year, we assume that they will be rather limited in 2021. They are to reach up to 0.5% of GDP of available grants unless there is an EU-wide agreement allowing for sizeable advance payments. We project major inflows to Poland to occur in 2022 and 2023 and reach 1.5% of GDP. The remainder will be absorbed in the following years.

Some quick takeaways

- The proposed distribution of the grant money does not appear to match fully with the EU guidelines and green and digital priorities, but it probably meets the formal requirements. This suggests, however, a rather lengthy dialogue with the EC to finalize the document. And time is money.

- We worry that the government lacks advanced reforms and projects e.g. those which would flirt with the idea of economy 4.0 or bring a technological leapfrog. So for the time being, it proposed investments plans, which rather foster inclusion, regional cohesion, enhance basic infrastructure (roads) or is an extension of the anti-pandemic rescue plan, provided in 2020. There are also structural changes planned but they seem to be at a quite early stage.

- Poland has not yet made up its mind on the utilization of the loan part of the available EU funding. This financing source is treated as potentially available, to be used in the later phase, maybe ad calandas grecas.

- The Plan will not give a boost to the Polish economy in 2021, the major fiscal impulse is to occur in 2022-23. Unfortunately, this will provide additional proof to the time inconsistency phenomenon in the economic decision making.

As we already suggested in our regional report from in November 2020 (https://think.ing.com/reports/green-opportunities-in-a-post-covid-world-what-cee-countries-should-do-next/), we will look carefully into the National Recovery Plans of the Central European countries and provide more detailed comments. Stay tuned for our following comments on the Polish and CEEs National Recovery Plans.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article