Poland hikes again, to 1.25%

Governor Adam Glapiński seemed to signal rate hikes until the headline CPI peaks in 1Q21. We see a longer period of tightening given the inflationary policy mix, which should keep core inflation elevated in 2022-23

The MPC decided to hike interest rates by 75bp, from 0.5 to 1.25%. We expected a 50bp hike (with risk to the upside). Economists were generally looking for between 25-50bp.

The hike by 75bp was neutral for the EUR/PLN rate. In our view, the FX market was expecting a stronger tightening (75bp) than the yield curve (50bp).

The NBP hiked the main rate from 0.5 to 1.25%

While the rate hike in October was a result of past inflation surprises, the MPC had more forward looking arguments in November, as the NBP's inflation projections were unveiled. These were significantly revised upwards, by as much as 2.5ppt to 5.8% on average in 2022. In 2023, average inflation, according to the National Bank of Poland, should reach 3.7% year-on-year, which means that inflation will be significantly above target (2.5%). In our opinion, CPI can only temporarily (at the turn of 2022-23) go below the upper band of the NBP's target (3.5%).

The NBP governor's comments were rather mild, given how much the CPI projection was revised up. They also differ significantly from the hawkish stance of other central banks in the region.

We see the governor's statement as an announcement of rate hikes until current CPI inflation reaches a peak, i.e. until the beginning of 2022 (slightly above 7%, according to the governor). In our view, this means that rates will be raised by ca. 25bp in December to the pre-pandemic level of 1.5%. We also see high odds of hikes at the beginning of the next year, despite the fact that 7 out of 10 MPC members will be replaced in January-March. We think rates could reach around 2% in February 2022, but that should not be the end of the tightening cycle.

The governor's assumption that tightening may stop when CPI peaks is too optimistic in our view.

While supply-side factors are driving CPI higher this year, demand and wage pressures should be important inflationary factors in 2022. We also see the first signs of second-round effects. Unlike some developed market economies (the UK for example), we expect a positive fiscal impulse in Poland next year and estimate that the structural deficit should expand from c.4% in 2021 to c.5% in 2022. High inflation is also caused by structural factors, i.e. consumption-driven GDP.

Therefore the decline in CPI from 2Q21 onwards would mainly be the result of a high base effect for fuel and food rather than a significant reduction in inflationary risks. In our view, core inflation should remain high in 2022. In addition, the risk of an intensified wage-price spiral will still be high, following the rise in inflation expectations of households and companies.

This would therefore require further additional rate hikes in 2H22. In our view, the terminal rate is 2.5% with risks to the higher side.

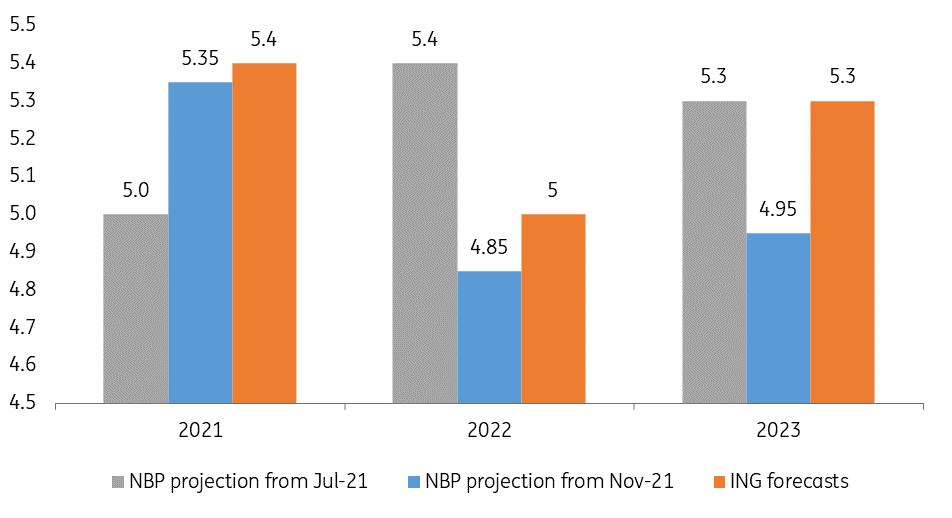

NBP projections of GDP vs ING forecasts

NBP projections of CPI vs ING forecasts

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article