Philippines: Double dose of stimulus to boost growth above 6%

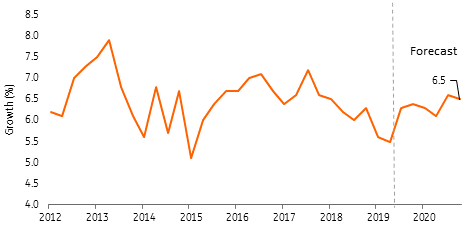

The Philippine economy hit a speed bump in 1H as revamped consumption failed to offset downbeat capital formation and government spending, with GDP slowing to the worst print since 2015. Within-target inflation and stimulus efforts from the government will push growth back to the 6% handle over the next six quarters as economic growth returns to form

Growth to accelerate in 2020

The Philippines posted a disappointing 1H GDP print of 5.5% as government outlays slipped on the budget delay while capital formation lost its lustre after the central bank hiked aggressively in 2018. Going forward, we expect growth to return to the 6% handle on the back of aggressive stimulus from both the fiscal and monetary side, while household consumption is seen to recover as inflation remains well within the central bank’s 2-4% target.

After the delayed passage of the 2019 spending bill, government spending bounced back with the latest expenditure reports showing a decent 8.78% expansion last August. Meanwhile, monetary authorities injected stimulus with several policy rate cuts in tandem with successive infusions of liquidity via reductions in reserve requirements. These actions will help revive lost momentum in capital formation, which contracted by 8.5% in 2Q19. Lastly, household consumption will continue to rebound sharply as inflation has fallen to less than 1% (latest print at 0.9%).

With growth emanating from three major sectors of the economy, ING forecasts economic growth to return to form with stimulus driving growth momentum back above the 6% level over the next six quarters.

Philippine GDP growth

Inflation outlook: Forecast to remain stable into 2020

Inflation in the Philippines is largely driven by the food and beverage subcomponent as it accounts for roughly 38% of the entire CPI basket. In the past, episodes of above-target inflation were traced to surging food prices and to a lesser extent transport prices.

Inflation decelerated sharply in 2019 and ING forecasts inflation to remain within the central bank's 2-4% target throughout 2020 on improved supply conditions and given new legislation which removed quotas on rice imports. Although the Philippine agriculture sector remains susceptible to storms (average of 19 typhoons annually), the government has recently become more open to importing basic foodstuffs to ensure ample supply. Meanwhile, the El Niño climate disturbance ended last August 2019 and neutral weather conditions are predicted until mid-2020.

On the commodity side, forecasts for weaker global growth will limit the rise in crude oil and in turn lead to only benign price pressures on Philippine transport costs over the next six quarters and there are no pending tariff fare adjustments for local jeepneys or buses.

Thus, we expect inflation to remain within the 2-4% inflation target for the rest of 2019 and into 2020 (ING forecast of 2.7% and 3.1% for 2019 and 2020), given expectations for ample supply of food stuffs to counter potential occasional spikes in food inflation due to probable inclement weather conditions.

Philippine inflation and forecast

Country specific highlight: government underspending

The Philippine legislative body failed to pass the national government budget in January 2019, triggering an automatic shift to the 2018 spending plan until congress could pass the 2019 version. The legislative body finally passed the 2019 budget bill in May but ambitious plans to accelerate state spending have been derailed with the year-to-date budget deficit a mere PHP120 bn compared to the PHP282 bn deficit posted in the same period of 2018.

The government pledged “catch up” spending in the second half of the year, with state spending up 8.78% and disbursements hitting 92% of budget as of August (versus 86% in 2018), showing early signs of a turnaround.

Meanwhile, Congress passed the 2020 spending bill in record time, handing the bill to the Senate for approval last September in an attempt to ensure that the country avoids another budget delay. Given the administration’s resolve to ensure timely passage of the spending bill, ING expects government spending to come back online in 2H19 and bounce back sharply next year with congress looking to extend the validity of the 2019 budget for an additional 12 months.

Philippine national government spending

Monetary policy and interest rates: BSP cut 75 bp in 2019, more possible in 2020

With inflation sliding quickly back within the 2-4% target, the Bangko Sentral ng Pilipinas (BSP) opted to gradually unwind the previous year’s 175 basis point rate hike in a bid to provide a boost to the ailing economy. The BSP cut policy rates by a total of 75 bp while also reducing reserve requirement ratios (RRR) by 300 bp in a phased manner, starting in May and ending in November.

Given ING’s inflation forecast for next year (average inflation at 3.1%) and a dovish outlook for the Fed, we expect BSP Governor Diokno to remain open to further rate reductions in the near term as he pledged to implement more “pro-growth policies”. ING forecasts BSP to cut policy rates further by 50 bp in 2020 with the first cut expected in 1Q.

Central bank policy rate and Philippine inflation

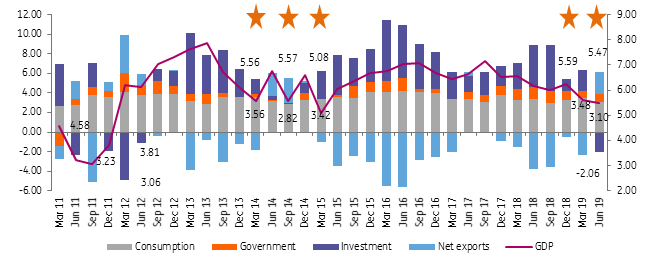

Cratering capital formation to rebound

Capital formation had helped contribute significantly to the recent string of 6% growth for the Philippines dating back to 2011. 2Q19 was the first time capital formation registered a negative contribution to overall GDP as investment activity slowed on the back of BSP’s aggressive rate hike in 2018. With the BSP quickly scaling back policy rates to help foster growth, we expect capital formation to come back online as early as 4Q19 with growth going into 2020 likely to enjoy an added push from investment activity to get growth above 6%.

Philippine GDP contribution to growth

* - growth of less than 6%

Currency movement: Rebound from 2018 plunge but gains to be whittled down in 2H

As expected, the Philippine peso has performed relatively well for most of the year, appreciating by 2.3% mainly on inflows from the financial account as risk sentiment improved in 2019. As the trade war continues, US economic indicators have declined, convincing the Federal Reserve to reverse course and cut rates to stem slowing growth. This change in central bank dynamic has helped bolster emerging market currencies for the year with most 2018 underperformers now transformed into 2019 outperformers.

The peso is expected to enjoy some short-term appreciation as investors have looked kindly on high-yielding currencies as the Fed has reversed its 2018 hike cycle. The risk rally can continue for as long as market sentiment remains focused on the now dovish Fed, however, a possible refocus on the global trade war and economic malaise that could follow may eclipse the euphoria from the Fed’s easing. In the medium term, we expect the peso to face renewed headwinds as the current account remains in deficit and with the BSP expected to continue cutting policy rates in 2020 with the Peso settling at 52.88 by end-2019 and eventually at 53.57 by end-2020 as the trade gap widens anew on ambitious infrastructure spending.

Select Asian FX performance year to date

Summary: double dose of stimulus to boost PHL growth

The Philippine economy hit a speed bump in 1H with growth slipping to below 6% for the first time in 4 years as robust consumption failed to offset slower government spending and lacklustre capital formation.

With inflation forecasted to remain within target well into 2020, we expect economic expansion to rebound over the next six quarters on the combination of fiscal and monetary stimulus with state spending back online and with the central bank scaling back its previous tightening stance.

The national government has pledged to catch up spending and we expect the economy’s acceleration to get a substantial boost from the fiscal side in both 2H19 and 2020. Meanwhile, ING expects stimulus from the monetary side as well with BSP expected to cut rates by 50 bp in 2020 with the first rate cut expected in 1Q given stable inflation and lacklustre growth. The Philippine peso is projected to face only a mild depreciation trend over the next 15 months after the projected easing from BSP and on expectations for sustained current account deficits tied to the resumption of revamped government infrastructure spending.

Philippine forecasts

Tags

PhilippinesDownload

Download article

21 October 2019

Good MornING Asia - 22 October 2019 This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).