Philippines country brief: 2019 to be a tale of two halves

The Philippine economy has seen strong growth momentum in recent years but will likely hit a speed bump in the first half of 2019. However, decelerating inflation and possible easing from the Bangko Sentral ng Pilipinas (BSP) could help restore some lost growth momentum to close out the year

Recent Growth and outlook: Robust but speed bumps ahead

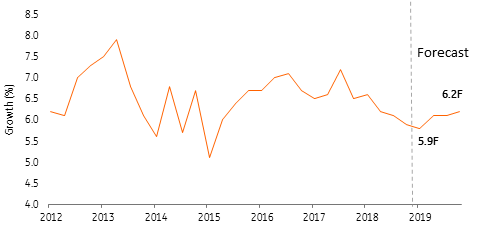

The Philippines continued to post growth above 6% as of the 3Q of 2018 with year-to-date growth at roughly 6.3% and almost all sectors of the economy contributing to that figure. In the past, the economy was heavily reliant on household consumption but in recent years we’ve seen a steady contribution from both capital formation and government spending as well. On the other hand, net exports have continued to act as a drag on economic growth as the Philippines runs a chronic trade deficit. This has become more pronounced in recent months with imports surging at a time when exports have struggled.

Growth, however, is expected to hit a speedbump in the next two quarters with still-elevated levels of inflation and higher borrowing expected to sap both consumption and investment momentum somewhat. Meanwhile, government spending may decelerate sharply as the administration is running on a re-enacted budget following Congress’s failure to pass the 2019 spending plan.

Philippines gross domestic product and forecasts (until end 2019)

Inflation and outlook: Multi-year peak but expected to decelerate

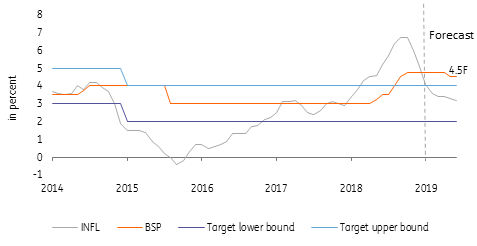

Price pressures resurfaced in 2018 with a confluence of events pushing inflation to multi-year highs. Excise taxes on fuel, tobacco, alcohol and select food items piled on to pressures emanating from supply bottlenecks caused by adverse weather while crude oil prices jumped more than 40% for the year. Given these developments, inflation peaked at 6.7% in 3Q but has since shown signs of a stark deceleration with the December 2018 number stalling at 5.1%.

With Congress passing a key legislative measure to help improve supply of the all-important rice grain and oil prices sliding from a peak in 2018, BSP is now expecting inflation to slow to below 4% as early as 1Q 2019.

Philippine inflation

2016=100

Monetary policy and interest rates: BSP hiked but likely to reverse in 2019

With inflation zooming past the BSP’s 2-4% inflation target, monetary authorities unloaded a string of policy rate hikes throughout the year, bringing the cumulative increase to 175 basis points for 2018. With inflation pushing higher and the BSP hiking rates, secondary market rates jumped as well with three-month paper up to 6.149% by year-end from 3.164% at the start of the year.

With inflationary pressures abating, we do expect interest rates to slowly edge lower especially at the long-end of the curve. We do not expect rates on shorter-dated securities to return to levels seen at the start of 2018 given BSP’s recent 175 bps hike as well as relatively tight liquidity conditions, as evidenced by a third straight month of single-digit growth in the money supply.

Given decelerating inflation, tight liquidity conditions and slowing growth, we expect the BSP to walk back its recent aggressive rate hike cycle by carrying out a two-pronged easing; slashing reserve requirement ratios (RRR) as early as 1Q and reducing its main policy rate by 2Q to bolster flagging growth momentum.

Philippines inflation, BSP policy rate and inflation target

2016=100

Country specific highlight: twin budget and current account deficits

The Philippines is experiencing ‘twin deficits’ in the form of a targeted widening budget deficit of up to 3.2% of GDP and a current account deficit expected to hit 2.3% of GDP. In many ways, the twin deficits are two sides of the same coin as the government’s aggressive infrastructure push has fomented increased borrowing by the national government while at the same time driven import demand for capital goods and raw materials. Government officials continue to assert the need for such an aggressive drive in borrowing and importation in order to improve the overall quality of infrastructure to usher in President Rodrigo Duterte’s ‘golden age of infrastructure’.

We expect the country to remain in this situation in 2019 with the current account remaining in deficit due to surging imports while the government runs a budget deficit to finance its aggressive infrastructure build up. As long as the government hovers close to its targets for the year, we do not foresee this worrying credit rating agencies.

Currency movement: Weakened on C/A woes but 2019 may be different

The Philippine peso weakened for most of 2018 in large part due to concerns about the country’s widening current account deficit. Investors also pointed to the central bank being ‘behind the curve’ as it postponed hiking rates even after inflation zoomed past its target. Risk sentiment improved considerably when inflation slowed sharply in the 4Q of 2018 as oil prices plunged and the food supply bottlenecks were mitigated.

The peso is expected to enjoy some short-term appreciation given the risk-on tone and as investors have looked kindly on high-yielding currencies as the Fed suddenly turned dovish. In the medium-term, look for the peso to face renewed headwinds as the current account remains in the red and with the BSP expected to switch to an easing stance as early as 1Q 2019.

Summary: Speed bump in 1H, rebound in 2H

The Philippine economy continues to post respectable growth despite the recent flare-up in inflation and borrowing costs in 2018. Speed bumps are directly ahead though with economic growth expected to slip slightly below 6% as higher borrowing costs and still above-target inflation sap consumption and investment momentum. Government spending, which has recently been a key source of growth, is expected to struggle in 1H 2019 with an election ban preventing fresh projects and a delay in passing the budget likely to halt last year’s strong growth. But with inflation expected to slip back within target in 1H and the BSP expected to ease, GDP growth momentum may be rekindled to close out the year.

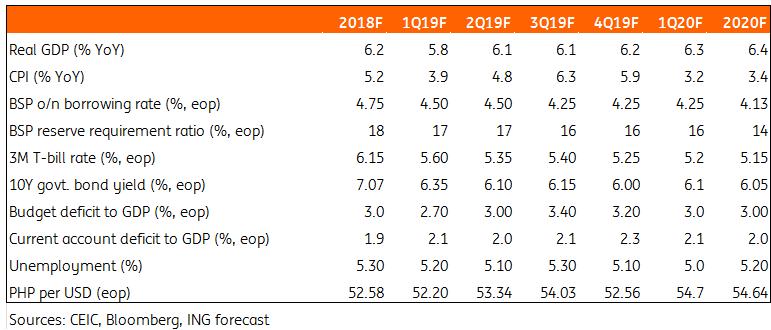

ING Philippine forecasts

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

14 January 2019

Good MornING Asia - 15 January 2019 This bundle contains 4 Articles