The Philippines: Triple threat could weigh on growth momentum

The Philippine economy recently returned to pre-Covid levels of GDP, but looming headwinds could sap some of the recent momentum

Headwinds loom as new president takes over

Ferdinand Marcos Jr. won the May presidential election by a landslide while simultaneously securing key posts for his allies. Marcos controls the upper and lower house of representatives and will have his ally Sarah Duterte as his vice president.

Marcos inherits an economy on the mend but the triple threat of accelerating inflation, rising interest rates, and multi-year high debt presents a major challenge at the start of Marcos’ six-year term.

Marcos holds a super majority with control of both the upper and lower houses of Congress

Philippine Senate Control

GDP grew 8.3% in 1Q22, bringing the economy back to its pre-Covid level

The Philippine economy returned to pre-Covid levels in early 2022 after 1Q GDP rose 8.3% year-on-year. The better-than-expected growth rate was bolstered by a heavy dose of household spending after authorities relaxed mobility restrictions last February. Consumption in subsectors of restaurants, hotels, and recreation all showed double-digit gains driven by pent-up demand for these services.

Campaign-related spending ahead of the nationwide election will likely carry 2Q22 GDP growth past 9%, but headwinds threaten to sap some momentum by the second half of the year.

Back to square one: GDP finally reverts to pre-Covid levels

Threat 1: Inflation spreads across CPI basket

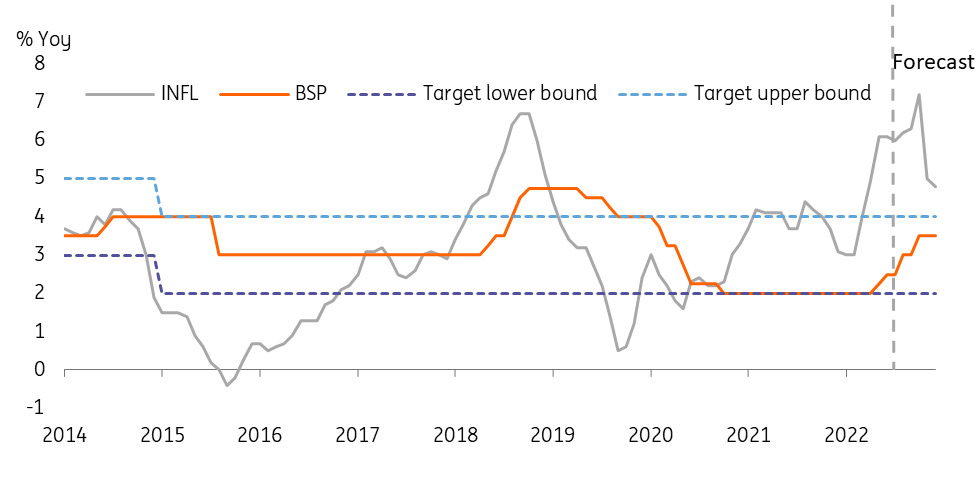

The Bangko Sentral ng Pilipinas (BSP) inflation target for the year is 2-4%. Inflation moved past 6% and is expected to average 5.1% for the year, marking it the second year BSP will miss its inflation target. A mix of supply-side factors and resurgent demand have contributed to price pressures heating up.

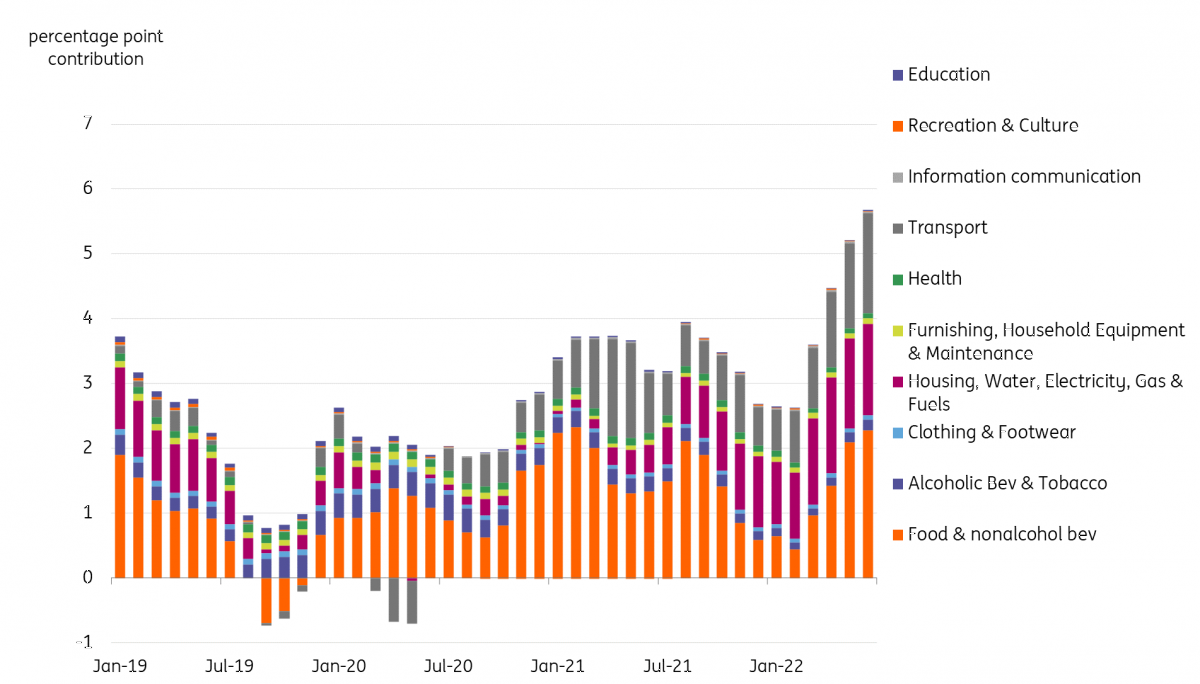

The Philippines is very susceptible to the recent global price surge, as it imports almost all of its energy and several key food items from abroad. Food inflation has a sizable contribution to the recent spike in inflation, followed by transport and utilities. The combined weight of items that have inflation above 4% is equal to 47.1% and the actual count of items in the CPI basket above target has moved past 100 (109) the highest number in a year, indicating that price pressures are now more broad-based and no longer confined simply to energy items.

Faster inflation will likely stunt purchasing power in the near term, a direct counterweight to household spending, which accounts for 70% of GDP. The latest BSP consumer expectations survey showed that Filipino households are increasingly concerned about the inflation outlook, weighing on overall sentiment for the current quarter and the rest of the year.

It's not just oil: Higher inflation noted for almost half of the CPI basket

Threat 2: Rates moving higher as BSP on the hike path

BSP joined the central bank rate hike club in May, increasing borrowing costs by 25bp followed by an additional 25bp rate hike in June. Governor Felipe M. Medalla telegraphed rate adjustments for at least the next two meetings while leaving the door open for additional policy rate increases later in the year should inflation remain elevated.

We expect the BSP to hike rates by a cumulative 150bp worth of increases in total for 2022 with another 100bp likely needed next year as well.

Higher borrowing costs have already been reflected in secondary market yields with the 10Y local currency bond yield up almost 280bp for the year. Elevated interest rates may dampen bank lending activity, which just recently recovered, posting a 10.1% increase in 1Q.

Welcome to the club: BSP joins chorus of central banks hiking to fend off inflation

Threat 3: Multi-year high debt levels

Covid-19 forced the Philippine government to lock down the greater part of the country for several months to mitigate the spread of the virus. The steep drop in revenues coupled with a sharp increase in outlays to support the economy resulted in overall debt levels hitting fresh records while the debt-to-GDP ratio tested multi-year highs. The current debt-to-GDP ratio is now at 63.5%, above the prescribed 60% threshold with Fitch lowering the Philippine outlook from stable to negative last year.

Despite the elevated debt levels, the incoming administration has indicated a preference to push on with heavy expenditure to “revitalise the economy”. The Marcos administration plans to fund increased spending via revenues from improved collection while refraining from implementing fresh taxes.

Given the limited fiscal space due to high debt levels, Marcos may need to eventually scale back fiscal stimulus measures or run the risk of a credit downgrade in the near term.

Fiscal handicap: High debt levels suggest fiscal space will be tight in the near term

Market implications? USD/PHP, inflation, and interest rates all headed higher

BSP’s relatively dovish stance has caused some anxiety with USD/PHP busting through previously long-standing resistance levels. With BSP initially committing to a “gradual rate hike path” we expect the Philippine peso (PHP) to march higher, especially as imports bloat on the weaker currency. This in turn will pressure inflation to accelerate further given the Philippines’ dependence on imported oil and food items. Price pressures could force headline inflation to the 7% level by 4Q which will likely drive bond yields to test multi-year highs as well.

Overall growth outlook positive, although near term headwinds are a cause for concern

The Philippines has done a much better job in terms of virus mitigation in 2022. Despite having a relatively low vaccination rate (65% of the population), new daily infections have stayed manageable, allowing the authorities to progressively re-open the economy. Consumption remains vibrant, supported by remittance flows from abroad, suggesting that overall growth momentum will stay robust in the medium term.

Despite these positives, looming headwinds pose a threat to the recent pickup in growth momentum. These challenges will likely dampen overall GDP growth prospects in the near term with growth slowing to 5% by the second half of the year, dragging full-year growth to 6.4%. This will be slightly below the official government target of 6.5-7.% but still faster than the 5.7% GDP growth recorded in 2021.

In the medium term, we believe the economy is capable of achieving growth of above 5% over the next few years driven largely by robust consumption.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article