Philippine central bank cuts rates as growth dips to 4-year low

The Philippines central bank has joined other Asian counterparts in easing monetary policy today. Although this is unlikely to be an entrenched easing cycle, we anticipate one more policy rate cut later in the year. The earlier the better

| 5.6% |

Philippine GDP growth in 1Q19The lowest in four years |

| Worse than expected | |

1Q19 GDP growth misses estimates

The Philippines posted 5.6% year-on-year GDP growth in the first quarter of 2019, a significant downside surprise against consensus and ING’s estimates of 6.0% and 5.9%, respectively. The 1Q19 figure is a sharp dip from the 6.3% growth in the previous quarter and will go down as the slowest pace of growth in the last four years.

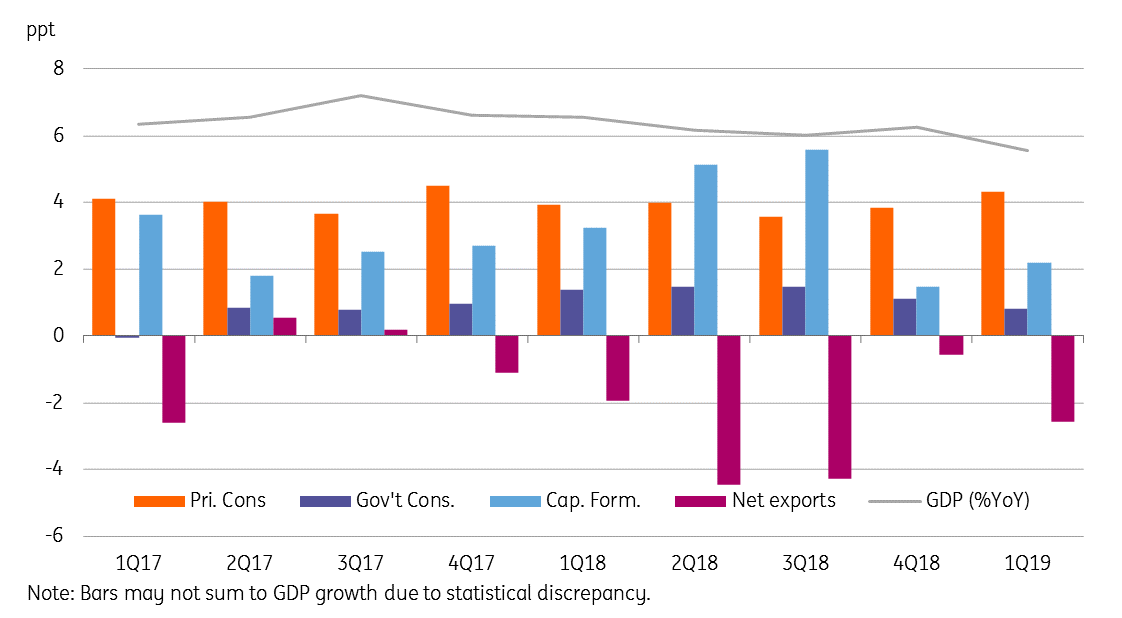

Underlying our below-consensus growth view for the last quarter was weak government spending down to the delayed approval of the budget for the current year. Indeed, government consumption shaved 0.3 percentage points of the headline GDP growth. But the bigger hit, 2ppt, came from net trade. Firmer private consumption and investments offset some of this but not sufficiently enough to keep GDP growth within the government’s 6% to 7% target for the year.

Surprisingly enough, manufacturing not only held up well but also contributed more to the GDP growth than in the previous quarter despite weakening exports. But again, this was more than offset by drags from constriction, utilities, and farm output.

Sources of annual GDP growth

Central bank moves to ease policy

Economic planning secretary Ernesto Pernia expressed confidence that the 6% to 7% growth target for the year was “still achievable, fortunately”. On technical grounds, it's possible as a more favourable base effect at work in the remainder of the year. After accounting for the first quarter dip, our full-year 2019 growth forecast still remains above 6%.

However, the central bank thinks persistent downside growth risks as warranting greater policy support for the economy going forward. They voted to cut the key policy rates by 25 basis points, taking the overnight borrowing rate to 4.50% and the overnight deposit rate to 4.00%. There was no change to the commercial banks’ reserve requirement ratio (RRR), currently standing at 18%.

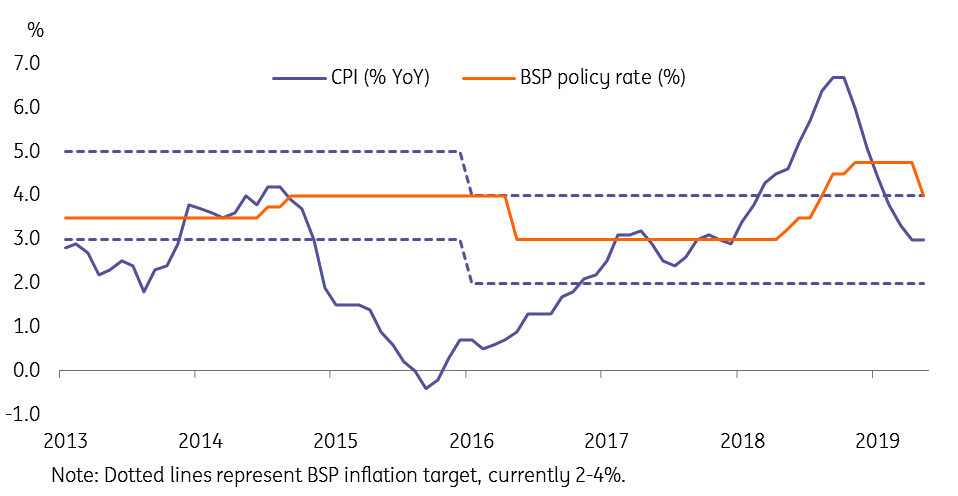

Inflation has started to firmly settle within the target of 2% to 4% and forecasts are closer to the central bank’s projections - BSP Deputy Governor Diwa Guinigundo.

A move in consumer price inflation back to the 2% to 4% policy target, and policymakers’ expectations of it staying firmly there created space for the rate cut. Although as of now, we don’t see this turning out to be an entrenched easing cycle, an aggressive 175bp policy tightening last year has created ample space for easing this year.

Inflation firmly back in BSP's comfort zone

Our house view has one more 25bp rate cut pencilled in for the fourth quarter for the year, though an earlier cut than that would be a better pre-emptive cushion for the economy amid escalated global trade tensions.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 May 2019

Good MornING Asia - 10 May 2019 This bundle contains 4 Articles