European credit supported by ECB changes

The European Central Bank announced an increase of its Asset Purchase Programmes (APP) as it transitions away from its Pandemic Emergency Purchase Programme (PEPP). We think this will be positive for European credit, with possibly an increase in the Corporate Sector Purchase Programme (CSPP) above what was bought with CSPP and PEPP

A timid reaction

The market reacted in a rather timid way on the back of the European Central Bank's news yesterday. This indicates that much of what was announced was already expected and priced into spreads. However, we believe this could be an underreaction, as we expect this will further strengthen technicals, Because of the increase in APP, CSPP will see higher than expected purchases, as CSPP already runs at 27.5% of APP. Indeed this may fall slightly, but CSPP will still be a large portion of APP. Furthermore, the ECB will be pushed into the secondary market a lot more due to lower supply and the bank may be adjusting their way of purchasing in primary.

There is market talk about the ECB changing their strategy for primary and lowering the amount they add to books, down from the normal 40% for all eligible new issues. This is in line with our expectation for more secondary market focus from the ECB.

To transition the end of PEPP in March, APP will increase by up to €40bn per month in 2Q22, then drop slightly to €30bn per month in 3Q22, to eventually come back down to the normal €20bn per month as per October. We expect this may actually result in more corporate purchases per month with increased CSPP, compared to the combination of CSPP and PEPP. This is assuming the ratio of CSPP to overall APP will drop slightly from 27.5% to 25% during 2Q and 3Q.

ECB's corporate purchases per month (€bn)

Note: 1Q22 includes €5.5bn in CSPP and €1bn in PEPP

Support for spreads

In any case, this will be very supportive for spreads, particularly as we expect to see a substantial drop in eligible supply. Therefore, the ECB will be forced to concentrate on purchasing more from the secondary market. We are forecasting supply to drop to €290bn, of which about €200bn will be eligible debt. Meanwhile, gross purchases under CSPP (and PEPP) in 2022 will total around €100bn.

This is certainly very positive for the strong technical picture we will see next year. With already lower net supply, the increase in CSPP purchases will push net supply after demand to below zero. We expect net supply will drop to €67bn in 2022, meanwhile net purchases will amount to around €85bn.

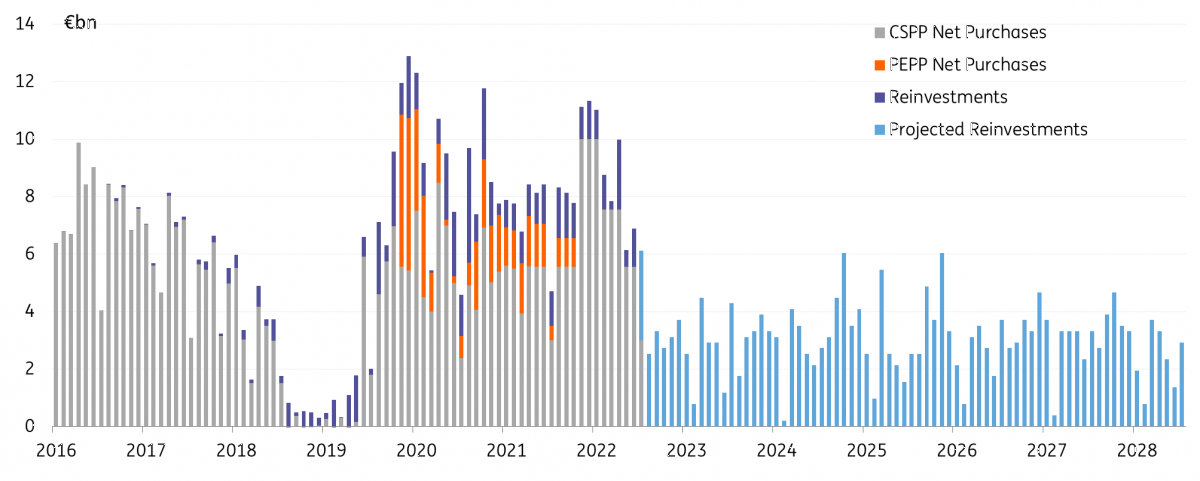

Additionally, reinvestments of redemptions will continue long after CSPP ends (likely in early 2023). We expect reinvestments will be at the tune of €3bn on average per month for years to come.

ECB corporate purchases will remain high in 2022, and reinvestments are significant for years to come

In conclusion, this will be supportive for credit and we expect this strong technical picture will keep any spread widening subdued, and likely keep spreads relatively tight. The ECB being pushed to do more purchasing in the secondary market will be particularly supportive.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article