Aviation sector outlook: The pandemic is testing airlines for far longer

Even after the worst year in history, the first quarter of 2021 isn't providing much relief for the aviation sector. However we expect the recovery to start in the second half of 2021, but the sector is unlikely to fully recover before 2024-2025. In the short-term, the real question is if the sector will be back this summer? Unfortunately, the jury is still out

Delayed recovery for airlines, cargo continued bright spot

The aviation sector has just had its worst year in history. The pandemic led to travel bans, and subsequently, airline volumes collapsed. So far, the prospects of easing travel restrictions and the introduction of digital vaccine passports have disappointed the industry.

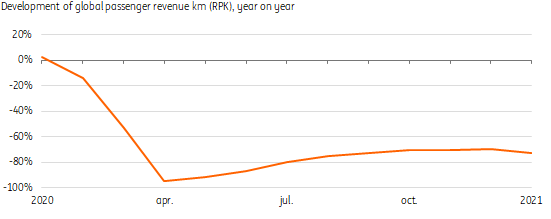

However, the roll-out of vaccinations will help the sector restart in the second half of 2021. As most leisure travel demand remains on standby, we expect it to return as soon as restrictions are eased and travelling becomes safe again. Revenue passenger kilometres (RPK’s) is expected to start rebounding this year and might end up at an average of 40-50% of pre-pandemic levels in 2021.

Full recovery of the aviation sector is unlikely to take place before 2024-2025

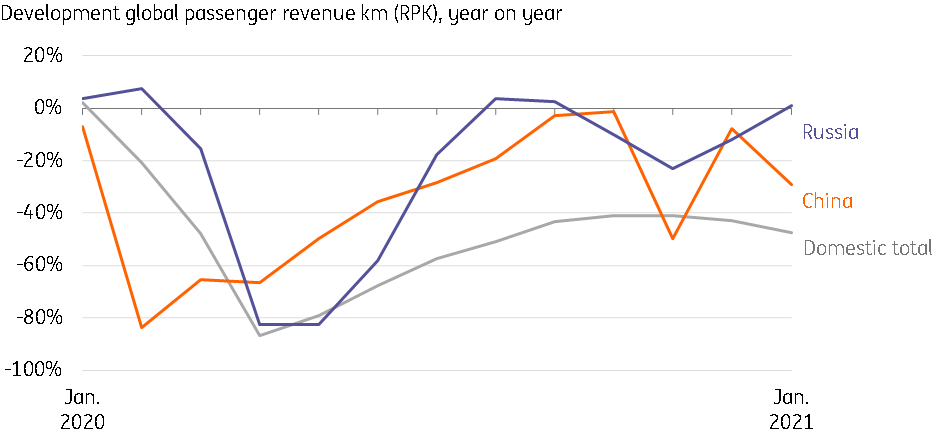

Full recovery will take several years, probably until 2024-2025. Domestic traffic in large countries like Russia and China is ahead of the curve as domestic travelling is easier particularly in China which has so far escaped a second wave. Due to ongoing capacity shortages and a positive outlook, air cargo is no longer an overlooked niche. Instead, it is expected to be a continued bright spot in 2021, with new players building up positions in the market.

Aviation sector starts 2021 at low levels after worst year in history

The year 2020 will echo for a long time in the aviation sector.

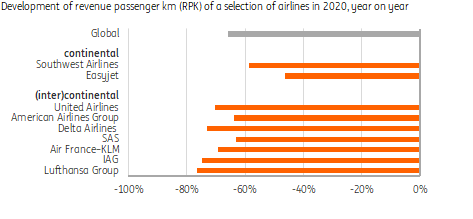

Following the global Covid-19 pandemic airline passenger volumes tumbled no less than 66% compared to 2019 and airlines across the world reduced staff, adapt their organizations and take on (government) emergency plans.

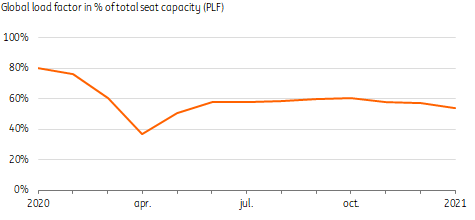

As a consequence, plummeting passenger levels inevitably increased inefficiencies which are reflected in the global average load factor falling to just 57.5% in FY20 whereas in a normal year it is around 80%.

Global airline passenger volume started 2021 relatively stable, but still 70% below pre-pandemic levels

Efficiency has fallen too due to all the empty seats

Recovery expected to start take off in 2021

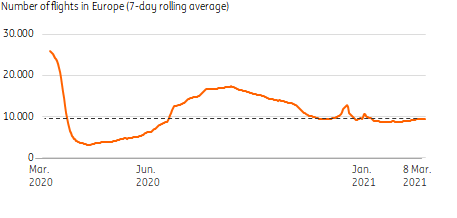

As the pandemic rages on and travel restrictions remain in place, sustained recovery is only expected to take off from the second half of 2021, when widespread vaccinations and potential travel policy based on testing bring relief. The jury is still out on whether the sector will be able to benefit from the summer season.

If airline passenger traffic stays at February 2021 levels for the rest of the year, we might end up just below last year’s average. All recovery from this point will turn into year on year growth. Depending on travel restrictions, IATA expects growth for 2021 to come in between 13% and 50% compared to 2020, just 40%-50% of pre-pandemic levels.

Current level of air traffic above first lockdown levels

Long haul to recovery and renewed growth

There is consensus among industry sources like IATA, Airbus and airport operators that a full recovery of sector volume is expected to take until 2024-2025.

Nevertheless, the general assumption is volume will ultimately return to its growth path in the long run, although the path will most likely be less steep than before. Boeing expects an average annual revenue passenger kilometre (RPK) growth rate of 4% for 2020-2040, driven by strong growth from Asia, which is already the largest airline market.

This is 6% below pre-pandemic levels and slightly less than the OECD pre-pandemic forecast of 4.5%, but this could still be on the optimistic side if business travel is structurally reduced and government taxation makes flying more expensive.

Low-cost and continental airlines expected to lead the recovery

Despite the international travel restrictions, domestic travel is recovering but there are significant differences.

Large domestic markets like China and Russia are leading the way while this trend seems to be much less visible in the US or Europe.

This is reflected in operational results of continental active (low-cost carrier) airlines (e.g. Southwest Airlines, Easyjet). At least in the first half of 2021 this pattern is expected to last. Besides that we expect that leisure travelling and visiting friends and family (two-thirds of passenger volume at larger international airports in the EU) will be the first to recover when vaccination rates increase and restrictions are eased.

Business travelling is likely to return at a much slower pace as digital meetings, conferences and remote working will continue for some time. This means demand for business seats will continue to lag affecting profitability.

Domestic passenger aviation seems to be recovering

Intercontinental airlines in Europe and US suffered the highest losses in 2020

Airlines did manage to secure additional liquidity into 2021

IAG, the company that controls British Airways, Iberia and Aer Lingus, said its revenues slumped by 69% in 2020, driven by a 76% decline in passenger revenue. Total group capacity, measured by available seat kilometres, was down by nearly 67% in 2020, with the passenger load factor down 20.8 percentage points to 63.8%. The company consumed cash during last year but finished 2020 with significant liquidity buffers of €5.9bn in cash, plus committed and undrawn general and aircraft facilities of €2.1bn. Accounting for additional liquidity of €2.2bn from the UK Export Finance agency, finalised after the end of the year, IAG has access to total liquidity of over €10bn.

Lufthansa reported a reduction in total revenue of 63% in full-year 2020. Passenger volumes declined by approximately 75% year-on-year, resulting in a load factor of approximately 63% (down 19.3 percentage points versus 2019). Freight kilometres sold were also down last year, but less dramatically, by 31%, while load factor increased by 8.4 percentage points to 69.7% and average yields rose by 55% due to supply shortages.

For 2021, Lufthansa expects capacity on offer to reach 40% to 50% of 2019 levels, with the ability to dial up capacity on offer to 70% of the pre-crisis level “in the short term” if the demand recovers more strongly. However, the group expects capacity to return to 90% of the pre-Covid-19 level only by the middle of the decade. In terms of liquidity, Lufthansa said it continued to consume cash at the rate of up to €300m per month during the first quarter of 2021 but that available liquidity was around €10.6bn at the end of last year (which included €5.7bn of unutilised government stabilisation funds). By the end of 2020, the group had utilised around €3.3bn of the government stabilisation funds, of which €1bn has now been repaid. Lufthansa also utilised bond and aircraft financing markets to raise €2.1bn in 2H20 and also issued bonds to the tune of €1.6bn earlier this year. Overall, the company commented that it believed it was presently “well financed beyond 2021”.

Another financial risk for 2021: Higher fuel costs

Despite restructuring plans, government support and job cuts, airlines continue to burn cash and cost pressure remains high, given the recovery is delayed

In 2020 falling fuel prices provided some relief, but since then oil prices have rebounded significantly from the lows seen in the second half of 2020. We expect ongoing upward pressure on oil prices throughout 2021 which will results in higher kerosene prices, trading over 40% higher than last years average by the end of February.

As airlines normally spend roughly 15-30% of their total expenses on jet fuel, this has a substantial cost impact. To manage fuel price risks, some airlines hedge fuel prices both completely and partially.

Cargo bright spot in 2020 and about to deliver in 2021 despite groundings

Capacity is expected to remain restricted in air cargo this year, as many intercontinental widebody aircraft carrying freight in their bellies (lower deck) are grounded. Roughly 50% of total airfreight is normally travelling in the belly. Extra freighters deployed still match only 60% of the missed belly capacity at the start of 2021, but load factors are on the rise.

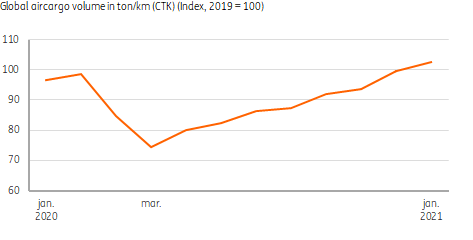

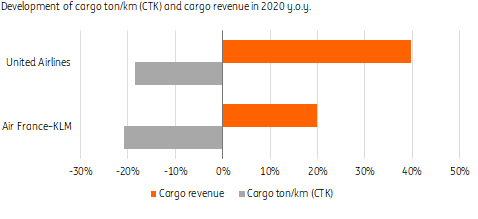

Due to capacity scarcity, freight tariffs sky rocketed in the spring of 2020 and still are much higher than the normal average of around $ 2-3 per kg. This resulted in higher revenues despite the lower volume. Higher are expected to last into 2021. After an 11% hit in 2020, showed a continued recovery (graph).

We expect global airfreight volumes to rebound by around 10% this year as trade picks up and volatility in supply chains continues. Surging international e-commerce volumes – still largely shipped through the air - and vaccine distribution will support volume growth in 2021. Nevertheless, reduced connectivity could still be a threat.

Global aircargo exceeds pre-pandemic levels at the start of 2021

Aircargo revalued amidst pandemic

In the past, air cargo was considered a niche activity receiving little attention, but now airlines operating freighters are making use of high tariffs providing some counterweight to losses in passenger transport. Some flag carriers – like AirCanada - are now, therefore, growing their freighter fleets.

Airports heavily relying on belly freight – like London Heathrow - suffered from lack of belly capacity, whereas others like Frankfurt profit from an increase in freighters taken into operation.

Less freight, more income: two examples

New entrants in airfreight market: Welcome Amazon

The developments in the airfreight market and their role in international e-commerce is attracting new players.

Amazon is rapidly extending its fleet to control its logistics network with a fleet already around 70 freighters (mainly B767 and B737s) as is parcel logistics company DHL also grew its fleet and operations too.

But what is particularly remarkable is the entrance of container shipper CMA CGM into this market looking to diversify its logistics activities, and competitor Maersk seems to have similar ambitions too.

Will the recovery be green?

- On one hand, some airlines phased out old generation aircrafts like B747 and reconsidered their fleets. For example, Lufthansa's decision to examine grounding aircrafts older than 25 years permanently. But on the other hand replacements and orders have slowed.

- New generation aircraft like B787 dreamliner or narrow-body A320 neo can reduce fuel consumption by 10%-20% compared to the previous generation. However, not all airlines postponed their replacement schemes. For example, Ryanair remains committed to its new B737 aircraft orders– returning to the air in 2021 – which is expected to reduce fuel consumption by 16%.

- In most government support scheme’s - like the US airline bailout fund - greening is not conditional, but in some cases it is. The Dutch government's package for KLM required a biokerosene blending grade of 14% in 2030 while the French government asked AirFrance to scale down short distance national flights where it competes with high-speed rail services.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

AviationDownload

Download article

17 March 2021

Come fly with me This bundle contains 8 Articles