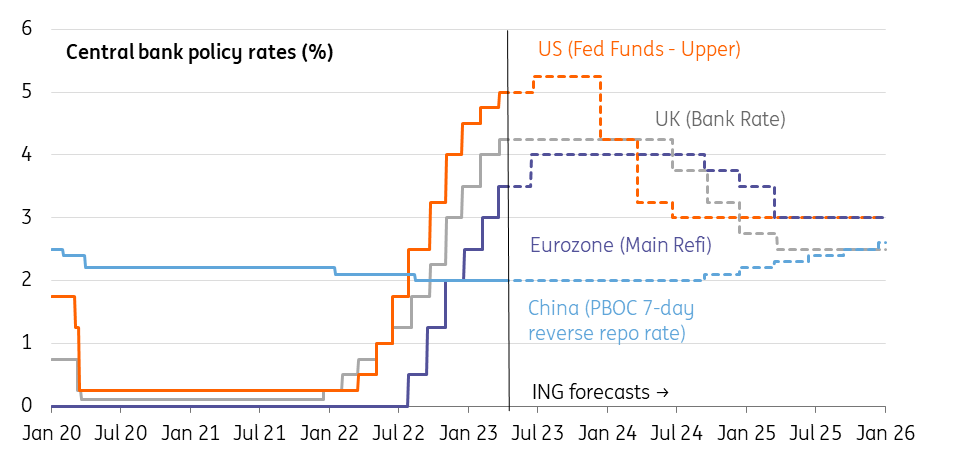

Our view on the major central banks

We think the US Federal Reserve will hike rates once more while we could see two more increases from the European Central Bank before the summer. On the other hand, we're expecting the Bank of England to pause

Our major central bank forecasts

Federal Reserve

A month ago, the Fed funds rate range was on course to hit 5.5-5.75%, with some commentators talking about 6%. Following the recent banking turmoil, markets now see only a 50:50 chance of one last hike to 5-5.25%. Even before the recent banking failures, the economy was experiencing a tightening in lending conditions, which we felt would weigh on credit flow. We think it's inevitable that banks will become more conservative in their lending while regulators will be more proactive in their monitoring of what banks are doing.

We agree that we could get one final 25bp hike in May, but the combination of higher borrowing costs and reduced access to credit means a greater chance of a hard landing for the economy that will get inflation lower more quickly. Historically, it has been just six months between the last hike in a cycle and the first rate cut. We are now forecasting 100bp of easing in the fourth quarter of this year.

European Central Bank

As long as the current banking crisis remains contained, the ECB will stick to the widely communicated distinction between using interest rates in the fight against inflation and liquidity measures plus other tools to tackle any financial instability. With no signs of any disinflationary process, discounting energy and commodity prices, as well as the fact that inflation has increasingly become demand-driven, the ECB will remain in tightening mode.

Still, the turmoil of the last few weeks has been a clear reminder for the ECB that hiking interest rates, and particularly the most aggressive tightening cycle since the start of the monetary union, comes at a cost. In fact, with any further rate hike, the risk that something breaks increases. This is why we expect the ECB to tread more carefully in the coming months. In fact, the ECB has probably already entered the final phase of its tightening cycle. It's a phase that will be characterised by a genuine meeting-by-meeting approach and a slowdown in the pace, size and number of any further rate hikes. We're sticking with our view that the ECB will hike twice more – by 25bp each before the summer – and then move into wait-and-see mode.

Bank of England

The Bank of England kept its options open in March, hiking by a relatively modest 25bp. It’s pretty clear that any further hikes are highly data-dependent, and for now things are looking more encouraging on the inflation front. The Bank’s own survey of businesses suggests price-setting behaviour is becoming less aggressive, while – as the BoE acknowledges – wage growth tentatively appears to have peaked on a three-month annualised basis. Services inflation should start to come down in time with lower gas prices.

Assuming these trends continue then we think a pause in May is likely. That’s also partly dependent on banking sector stability, but like its peers overseas, the BoE will keep reiterating that it has separate tools that are better suited to maintaining financial stability than interest rates themselves. Even before the recent drama, the BoE had set a much lower bar to pausing hikes than its peers.

People's Bank of China

Apart from the cut in the required reserve ratio (RRR) that generated CNY500bn in liquidity near the end of March, the central bank also injected CNY698bn of liquidity into the money market through daily open market operations between 20 March and 31 March. These operations hint that loan growth in March should continue to strengthen after the robust performance seen so far this year.

The central bank needs to put more liquidity into the money market to keep interest rates stable. Another reason for a large liquidity injection is to smooth out seasonal spikes in interest rates at the end of the quarter. The RRR cut could also serve as a preventative measure in case of money market tightness from the global financial market turmoil spreading to China. In short, the central bank is currently in pro-growth mode to make sure the recovery is on track. Further easing is not expected as growth in China is usually front-loaded in the first quarter.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 April 2023

ING Monthly: Everything, everywhere, almost all at once This bundle contains 16 Articles