Five things shaping UK wage growth

Potential upside risks to Wednesday's UK wage growth data could see markets think more carefully about a May rate hike

Wage growth data is very much in vogue at the moment. An unexpected surge in US hourly earnings growth has been widely cited as being at least partly to blame for the recent market turmoil. And with the Bank of England increasingly pinning the chances of further rate hikes on accelerating pay growth (alongside Brexit progress), markets will also be watching Wednesday's UK jobs report closely.

Alongside a further pick-up in employment growth (185k), we expect the key measure of wage growth (which excludes bonuses) to hold firm at 2.4%, although the risks definitely lie to the upside. A positive surprise would be another sign that pay growth is gaining traction, although what's less obvious at this stage is why exactly the recent trend has been so much stronger, or indeed whether this upward momentum will stand the test of time.

Here are five factors that we think could be playing a role...

The jobs market is extremely tight

The optimistic explanation for the recent pick-up in wage growth, and the one favoured by the Bank of England, is that companies are increasingly having to lift pay packets to retain key staff members and attract new talent. And there are certainly signs that this may be the case. The Bank's own Agents survey points to the strongest year for pay settlements since the crisis, meanwhile the latest Markit/REC employment survey indicated that starting salaries for permanent jobs are rising at the fastest rate in two-and-a-half years.

Raising pay to match the cost of living

Another possible explanation for the stronger momentum is that employers are increasingly feeling the pressure to raise wages in line with the cost of the living. At the end of 2016, headline inflation was still well below 2% (although clearly rising), whereas CPI is now up around 3%. In the latest BoE agents survey, consumer price expectations are cited as a key factor that could drive labour costs higher in 2018.

A slowing jobs market?

Is the economic weakness of last year beginning to take its toll on hiring? That certainly seemed a possibility towards the end of 2017: employment began to fall and the Manpower hiring survey showed employer confidence at a five-year low. Since then though, we saw a huge 102k rebound in employment in the latest numbers (although we suspect some of this could be down to statistical rather than fundamental factors) and the PMIs have painted a healthier picture of the jobs market.

For now, we're inclined to say the decline in hiring at the end of last year was a blip rather than anything more sinister. But if we're wrong and the jobs market does show further signs of weakness, that would have negative implications for wages.

A low starting point

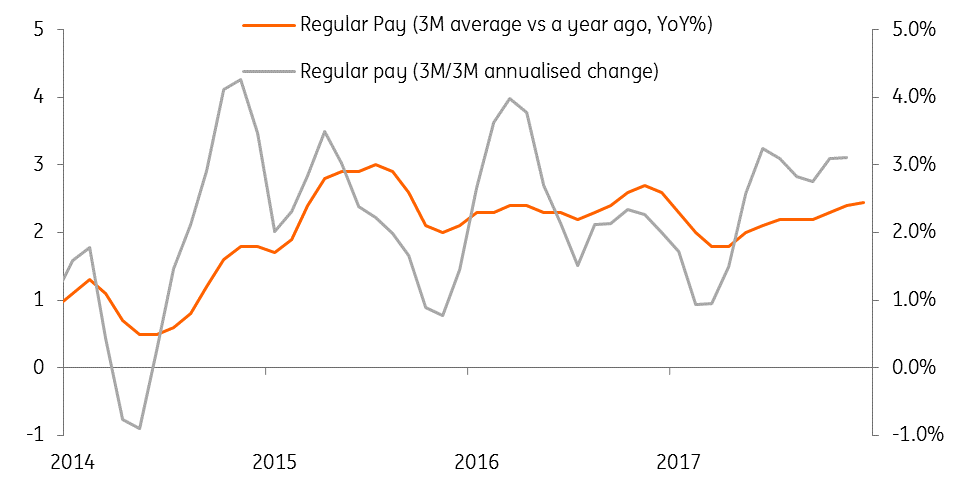

This time last year, the story on UK wage growth was quite different. Between the November 2016 and February 2017 labour reports, the absolute level of regular pay was virtually unchanged at £469 a week. So whilst the year-on-year wage growth figures may well pick-up in the next few reports, this says as much about last year's weakness as it does strong momentum now. It's worth noting too that the higher minimum wage has played a role in lifting pay packets over the past six-nine months. With all of this in mind, policymakers are increasingly focussing on alternative measures of pay momentum - for example, the 3M/3M annualised rate of wage growth - as a better guide of the current trend.

Recent wage data has been more positive

Uncertainty and sluggish demand

Whilst the overall jobs market remains tight, we suspect some firms will continue to take a more cautious approach to wage setting. The economic outlook remains mixed (the large consumer sector still struggling), input costs continue to rise, and uncertainty surrounding Brexit remains elevated. This could keep a lid on wage growth over the next few months, although admittedly the latest Agents survey suggests these factors will be less of a constraint this year.

The reality is probably a mixture of all these factors, although we agree the recent evidence suggests the positives are outweighing the negatives. We'd still caution that it is early days, and that the Bank of England's 3% wage growth forecast for this year still seems a bit of a tall order. But when it comes to interest rates, we doubt the data over the next couple of months will prompt policymakers to rethink their positive outlook for pay.

Following the Bank's hawkish comments a couple of weeks ago, we are pencilling in a rate hike in May, although this still relies on further Brexit progress - particularly on the transition period.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article