OPEC+ set to meet again

There are growing expectations that OPEC+ will prolong current cuts for at least another month, which will help to speed up the rebalancing of the oil market. The alliance are expected to come to a decision at their next meeting, which is currently scheduled for 9-10 June, although there have been suggestions that it could be brought forward to 4 June

The current OPEC+ deal

Having seen talks break down between Russia and Saudi Arabia in March, the broader OPEC+ group met again in April, forced to take significant action, given the massive amounts of demand destruction as a result of Covid-19 related restrictions.

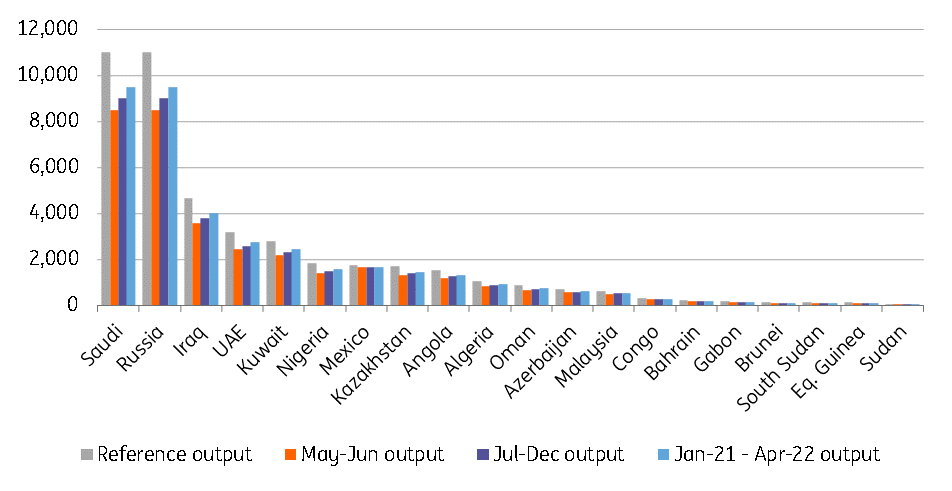

The alliance in April put their differences aside and agreed to cut output by 9.7MMbbls/d over the months of May and June, after which the cuts would be reduced to 7.7MMbbls.d from July through until the end of this year, and then finally from January 2021 through until the end of April 2022 the cuts would be further reduced to 5.8MMbbls/d.

The baseline for these cuts are their October 2018 production levels, with the exception of Saudi Arabia and Russia, who are using a baseline figure of 11MMbbls/d. The baseline production used is higher than their actual production over 1Q20, and so, in fact, the cuts are not as large as the headline numbers suggest.

Despite this, the agreement certainly is historic, with the group agreeing to cut output by record levels. However, OPEC+ cuts alone are not enough for the market. Market-driven declines from producers outside of OPEC+, along with recovering demand has helped to soften the scale of the surplus over 2Q20.

OPEC+ production cut deal (Mbbls/d)

OPEC+ performance so far

Supply numbers for OPEC members over May are already starting to come through, and in the first month of the deal, OPEC members failed to comply with the deal.

OPEC compliance came in at around 77%, and it was the usual culprits who fell short. Iraq and Nigeria had a compliance of 42% and 33% respectively. In fact, even the largest OPEC producer, Saudi Arabia did not meet its production quota of around 8.5MMbbls/d, with the Kingdom’s output averaging 8.7MMbbls/d.

Supply numbers for OPEC members over May are already starting to come through, and in the first month of the deal, OPEC members failed to comply with the deal

However, for June, we would expect compliance to continue improving, particularly given that Saudi Arabia, UAE and Kuwait agreed to cut by an additional 1.18MMbbls/d over June. This additional cut is an attempt to speed up the rebalancing process in the market, whilst it will also help to make up for the poorer compliance from other members.

Looking at producers outside of OPEC, and according to the Russian energy ministry, crude oil production in the country averaged 8.59MMbbls/d in May, leaving it very close to its quota of 8.5MMbbls/d. Russian compliance was around 96%, which is stronger than the 92% compliance seen from Saudi Arabia.

What is the new proposal?

Initial reports were that some members were keen to extend the current level of cuts through until the end of this year. However, there have been clear obstacles to such an extension, specifically Russia, who prefers to take more of a wait and see approach.

Therefore there will be the need for compromise, and more recent media reports suggest that the alliance will look to now extend cuts from anywhere between one to three months, which would make it more palatable to the Russians.

Is an extension really needed?

The key question though, is if extended cuts are in fact needed. The fundamentals in the oil market are improving, thanks to action taken by producers, and recovering demand. This is reflected in price action, with ICE Brent trading back around the US$40/bbl level, whilst time spreads have also strengthened significantly over the last month. The market is already set to transition from surplus to deficit as we enter the second half of this year, and so an extension of the deal will only speed up the pace that the market rebalances.

A short extension to the deal, will unlikely change the outlook for the market by year end, and we would still expect ICE Brent to average US$50/bbl over 4Q20. However, deeper cuts over part of 3Q20, would mean a moderately more constructive outlook for the third quarter.

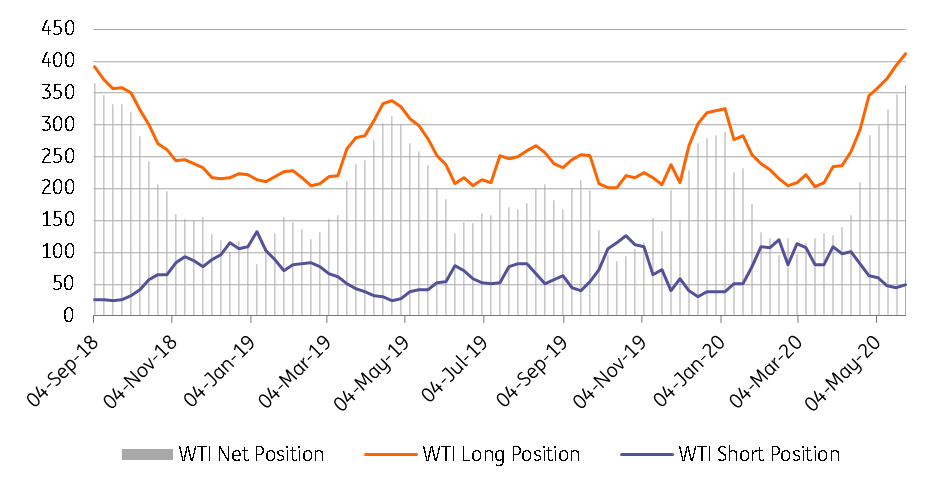

NYMEX WTI managed money net position (000 lots)

What are the downside risks for the market?

There are some clear downside risks for the market. The most obvious at the moment is that a failure of OPEC+ to extend current cuts could weigh on sentiment, particularly after the noise over an extension in recent weeks.

Secondly, refinery margins are still very weak, suggesting that the crude rally we have seen over the last month has got a bit ahead of itself. Weak refinery margins leave very little incentive for refiners to increase throughput rates, and so clearly not positive for crude oil demand.

Thirdly, is the risk of supply starting to return with strengthening prices. In recent days a couple of US producers have already said that they will bring back shut-in production in the coming months.

Finally, speculators do seem to be overstretched at the moment in NYMEX WTI, particularly in the current environment. The managed money net long position in NYMEX WTI stands at 362,724 lots as of 26 May, which is the highest net long seen since September 2018, which is when the global market was much tighter, and WTI was trading above US$70/bbl. Admittedly for ICE Brent though, speculative positioning is not as stretched.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 June 2020

The Covid-19 crisis: Finally, some good news This bundle contains 9 Articles