OPEC oil cuts: To continue or not to continue, that is the question

The oil market has rallied on the back of US sanctions on Iran, and Venezuelan production declines. We believe OPEC will formulate an exit strategy at its June meeting given the growing risk of demand destruction at current prices, along with increased pressure from key importers

It is fair to say that OPEC and its allies have achieved their job in bringing global crude oil inventories more in line with the historical average and, in the process, pushing ICE Brent back up to US$80/bbl. Not all of this credit can go to OPEC, however, with US sanctions on Iran and Venezuelan production declines clearly providing a helping hand.

Regardless, the question everyone wants answered is whether OPEC will scrap its current production cut deal. Uncertainty around Iranian and Venezuelan supply does offer OPEC a good opportunity to start implementing an exit strategy.

What has OPEC achieved?

Credit has to be given where credit is due, OPEC has done a great job in complying with its production cuts. The group has exceeded expectations and in fact, compliance amongst members has averaged almost 115% since the deal was introduced. Over-compliance has only increased since the start of this year, exceeding 160% in April. This has meant that OECD crude oil inventories have finally fallen below the five-year average, and inventories have declined by almost 120MMbbls since the inception of the deal.

However, as we have mentioned in previous reports, Venezuela has boosted OPEC compliance, with production in the country continuing to decline. Venezuela’s compliance in April was over 660%, with cuts for the month larger than those made by OPEC’s largest member, Saudi Arabia.

There are reports that OPEC will look to ease production cuts as early as June, with the matter set to be discussed in St. Petersburg this week. However, we believe any final decision will only be made at the semi-annual OPEC meeting on 22 June. We think OPEC will put in motion an exit strategy of some form, and failing to do so would require us to re-examine our current price forecasts, given Venezuelan and Iranian developments.

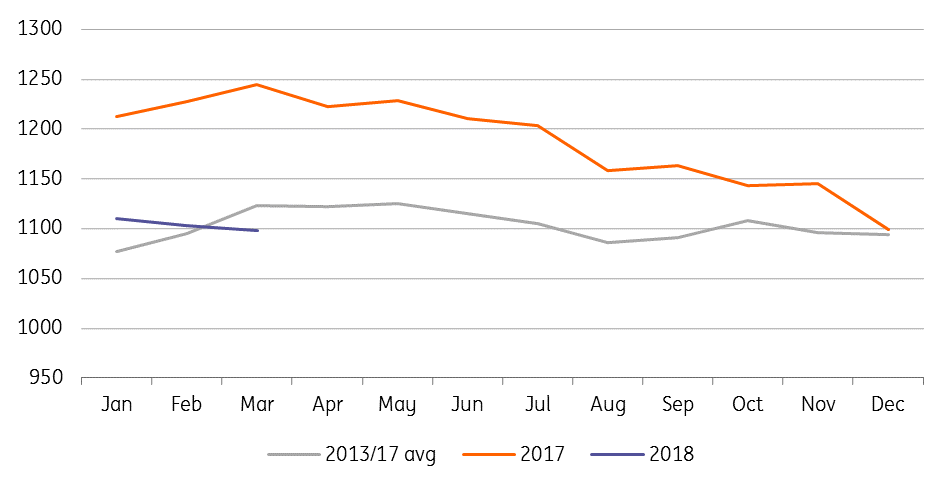

OECD crude oil inventories (MMbbls)

What will be the impact from US sanctions on Iran?

It was largely thought that the risk of US sanctions on Iran was priced into the market, however since President Trump pulled out of the Iranian nuclear deal, the front-month ICE Brent contract has rallied almost 7%. Uncertainty around the impact on supply clearly continues to offer support to the market.

The US does not have much support for pulling out of the Iranian nuclear deal, and as a result, it is unknown how effective sanctions will be in reducing Iranian crude oil exports. The US has given buyers 180 days to fulfil outstanding contracts, after which buyers are expected to start reducing purchases.

China and India are the largest buyers of Iranian crude oil, making up more than 60% of total exports, and we are of the view that this supply will continue largely unaffected. We believe that the supply which is most at risk is Iranian crude oil making its way into Europe. This could see up to 500Mbbls/d of Iranian exports disrupted. However, the EU is looking for a way around these sanctions by imposing a blocking statute. How effective such action would be is questionable, especially for European businesses which have a large interest in the US.

Assuming that EU flows from Iran do decline, we question the severity of this impact on total Iranian exports, given the potential for Chinese and Indian buyers to step in as even larger buyers of Iranian crude oil, taking advantage of potential discounts.

In our base case scenario, we are assuming that we will see 500Mbbls/d of Iranian supply lost by the end of this year. In our worst-case scenario, this increases to 800Mbbls/d, pushing the global market into deeper deficit over 4Q18, and the need for other OPEC nations and Russia to step in to meet this additional shortfall.

Iranian crude oil export destinations (%)

Is there any stopping Venezuela's decline?

Whilst there is still a lot of uncertainty around potential supply losses from Iran as a result of sanctions, what is clearer is that Venezuelan oil output is likely to continue trending lower. The country has seen a spectacular decline in output, falling from a little over 2MMbbls/d in early 2017 to below 1.5MMbbls/d in April 2018. We do not expect any improvement in production prospects for the country in the near term, and expect output to fall towards 1.2MMbbls/d by the end of this year. A clear case of underinvestment in the domestic industry supports this decline.

In fact, we would stress that there is the potential for even greater supply losses from Venezuela, with the US appearing to move ever closer to enforcing stricter sanctions, which could further disrupt oil flows for the country.

Is OPEC shooting itself in the foot?

There is growing concern amongst consumers about rising oil prices. In the US, gasoline prices at the pump are approaching US$3/g, just as we move into the driving season. These are levels last seen back in 2014, and may make motorists think twice before filling up.

Meanwhile, India has become very vocal over recent weeks about the strength in the oil market, and is looking at measures to deal with rising domestic fuel prices. For many importing nations, the strength in the crude oil market, along with the strength in the US dollar has meant that the price impact has been even more severe in domestic currency terms.

In Brazil, truck drivers are currently on strike over higher fuel prices. Previously, consumers were largely protected from international price increases, due to Petrobras’s fuel price policy. However, in late 2016, Petrobras decided to link domestic prices more closely to the international market, due to the financial pressure from selling into the domestic market at a discount to the world market.

In its latest report, the IEA revised down its global demand growth estimates for 2018 from 1.5MMbbls/d to 1.4MMbbls/d as a result of stronger prices. If OPEC continues to hold supply from the market, it risks further demand destruction, along with a continued pickup in US drilling activity.

US average gasoline price vs. YoY gasoline demand change

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

OilDownload

Download article

24 May 2018

In Case You Missed It: Why June’s the month to watch This bundle contains 8 Articles