OPEC+ goes big

There was no doubt that OPEC+ was going to cut supply when the group met in Vienna. However, the agreed 2MMbbls/d supply cut was at the top end of expectations. While the actual cut will be quite a bit smaller, it is still enough to dramatically change the oil balance over 2023

What did OPEC+ agree?

Given the amount of noise leading up to the OPEC+ meeting and the fact that the group met in person in Vienna for the first time in over two years, it was clear that the group was going to take some meaningful action. Members of the agreement have for the last couple of months voiced their concerns about the disconnect between the physical and paper market, and that the group would possibly need to take action. We recently saw OPEC+ make a symbolic paper cut of 100Mbbls/d at their September meeting, which translated to an even smaller actual cut.

Growing demand concerns have left OPEC+ uneasy and in the lead-up to this week’s meeting, expectations of a supply cut grew from around 1MMbbls/d initially to eventually 2MMbbls/d. Had the group announced a cut towards the lower end of this range, the market would have likely been disappointed. Therefore, OPEC+ announced that they would be cutting supply by 2MMbbls/d from November through until the end of 2023, although output policy could be reviewed before then, if needed. This is the biggest supply reduction seen from the group since the peak of Covid

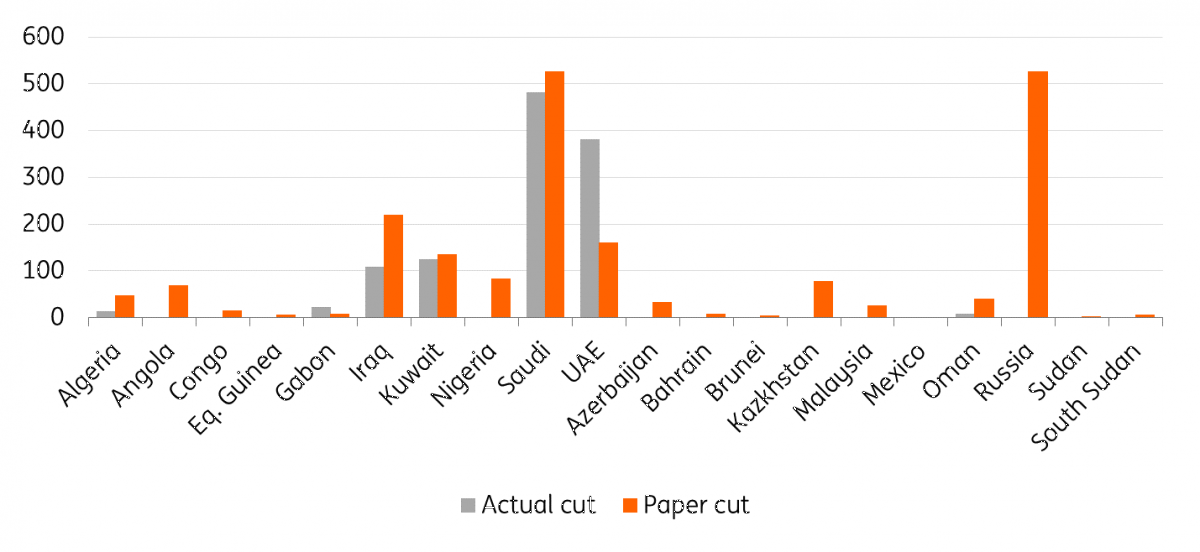

However, given that the bulk of OPEC+ members are producing well below their target production levels, the actual cut seen from the group will be smaller than the announced paper cut. Our numbers suggest that the announced cut will lead to an actual cut of around 1.1MMbbls/d from August production levels. It is likely that only Saudi, UAE, Kuwait, Iraq, Gabon, Algeria and Oman will need to cut output. All other members are already producing below their new target production.

This action from OPEC+ will raise some eyebrows, given the uncertain macro outlook, an ongoing energy crisis and uncertainty over how Russian oil supply will evolve once the EU ban on Russian oil and refined products comes into force, along with G7 price cap. The move will also do little to help improve relations between the US and Saudi Arabia.

A big winner from these supply cuts will be Russia. They do not need to cut output, given they are already producing below their targeted levels, yet they will benefit from the higher prices we are likely to see as a result of the cuts.

OPEC+ agreed paper cuts vs. actual cuts by country (Mbbls/d)

What does this mean for oil prices?

The announced cut from OPEC+ dramatically changes the oil balance for the remainder of 2022 and the whole of 2023, assuming we see full compliance. We had previously expected that the global market would see a sizeable surplus for the remainder of this year and then a more marginal surplus over the first half of 2023, before returning to deficit over the second half. However, removing around 1.1MMbbls/d of supply means the market is more balanced over the fourth quarter 2022, and in large deficit over the whole of 2023.

We had been expecting ICE Brent to trade in the US$90 area for the remainder of this year and through the first half of next year, before trading back above US$100/bbl in the fourth quarter of 2023. However, this latest action from OPEC+ suggests that there is upside to our current full year 2023 forecast of US$97/bbl.

What can counter these cuts?

The US administration will not be thrilled with the action taken by OPEC+, particularly given that US mid-term elections are just around the corner. Therefore, in the near term, we could see the US tap its Strategic Petroleum Reserves (SPR). However, with the US having already aggressively drawn down the SPR this year, which has left it at its lowest levels since 1984, there will be limits on much more will be released. Ultimately, OPEC+ can cut output for longer than the US can tap into its SPR.

The US administration could also put more pressure on domestic producers to increase output more aggressively. However, we have already seen the US call on domestic producers to do so, yet the rig count has been largely flat since early July. The uncertain demand outlook along with rising costs may be holding some producers back.

The OPEC+ supply cut could also put more pressure on the US to work towards an agreement for the Iranian nuclear deal. A positive outcome would mean that Iranian supply could increase by as much as 1.3MMbbls/d, which would more than offset the OPEC+ reduction, although admittedly, it would take some time for Iran to ramp up output if a deal were struck. In addition, there is always the risk that OPEC+ reduces production even further in the event of a nuclear deal.

These are all supply-side solutions for the market. Clearly, demand destruction could also help to partly offset these supply cuts, although how much demand destruction we see will really depend on the severity of any upcoming recession.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article