One Belgian in three does not consider their own home energy efficient

Property prices in Belgium are expected to rise by 5% in 2022 and 1% in 2023, less rapidly than inflation. An ING survey shows a great willingness among Belgians to invest in the energy efficiency of their homes in the next 12 months

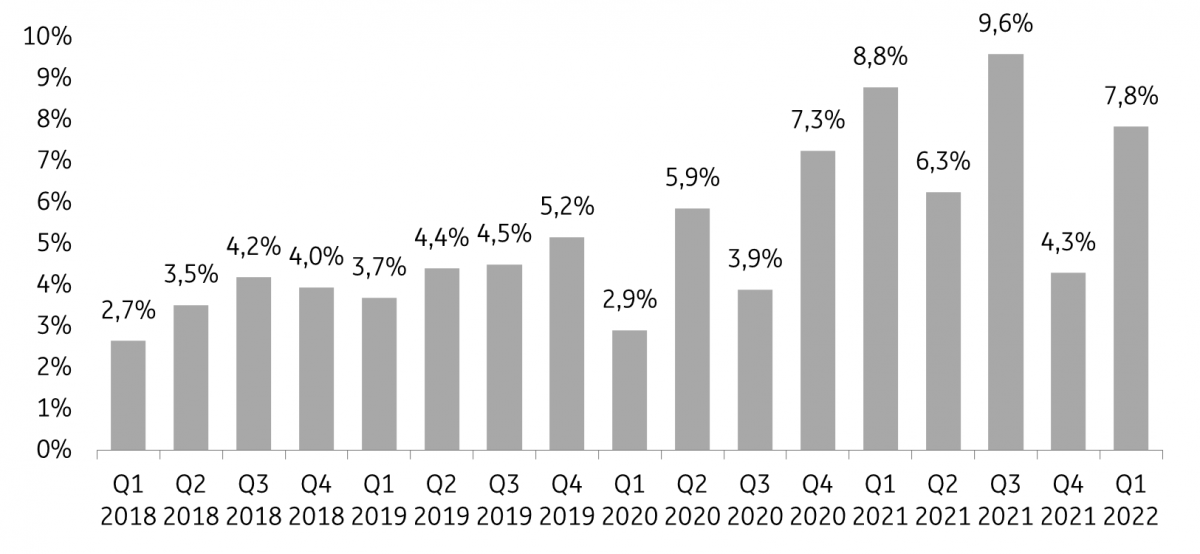

Belgian real estate prices rose sharply again in the first quarter

The official figures from Statbel show that in the first three months of this year, real estate prices increased by +7.8% compared to the same period last year. The ING survey also shows that Belgians believe in a further rise in property prices next year. Although 66% think that current real estate prices are currently overvalued, only 6% think that house prices will fall in the next 12 months.

Year-on-year growth of real estate median prices in Belgium, by quarter

Nevertheless, activity in the real estate market seems to have cooled down recently. The figures of the notary barometer, which are usually ahead of the official figures, showed a decrease in the number of transactions over the first half of the year (-1.8%). In June, activity was 12.7% lower than last year. Also, the number of Google searches on the three largest real estate search engines (Immoweb, Immovlan and Zimmo) during the first five months of this year was, on average, 15% lower than last year. In February it was more than a quarter lower.

We expect real estate prices to grow by 5% in 2022 and 1% in 2023, with price growth unlikely to outpace inflation, turning real price growth negative. Although the number of transactions seems to be cooling, demand for real estate remains high. The number of households will continue to rise in the coming years. In addition, real disposable income is holding up well thanks to strong employment growth this year and the expected automatic wage indexation in 2023, which will support price growth. On the other hand, rising mortgage rates will put pressure on property prices. Mortgage rates have already climbed sharply this year and home loans are likely to become even more expensive in the coming months. In addition, the ongoing war in Ukraine and high inflation are creating uncertainty that may cause homebuyers to postpone their purchase decisions.

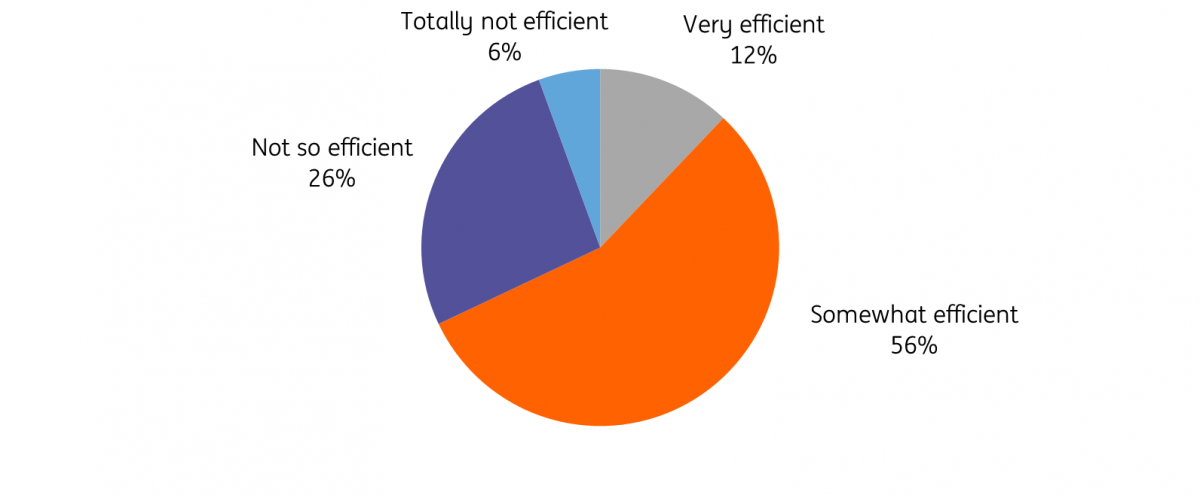

One in three think their own home is not energy efficient

A large part of the Belgian housing stock scores relatively low on energy efficiency. Some 32% consider their home 'not that efficient' or even 'not efficient at all', of which 28% are homeowners, and just over half are renters. For example, 80% of homeowners already have double glazing compared to 55% of renters. We see a similar pattern for other energy-saving investments.

Rental properties are less energy-efficient

Have you already invested in the following energy-saving items or are they already in place? (% of respondents)

Moreover, the survey shows that low incomes are extra vulnerable. Their homes score worse in terms of energy efficiency, and rising energy prices will cut into their budgets even more severely. The need to invest is high and many of these households no longer have the margin to do so. Since energy efficiency is becoming increasingly important when buying a home, these homes risk becoming extra vulnerable to a price correction and possibly losing part of their value.

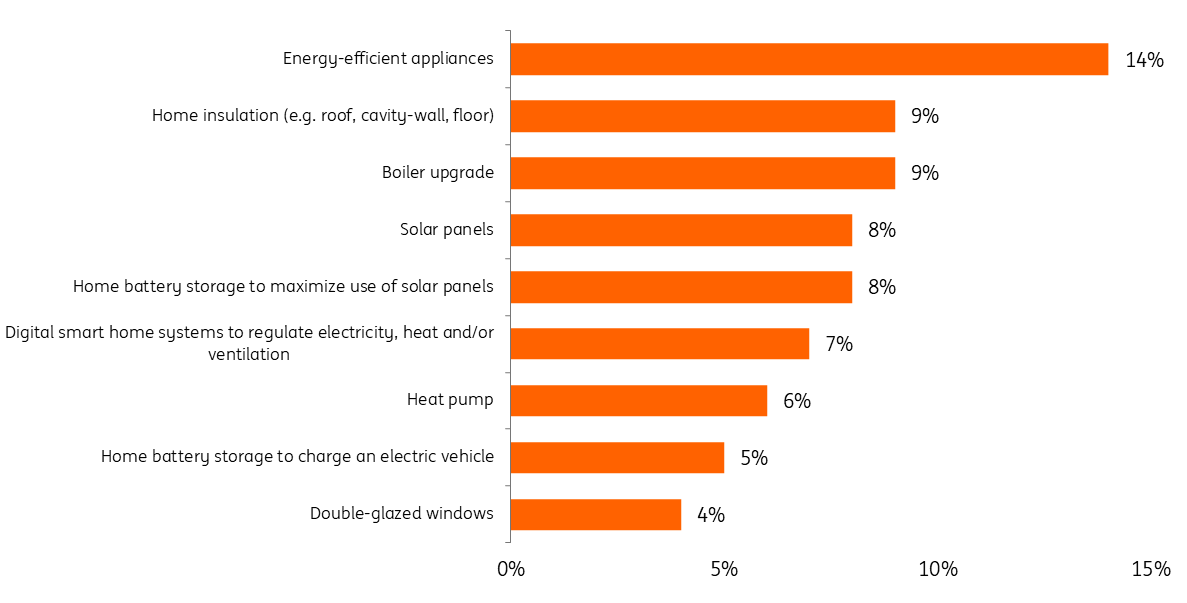

Our survey also indicates that some Belgians plan to invest heavily in the energy efficiency of their homes in the coming year. The high cost of energy is a concern for many households and is prompting them to improve the energy efficiency of their homes in order to reduce their energy bills. The purchase of energy-efficient appliances, better insulation and a more economical boiler are the three most popular investments. Respectively 14, 9 and 9% of Belgians plan to invest in these in the coming year. The question remains whether the deteriorating economic prospects will overtake these intentions. It is striking that the willingness to invest among young people is more than twice as high and this is for all energy-saving measures included in the survey.

15% plan to buy more energy-efficient appliances in the coming year

Do you plan to invest in these things in the coming year? (% of respondents)

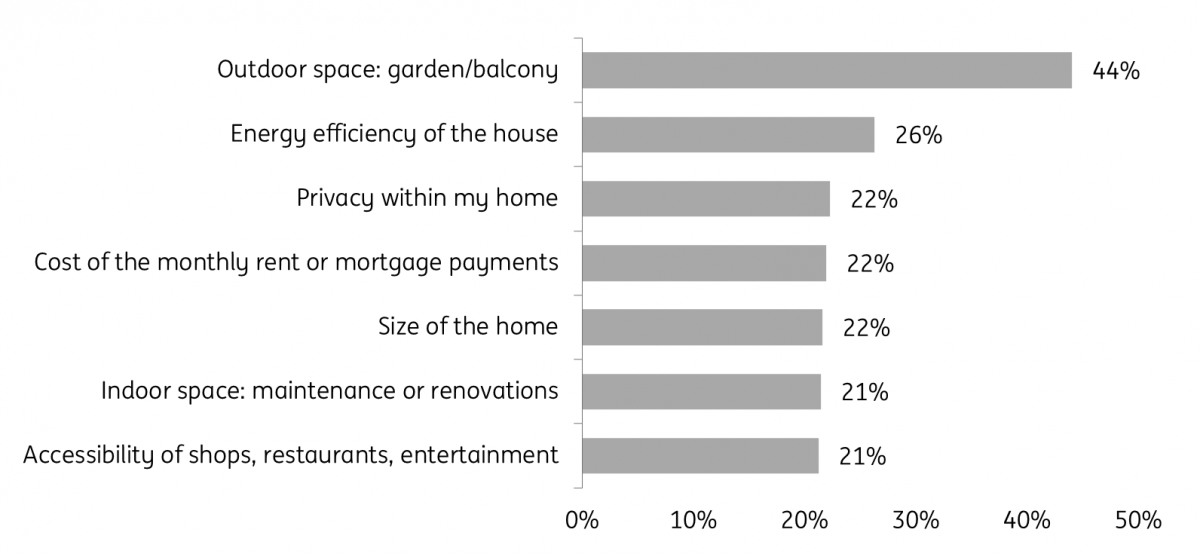

Belgians want to live in larger and more energy-efficient homes

Since the start of the Covid pandemic, the housing preferences of Belgians have changed. The average Belgian wants to live in a bigger home, preferably with a private garden. Most Belgians (44%) ticked that outdoor space has become important, such as a garden or a terrace. Outdoor space has gained even more importance over the past year, as 'only' 35% indicated this a year ago. In addition to a larger home, the energy rating of the home is also becoming more important. For example, one in four finds that the energy efficiency of the home has become more important, which is considerably more than a year ago when 'only' 15% indicated this. If energy prices remain high, this number can be expected to increase even further. Some 22% of respondents also attach more importance to privacy and the cost of the monthly rent or mortgage.

Outdoor space and energy efficiency more important when buying a house

% of Belgians who think that a certain characteristic has become more important since the start of the corona crisis.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article