US October inflation reading brings some cheer

US inflation slowed more than expected in October, fuelling hopes that the peak has passed and the Fed can slow the pace of rate hikes and perhaps bring them to an earlier conclusion. However, the jobs market remains tight and month-on-month readings are still tracking far higher than required to get inflation back to 2%. We can't give the all-clear yet

| 0.3%MoM |

Increase in core inflation |

A nice surprise on inflation

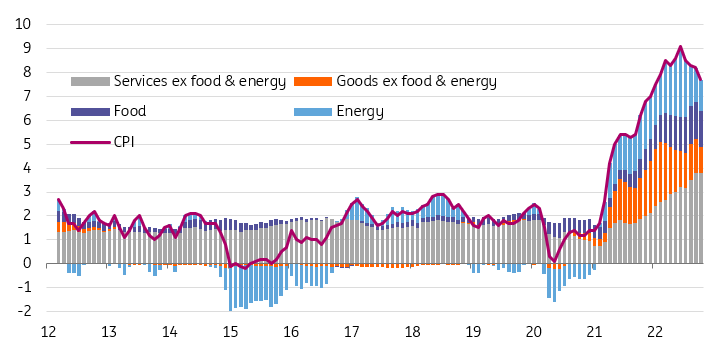

October US consumer price inflation (CPI) has come in at 0.4% month-on-month and 7.7% year-on-year versus the 0.6%MoM and 7.9%YoY consensus. This is down from 8.2%YoY in September with the chart below showing that we have clearly passed the peak for headline inflation. However, the focus should be the core rate given the Federal Reserve can do very little about food and energy prices, and this was even better rising "just" 0.3%MoM and 6.3%YoY versus the 0.5%/6.5% consensus. The YoY rate was 6.6% in September and again we are hopeful that the peak has passed.

Contributions to annual US inflation (YoY%)

The details show shelter (the largest CPI component) remaining firm at 0.8%MoM, but used cars (4% of the inflation basket) are finally responding to the declines in second-hand car auction prices, posting a 2.4%MoM drop. Airline fares fell 1.1% and apparel was down 0.7%MoM while medical care dropped 0.5% after having posted some big rises this year. We had expected this to be an area of downside risk given the way the Bureau of Labor Statistics calculates the series for out-of-pocket insurance costs, but we hadn't expected it to be as large as it was. It will help depress CPI readings over the coming year. Outside of these areas, things are more mixed with recreation up 0.7%MoM, and other goods and services up 0.5%.

Inflation must slow further before the-all clear can be given

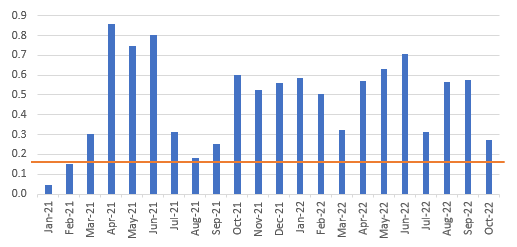

This is a rare moment of good news on inflation, although we are still well above the 0.17%MoM prints we need to consistently hit over time in order for inflation to reach the 2%YoY target (see chart below). The Federal Reserve will keep hiking given inflation remains well above target amid a growing economy with a tight jobs market, but today's outcome is very supportive for it to "step down" to a 50bp hike at the December meeting. That said we do have more data to come, most notably the November jobs report (2 December) and the November CPI report (13 December) ahead of the 14 December Federal Open Market Committee (FOMC) meeting, and nothing can be taken for granted.

Core MoM inflation readings: orange line marks the 0.17% rate required over time to get annual inflation to 2%

Fed will be wary of any relaxation of financial conditions

Indeed, market reaction has been swift and aggressive with sharp falls in Treasury yields as some interpret that one CPI downside surprise means that the Fed’s work is almost done. However, the Fed won't want to signal that yet as it will contribute to a loosening of financial conditions that could undermine all the hard work in trying to constrain inflation. We would expect to see some fairly hawkish rhetoric over the coming days' messaging, that while there likely will be a moderation in the size of rate hikes, inflation is not defeated so the Fed has more work to do with a higher terminal rate than it signalled in September.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article