North Macedonia elections: Heading into a run-off

The upcoming presidential elections are unlikely to see North Macedonia change course in its approach towards Western integration. The incumbent government’s candidate, Stevo Pendarovski, is currently ahead in the polls which would further underpin the ongoing political path although a second round appears very likely

The successful passing of the name change deal in Skopje and Athens in January has been game-changing for the small country in the Balkans. Since then, North Macedonia is in the midst of the NATO ratification process and expected to start EU accession talks in the second half of 2019. We believe near-term obstacles are manageable although eventual EU membership remains distant with Montenegro and Serbia (which have already started accession talks) only expected to join by 2025.

Presidential elections due on 21 April are the first since the country has changed its name. Despite the mostly ceremonial role of the president, it's important for the leading coalition to prove that it still enjoys popular support.

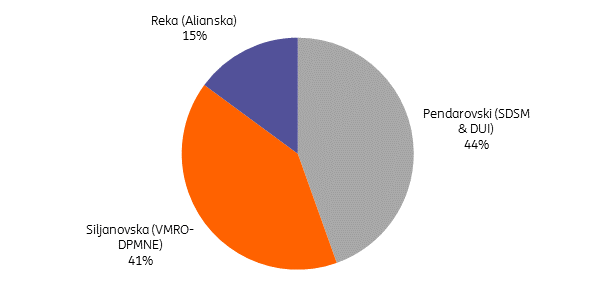

The candidate backed by the government coalition parties (social democrats SDSM and ethnic Albanians DUI) is credited with a slight advance in the opinion polls, which is why a second round is quite likely. The social democrats are expected to secure the presidency after the run-off, but it depends a lot on the turnout of ethnic Albanians which is expected to be lower than Macedonians. Needless to say, opinion polls have recently displayed modest predictive power. There is also the material risk that the minimum turnout of 40% for the elections to be validated isn't reached. Run-off is scheduled in two weeks’ time around 5 May.

Heading into run-off

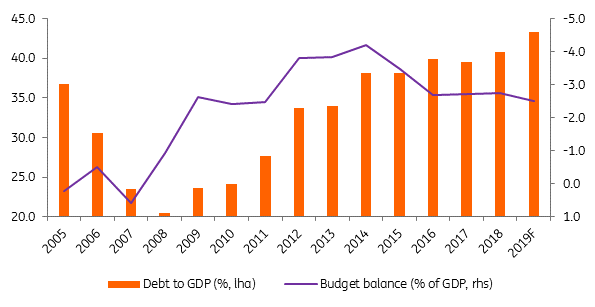

Regardless of the election outcome, we see no obstacle to NATO membership and negotiation on EU accession processes. The government program for 2019-2020 sees some fiscal consolidation ahead with the budget deficit reaching -2.0% of GDP by 2021 from -2.5% target for 2019. As the economy is expected to run below its potential, the structural deficit is seen rising further. Provided that growth accelerates, government debt as a percentage of GDP is likely marking its top in 2019.

Slower fiscal consolidation ahead

Rating factors that could lead do an upgrade or downgrade

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 April 2019

In case you missed it: China to the rescue? This bundle contains 10 Articles