Norges Bank supports attractive NOK prospects

The Norges central bank stayed on hold today but the Bank’s interest rate forecast does not rule out a hike in 2020. NOK is our top European G10 FX pick for the early part of 2020. We target the EUR/NOK 9.80 level

Not ruling out a hike in 2020

The Norges bank did not deliver any surprises today. The widely expected decision to remain on hold was accompanied by the largely unchanged interest rate forecast, where the central bank still pencils in a probability of a partial rate hike next year (albeit the timing of the possible partial hike was moved from the first quarter to the second quarter of 2020).

The interest rate path for 2H21 has been marginally upgraded higher too. The unchanged / very marginally higher interest rate outlook reflects the growth and CPI forecasts for the next three years which were either unchanged or very modestly upgraded. In short, no big surprise and the Nordic central bank may still raise interest rates next year if the domestic economy does well and NOK is not overly strong.

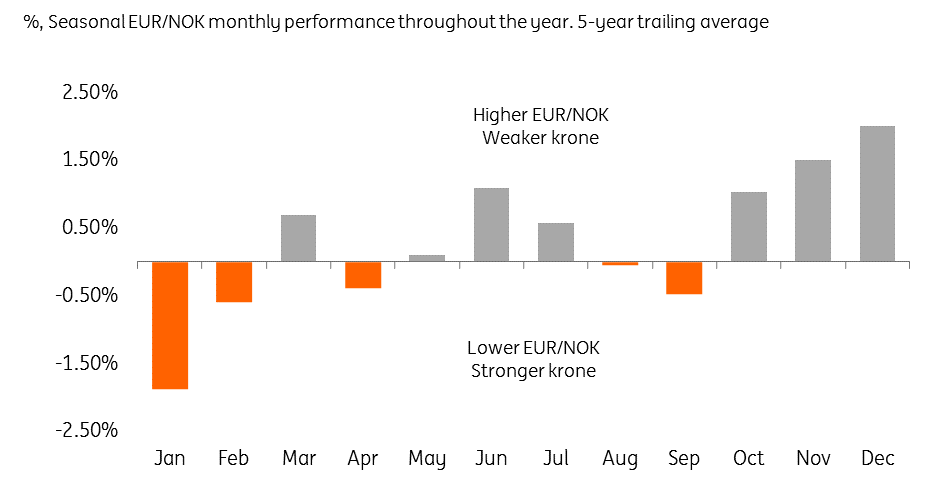

Figure 1: NOK tends to do strongly in January

NOK: Standing out in the European G10 FX space

We have seen a positive NOK reaction to the decision today, largely because the unchanged prospects of a partial rate hike in 2020 and the currency’s attractiveness on the carry - valuation matrix makes it stand out in the European G10 FX space. EUR/NOK is trading below the 10.00 psychological level for the first time since early October this year.

With risk appetite stabilising on the back of an improvement on the US-China trade front, we see NOK as the most attractive European G10 currency at this point and going into 2020.

Solid carry, seasonal NOK strength in January (Figure 1) and cheap valuation all suggest the krone’s outperformance early next year. On a regional basis, we prefer NOK to SEK as the former screens better on the carry-valuation basis. We target the EUR/NO 9.80 level by end-January 2020.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article