No surprises here as NZ dollar continues to underperform

Expect the NZD's paltry performance to continue till the looming elections and central bank FX intervention threat doesn't fade

| 0.69 |

NZD/USD expected levelGiven a 'perfect storm' of rising US yields and greater NZ political uncertainty |

Are all election outcomes NZD negative?

The 2017 New Zealand General Election takes place on September 23 and is likely to command greater attention from NZD investors given the potential economic and policy implications at stake. While we have no house view on the outcome of the election, we note the prospective policies of the next government could be deemed NZD negative in either of the two likely scenarios:

- Scenario 1

Should the incumbent National Party win, they will most likely need to form a coalition with the anti-immigration New Zealand First Party to achieve a working government. Naturally, the greater focus on policies to lower immigration could be seen as a negative factor for trend economic growth. We suspect the negative growth factor will dominate the initial market narrative, as opposed to arguments that lower trend growth and a potentially tighter labour market may warrant earlier - albeit less pronounced - RBNZ tightening. - Scenario 2

The opposition Labour party have also promised to curb inward migration by 30,000. Additionally, they have pledged policies to directly reform the RBNZ, which could see the central bank keeping rates lower for longer. Indeed, the shift towards a Fed-like dual-mandate - which focuses on achieving full employment in addition to the 1-3% inflation target band - may warrant a loose monetary policy stance for some time. It's worth noting current unemployment rate at 4.8% remains substantially above the 3.5-4.0% levels seen before the 2008/09 financial crisis. Also, the creation of a Monetary Policy Committee could ensure any policy normalisation would be gradual, especially given that the dual-mandate focus would see members placing different weights on each objective.

Given the heightened domestic political uncertainty and prospects of significant policy changes by the next government, our base case for the kiwi dollar is to trade with a negative bias ahead of the elections. Indeed, while our AUD/NZD financial fair value model suggests the pair is trading with a modest upside skew in recent days, we would conclude there is scope for a more significant NZ political risk premium to be priced in. At peak political uncertainty ahead of the elections, there could be a further 1-2% idiosyncratic NZD weakness to capture the event risk.

NZD could trade with a bigger political risk premium

RBNZ getting what they want... a lower NZD

The Reserve Bank of New Zealand has been saying no thanks to a strong NZD for a while now and ramped up its jawboning attempts in August by dropping the threat of intervention into the mix. While the threat of FX intervention remains non-credible at this stage – as the costs of an RBNZ rate cut in terms financial stability risks outweigh the benefits of a weaker NZD – we attribute part of the kiwi's recent underperformance to the verbal jawboning by RBNZ officials.

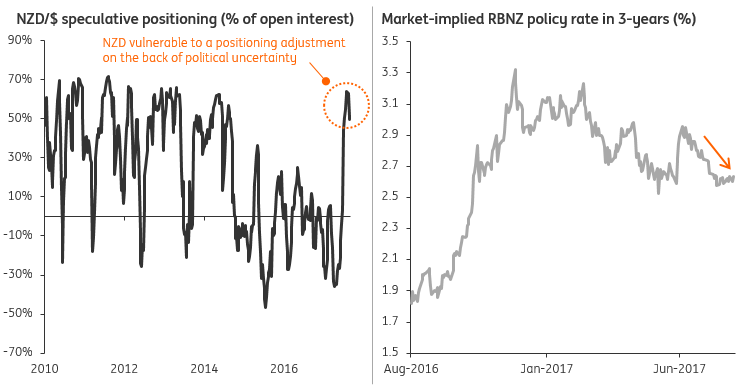

Earlier in the week, RBNZ Governor Wheeler reiterated the need for a lower currency and ongoing verbal jabs might see long NZD speculative positions neutralise further in the weeks ahead. Equally, a slowdown in house price growth is reducing any tail risk of near-term rate hikes to address any financial stability concerns; we note that three-year implied policy rates have fallen back towards their 2017 lows in recent months, thereby justifying the recent NZD weakness.

Positioning adjustment could fuel NZD downside

Bottom line: Further NZD weakness ahead of the elections

With speculative markets still significantly net long NZD and initial signs of a political risk premium yet to reach extreme levels, we suspect a narrower focus on the September elections could spell further weakness for the kiwi dollar. A data-driven recovery in USD sentiment could see NZD/USD temporarily undershoot our 0.71 forecast for 3Q17, with a break of the 200-DMA (0.7130) supporting this view.

Even worse, under a 'perfect storm' of rising developed market bond yields and greater domestic political uncertainty, we think NZD/USD could drop towards the 0.68-0.69 lows seen earlier in the year. We would also expect AUD/NZD upside to extend to the 1.11-1.12 area if markets see the NZD as an easy political target in the near-term.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article