No quick fixes for supply chain frictions

New lockdowns in Asia, including that of another major Chinese port, mean more disruption to supply chains. Each new setback is proving harder to recover from in a congested system

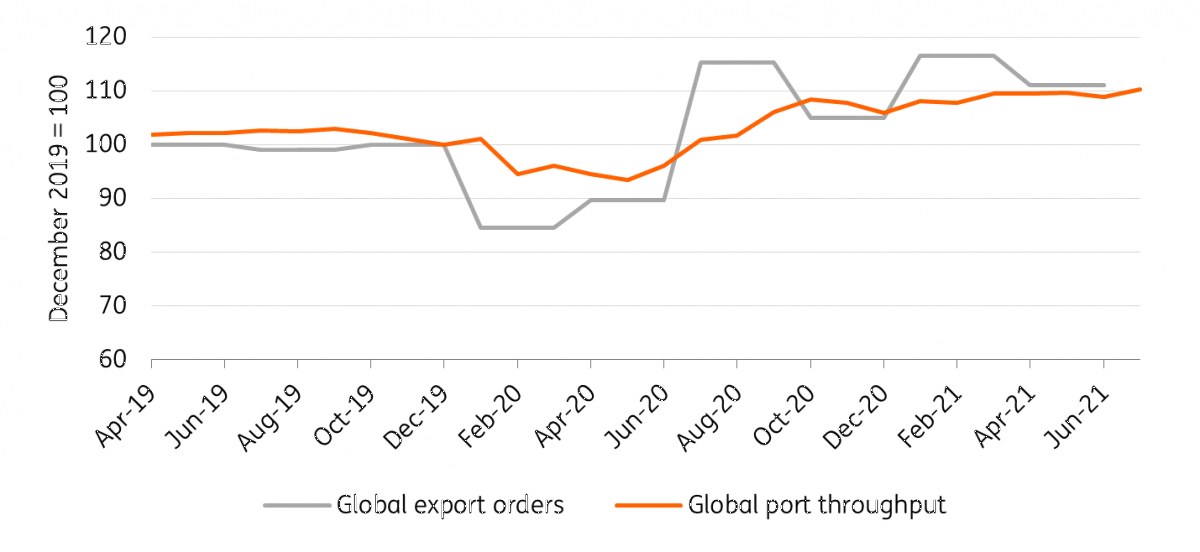

During the summer, demand for traded goods has remained strong as the US and eurozone economies have seen activity increase. But a gap has opened up between global demand and the capacity of ocean freight to deliver. New lockdowns to combat the spread of the Delta variant of the virus are causing fresh problems for supply chains that are increasingly visible in low stock levels, rising lead times, and materials shortages.

Ocean freight capacity is struggling to meet demand

Global port throughput and new export orders

Lockdowns affecting key hubs of global supply

Local lockdowns are having global consequences by affecting hubs of global supply and ocean freight capacity. Factory closures in Vietnam in recent weeks have disrupted the supply chains of major clothing, footwear and electronics brands, as well as Japanese car manufacturers. And the closure of China’s Ningbo-Zhoushan port in mid-August follows the lockdown at another major Chinese port, Yantian, in March, which saw the port operating below its full capacity for several weeks.

Each setback causes a fresh set of problems for supply chains, most obviously through the delay of key inputs, but also the displacement of containers, which in turn makes it even harder to catch up again. As a result of congestion in ports, less than half of ships globally have been arriving at their scheduled arrival times through 2021, and delays for late ships are consistently adding more than a week to delivery times.

Shipping capacity improves, but no quick fixes

Capacity on major shipping routes between Asia, Europe and the US has recovered to levels before the major lockdowns in 2020, but this capacity is being tightly managed by shipping companies in their alliances. Blank sailings (container ship journeys being scheduled, but then cancelled) have caused around 10% of scheduled capacity to be cut at short notice through the first half of 2021. On current plans, cancelled sailings will fall to around 4% in the second half of the year.

There are no quick fixes in sight

The cancellations are partly shipping companies’ response to delays, and therefore likely to remain a source of uncertainty for exporters and importers during the pandemic recovery, and even as capacity is expanded through the building of new container ships. In the meantime, each new disruption to production and ocean freight capacity will continue to see supply chain problems build up quickly and then linger, with no quick fixes in sight.

Frictions won’t be forgotten

Frictions are adding to other trade barriers which have arisen during the pandemic. Emergency measures to secure supplies of medical goods and food, as well as the subsidies to domestic industry from stimulus programmes, have made it more difficult to export to foreign markets - something that had already been becoming more difficult before the pandemic, partly thanks to the US-China trade war. And there is no appetite to bring trade barriers back down. Policy efforts in China, the EU and the US seem instead to be focusing on reshoring in key sectors, with a new push to develop domestic capabilities, especially in technology, and create a degree of independence in the supply of essential medicines and technology goods.

If policies, along with the frictions that have built up in supply chains, lower the relative costs of producing at home, this may tilt the balance for some supply chains to be brought home. Any changes are likely to be slow, as reshoring is difficult and costly. However, the ongoing disruptions to supply during the pandemic have brought the risks of using global supply chains into focus. The sudden and persistent rise in frictions during the pandemic won’t be forgotten as firms decide whether to adjust supply chains.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 September 2021

ING Monthly: Back from the beach, into the breach This bundle contains 11 Articles