No quick fix for high energy prices

European gas and power markets are extremely tight and prices have soared. EU leaders increasingly say the situation has become ‘unbearable’ for household and businesses. Gerben Hieminga and Warren Patterson look at the policy options, but conclude there is no panacea

Soaring energy prices

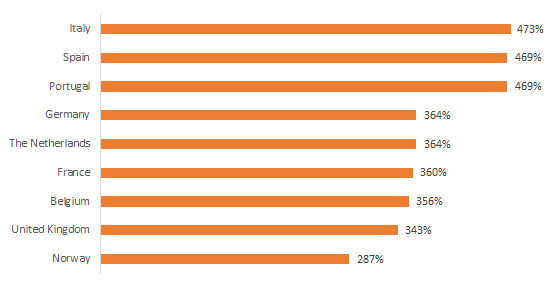

European gas prices have been very high and volatile lately. At the time of writing, gas prices are around €90/MWh but have in fact briefly traded in excess of €160/MWh. These prices are well above the long-term average of about 20/MWh in the Northwest European gas market. The impact is even more pronounced given that gas prices were trading at all-time lows of €3.50/MWh during the depths of the Covid-19 crisis. As a result, power prices have risen almost fivefold in Southern European countries like Italy, Spain and Portugal and have more than tripled in Northern European countries like Germany, the Netherlands, France and the United Kingdom.

Power prices have gone through the roof this year

Increase in baseload wholesale power prices between 1 January and 5 October

Perfect storm for energy markets

The many factors driving up energy prices are widely discussed and known by now (see box), but the recent surge could hardly have come at a more awkward time for governments. With just a month to go until the COP26 global climate summit in Glasgow, the current stress in energy markets exposes the challenges of moving towards a net zero economy. There is a danger that COP26 could shift the focus from long term solutions to reach the Paris climate goals towards short term solutions for companies and households facing high energy prices.

Factors driving up energy prices

Demand factors

- A colder than usual start of the year.

- A stronger than anticipated economic recovery from the pandemic.

- Fear of tight supply in case of a bad winter.

Supply factors

- Low levels of gas storage in European facilities.

- Competition for LNG between Europe and Asia with Asia trading at a premium to Europe.

- Lower than usual wind speed levels in Northwest Europe reducing the availability of power generation from wind turbines.

- No additional supply from Russia: the country is meeting its contractual obligations for delivering gas to Europe but has not provided much additional supply as markets tighten.

- A fairly heavy maintenance season in Norwegian fields over the summer.

- Less domestic supply as production at Groningen gas field has been reduced to prevent further earthquakes in the region. Note that this gas field in the Netherlands also supplied parts of Germany, Belgium, northern France and the United Kingdom.

- The phase out of coal-fired power plants and nuclear plants make the Northwest

Both companies and household are impacted

Utilities are on the frontlines of the energy markets. In general, they benefit from mildly higher gas and power prices as they hedge large parts of their portfolios upfront, especially the larger ones with big trading desks and strict risk policies. The winners are the oil & gas producers and utilities operating their own power generation assets. Nevertheless, not all utilities have integrated business models and many power retailers have been negatively impacted with some declaring bankruptcy. Their business models, based on gaining new consumers through lower prices, lock clients into long contracts. The generated revenues become insufficient when wholesale power and gas prices start to skyrocket, plunging the retail players into a price crunch situation.

Soaring gas and power prices potentially have a big impact on energy-intensive sectors too, such as chemicals, steel, cement, paper and glass industries. To what degree companies are under pressure largely depends on their energy sourcing and hedging strategies. Dutch aluminium smelting company Aldel, for example, recently announced that it needs to cut production if prices stay high. One tonne of aluminium requires 15 MWh of energy which costs the company €2,400 at current prices, whereas the world market price is at €2,500. Adding wages, maintenance, grid and capex costs results in a loss. Lower production levels could impact supply chains further and have consequences for other sectors such as construction.

In transportation, most sectors have been less impacted thus far, although railway operators are large electricity consumers. Oil is the main energy source in transportation. Oil prices have gone up too, but not to the same degree as gas, coal and power prices. Nevertheless, fuel costs are on the rise and pose challenges to airliners as fuel costs account for a quarter of the cost price. Hedging strategies might cushion the immediate impact, but the sector is under financial pressure already and airlines are still losing money. The same applies to shipping companies paying their own fuel bill, but the impact is less severe as they also benefit from high tariffs and profits. Road carriers, meanwhile, can often pass on a substantial part of the cost increase to clients via clauses, so importers, exporters and consumers are impacted, too.

Policy makers can intervene in gas markets

Pressure is mounting on policy makers to act. Some large companies in energy-intensive sectors have warned about cutting down production as they are operating at a loss due to high energy prices. Households in Spain have already hit the streets as their energy bills have risen. The European Commission has suggested publishing a toolbox of options for how governments and the EU could react. However, there is less talk and consensus on which tools to add. We take a look at the possibilities.

Buy gas from Russia and Norway. Europe’s gas demand stands at 604 billion cubic meters (bcm), whereas gas production is only 260bcm. So, 344bcm is sourced in international markets, according to the latest World Energy Outlook from the International Energy Agency. Most comes from Russia and Norway, while in recent years there has been a growing share of LNG entering the region. Policy makers could sign long term contracts with Russia and Norway to raise gas deliveries. Nadia Calvino, the Minister of Finance in Spain, made a plea on Monday for the centralisation of gas purchases in Brussels. That could increase bargaining power and result in better deals compared to every member state sourcing its own gas supply.

Fill up gas storage facilities. Europe’s gas storage facilities are at record low levels for the time of the year. Gas storage in Europe is around 76% full, compared to a five-year average of around 90%. But the situation in some countries is even worse. In the Netherlands for example, storage facilities are half empty on average.

Implement regulation for gas storage utilisation. European member states have different policies for the utilisation of gas storage facilities. Some countries, like Poland and Spain, apply minimum filling requirements, which guarantee that the storage facilities are at least 80% filled before the winter. Other countries, like the Netherlands, leave it up to the market. And this summer, market players had no incentive to top up reserves. Spot prices for gas were already unusually high in the summer months, with futures prices for the winter months being flat to lower (backwardation). That unusual situation provided little incentive to buy and store gas. It stood in sharp contrast to normal market conditions, with spot prices for gas being low in summer months and gas futures indicating higher prices during the winter months (contango).

Speed up Nord Stream 2. The 55 bcm Nord Stream 2 pipeline was designed to increase gas exports from Russia to Europe, but has faced some delays due to fierce opposition from Washington. Gazprom finished construction last month and the German regulator, the Bundesnetzagentur, now has four months to certify the pipeline and to comply with EU standards and regulation. If parties speed up the process, the pipeline could be operational before January or February, which are typically the most severe winter months.

Substitute gas for other energy sources. Gas plays a large role in power generation as many European countries are phasing out coal or nuclear-fired power plants, and renewables cannot fully make up for the difference. But there are ways of alleviating the current situation:

- Production from coal-fired power plants is often restricted by declining maximum generation levels, which could easily be raised. And some coal-fired plants that have already been shut down recently could be brought back to life.

- Nuclear power plants are likely to give less flexibility in actual power generation, but a postponement of the phase-out could positively impact market sentiment by taking away some of the anxiety.

- Countries can increase power generation and heating from biomass sources.

- Gas can be swapped for oil-fired power generation. In fact, this is already happening in Asia where spot LNG prices have rallied to an oil equivalent as high as $320/bbl compared to Brent trading around US$81/bbl. In Europe, it is less common to generate power and heat with oil, except for power generation in remote locations or for emergency supplies. But this could still help in case of an energy crisis.

Increase production from Groningen gas field. The production ceiling of the Dutch Groningen gas field, the largest field in Europe, was reduced from 42bcm in 2014 to 7-8bcm currently, which is considered in line with the safety level of around 12bcm to prevent earthquakes. The Dutch government has been aiming to cut production from Groningen to zero over the 2022/23 gas year, which runs from October 2022 to September 2023. This raises the country’s dependency on gas imports. This has also been felt outside the Netherlands, as parts of Germany, Belgium, France and the UK have been partly supplied with gas from Groningen. The current gas year has just started and the government is aiming for 3.9bcm of production, or probably a bit more if the winter turns out to be particularly cold, as production caps are dependent on weather conditions. That is far below the safety level of about 12bcm. But increasing production to that level runs against the ambition of the Dutch government to reduce production further and shut down the field entirely in the gas year 2022/2023.

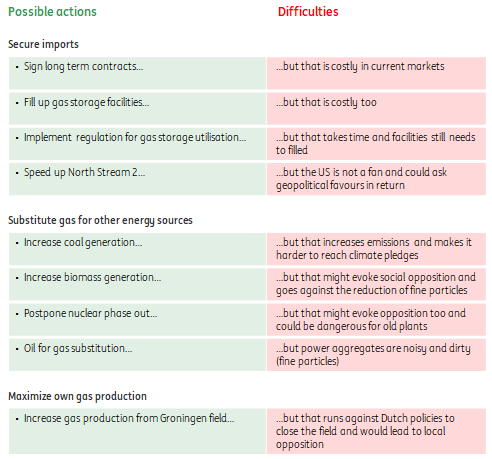

But all measures come at a cost

While there are plenty of ways for policy makers to intervene in energy markets, they come at a cost.

Signing long term contracts and topping up gas storage facilities before winter is expensive in current gas markets. Europe will need to compete against Asia, and particularly China for LNG cargoes. This might be difficult given the power issues that China is also going through now. A move back towards long-term contracts will also go against the more recent trend of growing the spot market.

Increasing power generation from coal or oil-fired power plants will make it harder to reach ambitious climate targets that the European Commission recently increased in its Fitfor55 strategy. It might also meet social opposition, just like higher gas extraction from the Groningen field, more biomass use for energy generation and a postponement of the ‘Atomausstieg’ in Germany and Belgium.

A speeding up of Nord Stream 2 could turn out to be the least controversial option in Europe to deliver security of energy supply. The new Biden administration is less tough on it compared to the Trump administration but still, the US might ask geopolitical favours in return.

There are ways to intervene in gas markets, but all prove difficult

Possible policy actions and their difficulties

Governments are likely to act

While the measures in energy markets can help to make the market less tight, energy prices are likely to stay at elevated levels for some time. The price level will be largely determined by weather conditions and market perception. Prices could stay at current levels or continue to increase in the case of a cold winter. Prices could drop significantly if the winter is warm and the anxiety of market participants decreases. Either way, markets are likely to ease in the spring so it is more likely that the current highs turn out to be temporary. In that respect, it is worth remembering the situation in spring 2020 when oil traded at negative prices. These extreme circumstances often do not last long; oil is currently trading at about $80 per barrel.

Despite the likelihood of a temporary situation, fuelled by a strong economy, policy makers are likely to act on current high prices. Italy, for example, already committed €3bn support to low income households, France €580m and the Netherlands €500m. Policy makers in Spain want to reduce excess profits from utilities that benefit from high energy prices. And the United Kingdom is providing emergency state-backed loans to utilities that take on customers from bankrupt energy providers. These loans provide for the losses they make by onboarding these clients and the regulated contracts they bring.

There are also talks about a temporary reduction in energy taxes in many countries. Research shows that energy tax rates are about €10/MWh in countries like Poland, Hungary and Belgium to as much as €30-35/MWh in countries like Germany, Italy and the Netherlands. However, this is quite a general measure that benefits all households, both rich and poor. Policy makers could also implement subsidies or income tax measures that specifically benefit households and companies that are most impacted by the current prices.

Energy markets are likely to remain tight in the coming months, especially if the winter turn out to be cold. Policy makers cannot rely on a mild winter alone and are likely to act. Luckily there are policy options available, but all come at a cost.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article