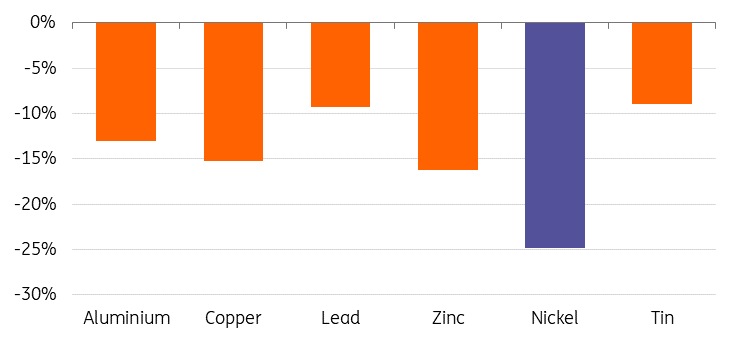

Nickel’s underperformance to continue

Nickel has been the worst-performing metal on the LME so far this year with prices down around 45%. We believe this underperformance is likely to continue, at least in the near term, amid a weak macro picture and a sustained market surplus

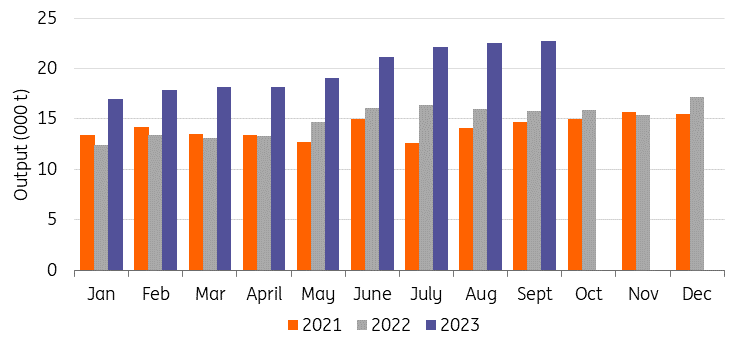

Indonesia’s output surges

One of the key drivers for nickel’s underperformance this year has been the supply surge from Indonesia, the world’s largest nickel producer. It holds the world’s largest reserves of the metal with much of Indonesia’s output being of Class 2, lower purity material, used in stainless steel production.

Indonesia's nickel mine production hit an estimated 1.6 million tonnes last year, up 54% from 2021, according to the US Geological Survey. That makes up nearly half of global nickel production, which totalled an estimated 3.3 million tonnes.

Nickel smelting has expanded in Indonesia since the government imposed a permanent ban on nickel ore exports in January 2020 in a drive to attract foreign investors, encourage domestic processing and further downstream use of its raw materials. The ban has enticed foreign investors, mainly from China, to build local smelters and has helped to boost the value of Indonesia’s exports.

We believe rising output in Indonesia will continue to pressure nickel prices next year.

In China, the world’s second-largest producer, Class 1 nickel output also continues to expand. China’s refined Class 1 output rose more than 36% year-on-year in the first three quarters of the year, in response to historically elevated LME prices.

China’s refined class 1 nickel output has increased in 2023

The surplus in the global nickel market is expected to widen to 239,000 metric tons in 2024, the International Nickel Study Group (INSG) forecasts, marking the third consecutive year of excess supply. The surplus will be the largest yet.

It expects global output to increase to 3.71 million tons in 2024 from 3.42 million in 2023 as Indonesia’s nickel pig iron (NPI) production continues to rise. Indonesia’s new high-pressure acid leaching (HPAL) plants that produce mixed hydroxide precipitate (MHP) are also continuing to ramp up output, and the conversion of NPI to nickel matte is growing.

Last year, the market was in a 104,000 tonnes surplus, which is set to rise to 223,000 tonnes this year. The cumulative forecast surplus over the three years amounts to 566,000 tonnes.

Nickel market balance

(Thousand tonnes)

Historically, market surpluses have been linked to LME deliverable/class 1 nickel but in 2023 and 2024, the surplus will be mainly related to class 2 and nickel chemicals.

Concerns about the oversupply in the nickel market have been reflected in investor positioning on the LME, which is the most bearish it has been since 2019. The nickel short position is the largest of the six LME base metals. This build-up makes nickel vulnerable to violent price spikes should inventors unwind their short positions.

LME nickel net short position grows

(LME investment funds’ short position, % of total open interest)

Demand disappoints

On the demand side, in more traditional sectors like construction, demand has mostly disappointed. China’s flagging recovery following Covid lockdowns has hurt the country’s construction sector and has weighed on demand for nickel this year. Investment in property development fell 9.3% in the first 10 months of 2023, while residential property sales fell 3.7% in January-October compared to the same period in 2022.

However, looking into next year, global consumption for nickel is expected to increase to 3.47 million tonnes from 3.2 million in 2023 due to the recovery of the stainless-steel sector and increased usage of nickel in electric vehicle batteries. Batteries now account for almost 17% of total nickel demand, behind stainless steel. In EV batteries, nickel boosts their energy density and increases their driveable range.

Russia-origin material increases in LME sheds

LME nickel stocks have been rising amid inflows of Russian-origin material. In October, Russia-origin refined Class 1 nickel stocks stood at 8,238 tonnes. This compares to 6,756 tonnes in January this year, however, it was down from September’s 9,336 tonnes. Russia-origin material is behind Australia-origin metal, which stood at 18,834 tonnes in October.

In addition, 1,236 tonnes of China-origin material were delivered into LME warehouses in September. Although it accounted for only 3% of total nickel stocks on the exchange, this was the first arrival of China-origin nickel into the LME warehouses since the exchange started publishing the country-of-origin stock data report in January this year. An additional 1,572 tonnes of Chinese-origin material were delivered in October.

The arrivals also follow the approval of nickel cathodes produced by a subsidiary of Chinese nickel producer Zhejiang Huayou Cobalt in July as an LME-deliverable brand.

We believe there could be more Chinese-origin material delivered to the LME warehouse system in the next few months. In November, the LME approved the listing of GEM-NI1 full-plate cathode for delivery against the nickel contract. CNGR has also applied to the LME to have its full-plate cathode listed.

LME open tonnage by country of origin

(metric tonnes)

LME nickel stocks remain critically low

However, historically, LME nickel stocks remain critically low despite the recent deliveries. But we believe that the LME’s new initiative – which has reduced waiting times for approving new brands that can be delivered against its contract – could potentially increase inventories. We believe Chinese producers will continue to submit fast-track LME nickel brand applications. This will allow them to deliver their Class 1 material to LME warehouses and could potentially increase inventories.

There are also supply risks around Russian metal. If European consumers continue to shun Russia-origin material, this could result in more Russian material being delivered into the LME warehouses. This would put downside pressure on nickel prices. Russia is the third largest primary nickel producer after Indonesia and China, accounting for around 20% of the global supply, and the largest exporter of refined nickel metal – the type deliverable on the LME. Europe is one of the key destinations for Russian metal. If we see more Russian metal being delivered into LME warehouses, it could potentially mean that LME prices trade at discounted levels to the actual market.

LME nickel stocks are at historical lows (metric tonnes)

LME nickel price returns to pre-crisis level

LME nickel prices have now returned to similar levels before the nickel short-squeeze in March 2022 following Russia’s invasion of Ukraine, when prices doubled to more than $100,000/t in a matter of hours and the LME subsequently cancelled the trades.

The LME has had a difficult year handling the aftermath of the nickel crisis in 2022. The exchange is still struggling to regain momentum following its decision to suspend nickel trading for a week and cancel billions of dollars’ worth of trades. LME volumes have declined since then as many traders have reduced activity or cut their exposure due to a loss of confidence in the LME and its nickel contract.

These low levels of liquidity have left nickel prices exposed to sharp price swings, even amid small shifts in supply and demand balances.

But since the exchange introduced daily price limits and margin requirements fell, volumes have started to pick up. The resumption of Asian trading hours (after a one-year suspension in the wake of the nickel crisis) has also encouraged more volumes and improved liquidity, which in turn has reduced volatility in the contract. The recent win by the LME in a UK court challenge by Elliot and Jane Street over the exchange’s decision to cancel nickel trades in March 2022 has also marked an important milestone for the exchange as it continues to rebuild confidence in its nickel contract.

LME nickel volumes pick up after 2022 crisis

Prices to remain under pressure

We forecast nickel prices to remain under pressure in the short term as a surplus in the global market builds and a slowing global economy mutes stainless steel and EV demand. We see prices averaging $16,600/t in 1Q with prices gradually moving up to average $17,000/t. We forecast an average of $16,813/t in 2024.

Prices should, however, remain at elevated levels compared to average prices seen before the historic LME nickel short squeeze in March last year due to nickel’s role in the global energy transition. The metal’s appeal to investors as a key green metal will support higher prices in the longer term. We believe demand for use in EV batteries will be the key factor in nickel’s longer-term story. Although there are signs of a slowdown in 2023, intensified competition and lower relative prices will push the trend forward, with China in the lead.

Nickel is crucial in global electrification push

The US has assessed nickel as a critical material in the medium-term. The US Department of Energy (DOE) recently released its 2023 Critical Materials Assessment, which evaluated materials for their criticality to global clean energy technology supply chains. The department expects nickel and lithium to become the most critical minerals globally between 2025 and 2035. The DOE expects nickel to become critical over this period due to the crucial role the metal is expected to play in the wider global electrification push.

ING forecast

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 December 2023

Commodities Outlook 2024: Cautious optimism This bundle contains 12 Articles