Nickel’s price drop suggests caution ahead

Profit-taking saw nickel slipping in London as the market turns more cautious. Precursors’ margins have turned negative in China. Meanwhile, China's Tsingshan Holdings has confirmed a shipment of a first batch of nickel matte to the country

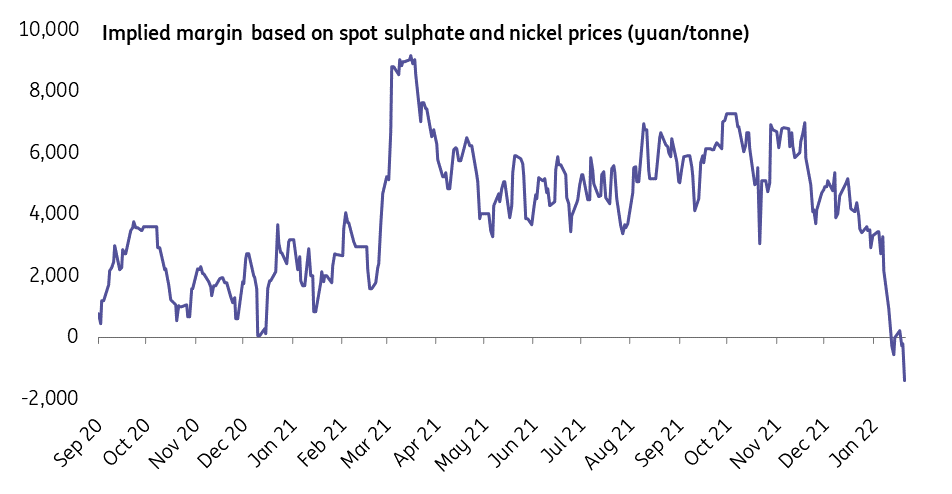

A deeper negative sulphate margin bears a caution

The strong run in the metals markets stalled in early London trade with LME 3M nickel prices leading that correction; it lost more than 4% from Friday's close.

Last week, nickel prices reached their highest point in a decade as tightness in the fundamentals persisted in the market, with the Class 1 market driving the rally. Market sentiment was compounded with positioning changes after a historical squeeze in the LME market which further fueled the rally.

Clearly, the market's turned more cautious and some investors are taking profits. There are two main reasons for that. First, we have a Fed meeting later this week which could ruffle some feathers. Click here to read about what we're expecting.

Secondly, sulfate production margins at Chinese precursors have fallen into negative territory based on the current spot prices. Theoretically, this could disincentivise their purchase of briquettes and ease the pressure of exchanged inventory outflows. However, this spot margin measurement does not always provide a reliable indication as some producers' procurement of raw materials and sale prices are not based on spot prices. Moreover, nickel is the single largest cost component to precursor makers, accounting for more than 50% on average depending on the battery makeup. And as physical market activities are set to slow during next month amid the Chinese New Year (CNY) and the Winter Olympics, we could see a pause in the stock buildup.

Spot margins have plunged to negative on spot prices

More nickel products on their way to China's markets to ease the tightness

There are reports that nickel products (Class 1& 2) have started their journey to China's markets. Tsingshan said it had shipped the first batch of matte products to the country, helping add more feedstocks supply to precursor makers and thus could see biddings for briquettes to abate, and further easing the pressure of exchange stock outflows. The nickel matte is from the NPI-to-matte conversion project announced last March. Originally they planned to deliver 75kt nickel matte to Huayou and Zhongwei between October 2021 and October 2022.

The first batch is said to be around 500t, but it remains to be seen how quickly it can increase supply. It's worth noting that the first matte product delivery that came amid the spread between matte and NPI has not hit the theocratical incentivising levels based on estimated costs. In other words, it doesn't make sense to produce matte via the NPI-to-matte conversion route based on the spot prices.

In the short term, these dynamics may take some winds out of nickel's sails. However, as exchange inventories continue to draw down, investors may remain wary of short nickels, though some may take profits for now.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

NickelDownload

Download article