Limited NZD implications from New Zealand’s general election

New Zealand's prime minister Jacinda Ardern is set to be re-elected on Saturday according to the polls. Political risk is not particularly a factor for NZD at the moment, but if her party manages to achieve a full majority in the House, the NZD may receive a modest push. Monetary policy and the US election remain the key short-term drivers, however

Ardern set for a second term

The Labour party in New Zealand, led by prime minister Jacinda Ardern, appears set for a rather comfortable win at the general elections to be held on 17 October.

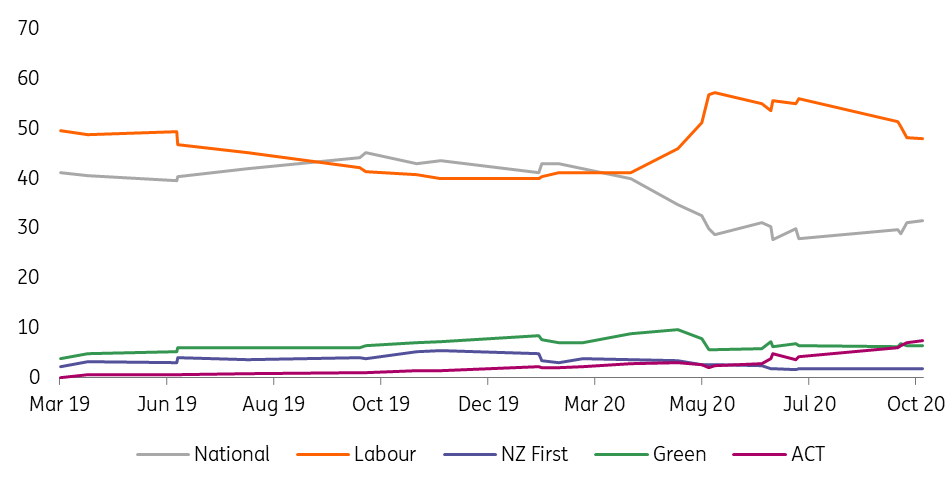

All opinion polls have indicated a marked change in preferences in the past few months as the Labour party appears to have built up a wide advantage over the main opposition National Party, which had looked slightly ahead in the second half of last year, as you can see in the chart below.

NZ election polling

PM Ardern's response to the Covid-19 emergency, with a mix of ultra-stringent lockdowns and large fiscal support measures, has boosted her popularity and it's widely expected she'll be returned for a second term. The only question is if Labour will be able to gain control of the 61 seats needed for a majority in the House. Most projections give Labour between 60 and 62 seats at the moment.

The alternative would be a coalition government with the Green party, which should be able to hold on to their current eight seats and are already providing their support to Ardern’s government.

Market reaction likely muted

In terms of policy implications, the difference between Labour taking full control of the House and a Labour-Green coalition would hardly be significant and markets are expecting the current commitment to support the recovery with additional fiscal stimulus to be renewed.

Still, a majority win by the Labour party may convey the idea of even more government stability and there may be some positives – although short-lived – implications for NZD as markets re-open on Monday 19 October.

Otherwise, with expectations well-cemented around a confirmation for PM Ardern and polls suggesting very little room for surprises, the market reaction after the election may be negligible.

US elections and RBNZ remain key currency drivers

The short-term outlook for NZD remains firmly tied to the US elections, where the prospect of a non-contested Joe Biden win may provide some steam to the whole high-beta currency bloc.

Australia-China rising tensions and NZD's overstretched net-long positioning

On the domestic side, the key factor that can drive the divergence with other pro-cyclical currencies is the central bank's dovish stance and the possibility of more monetary stimulus in November. We don’t think the Bank will cut rates before the end of the year and we are still not entirely convinced negative interest rate policy will actually be deployed at all, but the Bank is clearly gearing up for such a move in the first half of next year.

Two more factors to keep an eye on for the NZD short-term outlook. First, rising tensions between Australia and China (China banned imports of Australian coal this week and NZD may be caught in the crossfire due to strong ties with both countries even if New Zealand is not involved in any diplomatic spat.

Second, NZD’s overstretched net-long positioning (here is our latest FX positioning commentary), which highlights a somewhat higher downside risk for the currency compared to its G10 peers AUD and CAD.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article