New York Climate Week emphasizes the need for action

Corporates and organisations gathered (virtually) in New York this week to show that they mean business when it comes to combating climate change. It was a group of the like-minded, presenting a plethora of examples of progress, mostly at the corporate level. But there were also loud calls for much more to be done, and especially from government

New York Climate Week has concluded. It has not made many headlines in mainstream media, but it did contain a few days of interesting discussion on the merits of taking action now to secure a net zero future, and specifically to balance emissions versus production of greenhouse gases by 2050. It was very much a talking shop of the convinced, those that are of the firm opinion that climate change is happening, and that the behaviour of humanity is a central cause of it. And by extension, action taken now and in the coming years in an accelerated manner can help to stem the negative impact, bending the curve towards a more carbon neutral future. As is typical in such events, the case for the defense is typically not made, or at least a platform is not provided for it. But we’ll leave that for another day. Here we focus on the key soundings and themes from the event.

It was very much a talking shop of the convinced

A whole series of corporates lined up to champion their efforts to lower their own carbon print. The range of names was impressive, spanning the sectors of energy, transport, food and agriculture, health, finance and more. And there was a global focus to the discussion, with a heavy European influence, especially in the healthcare and finance discussion, and in energy. There was also a solid nod to emerging markets, with the likes of India and Latin America singled out for coverage, and China was a strong discussion point too. The central theme was one of championing the work that has been done, while acknowledging that much more needs to be done. This was overlayed with loud calls for governments on a global scale to do much more; in a sense to catch up with segments of the private sector that deem themselves to be ahead of the pace.

Climate: “Code red for humanity” reiterated

It has become clear that there is a real urgency to address climate change with all stakeholders involved. The UN Intergovernmental Panel on Climate Change (IPCC)’s assessment report published this August forecast that it is likely the global temperatures will have increased by 1.5 degrees Celsius compared to pre-industrial levels by 2040, much faster than previously projected.

There is also an important social dimension to big ambitions

Moreover, despite the flurry of targets set by countries and companies to achieve net-zero emissions – a stage where greenhouse gas emissions are balanced with an equal amount of carbon removal from activities such as reforestation or carbon capture and storage – the pathway toward realizing this goal is very narrow.

At this year’s New York Climate Week, governments, UN agencies, business, investors, and NGOs all stressed the imperativeness to tackle climate change and showed great enthusiasm to marry bolder plans with concrete actions. There is also an important social dimension to big ambitions, where vulnerable parts of society are not cast aside by new technologies. A just decarbonization process is what’s required.

Supply chain management at the heart of corporate sustainable practices

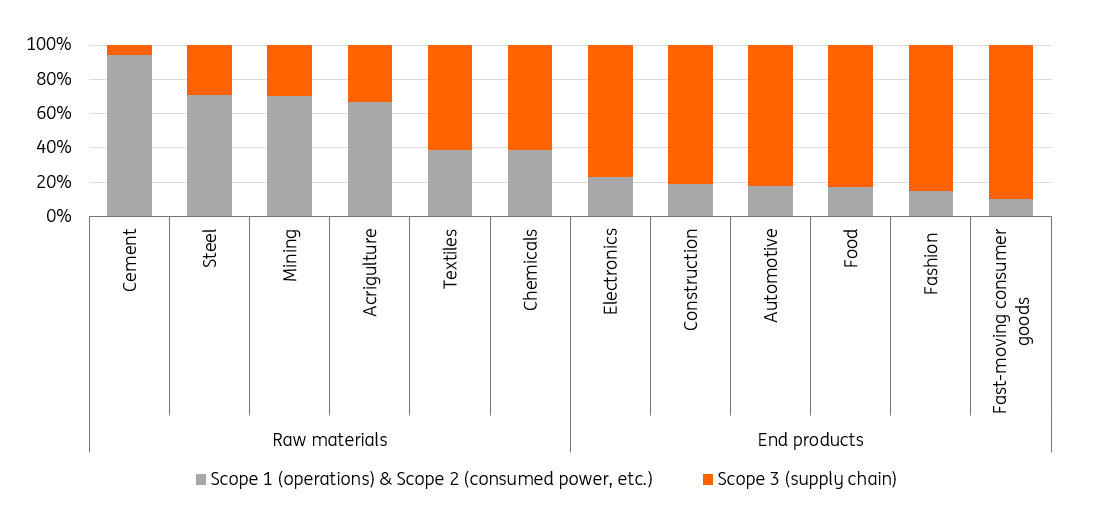

One hot topic among corporates at the Climate Week is the sustainable management of supply chains. Emissions from eight major supply chains including food, construction, automotive, and freight sectors together contribute to over 50% of all global greenhouse gas emissions. In the automotive sector, for instance, 14% of global steel production is for vehicles, and steel and iron production makes up 11% of global CO2 emissions.

Breakout of emissions and the supply chain effect

Across sectors, a growing number of companies are developing strategies to decarbonize their supply chains. Common best practices agreed by participants at Climate Week include requiring suppliers to disclose sustainability-related information, investing time to listen to suppliers, assessing suppliers based on both the ambition and progress of their science-based sustainability targets, as well as helping suppliers improve their sustainable performance.

From a corporate management perspective, best practices also involve setting up a clear tone from top management on sustainability

From a corporate management perspective, best practices also involve setting up a clear tone from top management on sustainability, communicating effectively with consumers and suppliers, and building a radically transparent and traceable management system. Tangentially to this point it was interesting to see some of the companies emphasizing the importance of the circular economy with one large technology company aspiring to reuse or recycle a product for every new purchase.

One element that companies desire, but the market current lacks, is industry standards on sustainability and the circular economy so that players can be properly aligned, creating some consistency of treatment and a level playing field.

Many of the technology companies have come out to declare that they are currently at a point of net zero emissions, and they deem that to be the case from a full supply chain perspective. It gets tougher to achieve this as we move out the curve to corporates that survive off a more complex and heavier supply chain that could span players across different continents with different agendas.

One of the key declared ambitions for the corporates that spoke up on the issue was to take some ownership of the emissions profiles of their suppliers. This is quite a grandiose task to take on, especially for the producers of more complex product, and requires quite some due diligence across a number of supply chain fronts. But it seems many corporates are up for the challenge.

The energy sector – where the most urgent attention is required

At a very early stage of Climate Week it was agreed among participants that the system that needed our most urgent attention was in the energy system. Here we have the root of the carbon print, and that comes with a clear acknowledgement that changes are required. Wind, solar and hydro power were the key areas where more resources need to be directed towards.

Participants acknowledge that hydrogen has not yet achieved cost parity with other fuel alternatives

There was also an energetic discussion on hydrogen as a source of power, directed by one or other of the above, and a very interesting picture of New York energy being supplied in this fashion was featured. The usual requirements were trotted out here along the lines of cleaning up electricity generation generally, replacing fossil fuel plants, and aiming for clean electricity generation, and dramatic reductions in damaging emission. And not just in the coming decades, but as soon as this decade. Calls for governments to act here were loud.

Participants acknowledge that hydrogen has not yet achieved cost parity with other fuel alternatives in most cases. To support the development of the fuel, many G20 countries included in their Covid-19 recovery stimulus packages investment plans to support hydrogen production – especially “green” hydrogen produced through renewable energy. But more policy incentives are needed – not just in hydrogen, but in all parts of the energy sector.

Developing green and sustainable energy is also important for energy security. As we can currently see across Asia and Europe, a reliance on fossil fuels, often from foreign countries, creates vulnerabilities to supply shocks that are economically and societally disruptive.

Transport and lots of talk on electrification

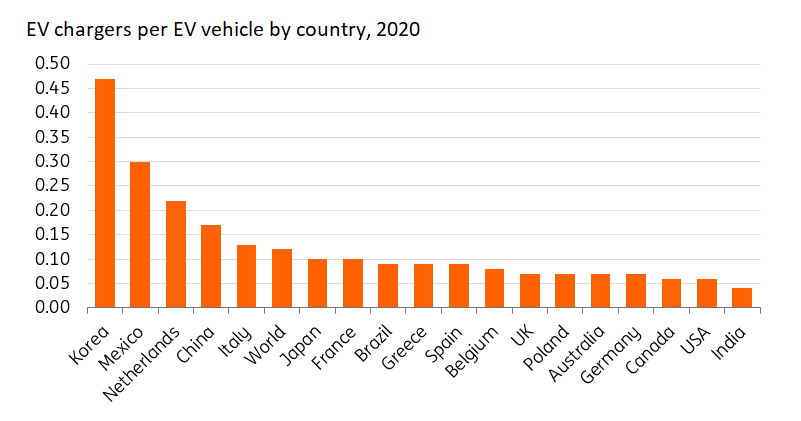

The development of zero-emission vehicles (ZEVs) are crucial to help regional, country, and local jurisdictions achieve net-zero emissions targets. Yet, one main challenge to the uptick of EVs, especially in the US, is the lack of charging infrastructure. The density of charging stations in the US is lagging its European and Asian peers, which in part has led to low percentage of EVs in the automotive sales in the US. In 2020, EVs accounted for 74.8% of light vehicle sales in Norway, followed by Iceland (45%), Sweden (32.2%). In China the ratio was 6.2% and the US just 2.3%.

Electric Vehicles Chargers - The US has some catching up to do

One of the reasons for the low level of EV deployment in the US is insufficient supporting policy at the federal level, which is only starting to build up this year. President Biden’s infrastructure plan is only setting aside $7.5bn to expand electric vehicle charging – half a million EV chargers – with a priority to dedicate money to rural and low-middle income areas. There is another $7.5bn for electric school buses and other public transportation.

The US looks set to continue lagging major European and Asian countries in EV adoption in coming years

President Biden had initially proposed upwards of $100bn for incentives to buy an EV through credits or rebates on purchases, but this was cut from the final plan and will mean uptake will be much slower. Indeed, one of the key reason’s that Norway has been so successful is that ordinarily the country charges hefty import duties and registration taxes. If you purchase an EV these fees and taxes are significantly reduced while there are also certain toll exemptions – a significant inducement.

With less financial support and a less developed charging network the US looks set to continue lagging major European and Asian countries in EV adoption in coming years and is in danger of being overtaken by much smaller European countries. This is not only important for climate change, but as many of the panelists pointed out, it is hugely detrimental for air pollution, which has knock-on implications for health.

Mother Earth and Health are key sources of pollution that require action

The food and agriculture sector is traditionally seen as having contributed to worsening the environment, leading to biodiversity loss, deforestation, water quality degradation, and chemical pollution. At Climate Week, food companies talked about conducting business while respecting the planetary boundaries. To do that, they are rethinking how to fit in to the food system, which can help them develop tailored climate strategies and be part of the climate solution. These include building up sensor systems for smart farming, advancing plant-based technologies to reduce emissions from food production, among others, to establish a regenerative and restorative food system. Such a system is a clear requirement to help bend the emissions curve, with a focus on greenhouse gas emission per calorie consumption as something to focus on when accessing the merits of alternative methods.

Food companies talked about conducting business while respecting the planetary boundaries

However, there was little discussion of personal responsibility on this key topic. According to the US Department of Agriculture food waste is estimated at 30-40% of the food supply. This is hugely detrimental to sustainability goals given the significant energy waste from machinery and logistics and fertilizer production plus the harm to biodiversity. While much of this is in supply chains there is also waste from people buying too much and throwing out food waste. There is also the diet that people choose that in the Western World and the US in particular tends to be protein heavy, which is also more energy intensive.

It was acknowledged that healthcare was an unusual polluter, responsible for some quite significant waste and gas emissions. Lessons from Europe featured here for the large US healthcare business, an area that no doubt will become a key target area in the coming years.

Asset management and banking are seeing change, and more is coming

The notion of taking responsibility for what stakeholders get up to was a related topic of the week. In the area of finance there was a focus on the behaviour of asset managers. We know there has been a ballooning in environmentally friendly and sustainable funds at the asset management level, but the talk was to take this one step further and look at the entire holdings of assets managers when assessing how green and sustainable they really are, holistically.

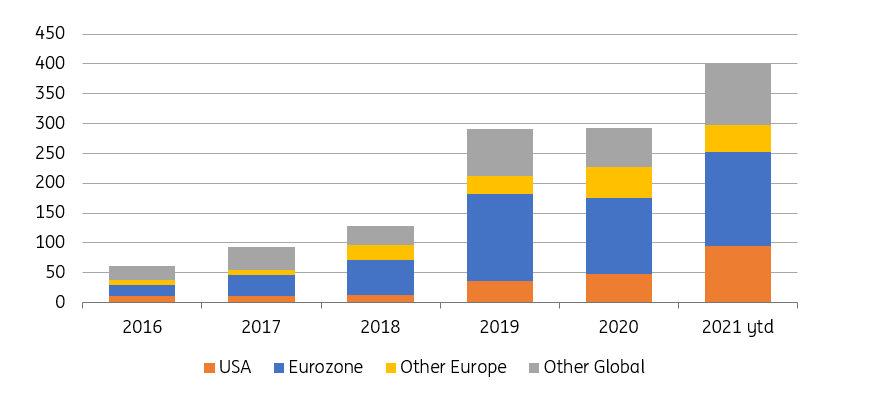

Corporate issuance of sustainable bonds – the US is on the up

Asset managers should also take on a more pivotal role in proxy voting, to help ensure more green objectives are achieved, including having an eye on board memberships, ensuring enough sustainability expertise is present. A similar theme obtains when it comes to banks, where their loan books should increasingly be pivoted towards a more sustainable friendly underpinning, and where brown players get funded that they have sustainability linked objectives tagged on to the takedown of borrowed funds.

Steel – a heavy hitter and an example of where change is required

Companies are realizing that hard-to-abate sectors such as steel need to be part of the solution to realize net-zero emissions goals. There have been increasing discussions today about the decarbonization of these sectors, compared to even five years before when much of the focus was on cleaning up the power sector. That said, steel consuming companies like automakers are increasingly demanding greener steel, whose production is powered by renewable energies such as wind, solar, or hydrogen.

Steel consuming companies like automakers are increasingly demanding greener steel

Steel manufacturers and consumers with sustainability mandates have used Climate Week as a platform to express that the sector would need trillions of dollars to facilitate the greening process. Capital is required to de-risk investment, reduce the green premium, among others. Companies have also voiced their support for public procurement policies of steel, as well as a gradually increasing carbon price scheme.

Winners and losers, and there are many of both

There are clearly significant opportunities for companies and employees as the world pivots towards action on climate and sustainability, but there was little discussion at the event surrounding what happens to the losers. Many companies will not be able to adapt to the new environment quickly enough to survive in their current form and this could have devasting impacts on the communities left behind.

As we have seen with the loss on coal mining, ship building and general manufacturing jobs across the US and Europe, a trail of economic hardship is left in its wake, that will need to be addressed. Inequality, in the sense of a loss of purpose, and a consequent rise in crime, can all quickly result in and create a polarizing political environment. Governments will need to come up with policies to mitigate this very quickly.

Be careful what you ask for

Time and time again, participants at Climate Week concluded with a call for more government support. This is timely, ahead of the UN COP26 set for Glasgow in November. There, the stage is set for a further overlay of potential governmental action. In fact a gathering of the UN General Assembly also took place in New York, coinciding with Climate Week, from which the Biden administration announced a doubling of climate aid to USD11.4bn annually by 2024, and China pledged to halt the financing of new coal-fired power plants overseas (although there is more scrutiny on domestic emissions).

As a final aside, we wonder whether corporates fully understand that they are in a way asking for more regulation, and likely more taxes on activities that are responsible for the various externalities that manifest in climate erosion. Just like the lack of case for the defense, we will leave that whole debate for another day…

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 September 2021

Sustainability: here comes the hard part This bundle contains 8 Articles