New US inflation highs heap pressure on the Fed

Inflation is at a new 40-year high and it it isn't just the rate that should be worrying the Federal Reserve, but also the breadth of corporate pricing power. With wages, commodity prices and supply chain strains all contributing, the Fed will need to respond aggressively with a very real prospect that they choose to signal their resolve with a 50bp March move

| 7.5% |

Highest inflation reading since February 1982 |

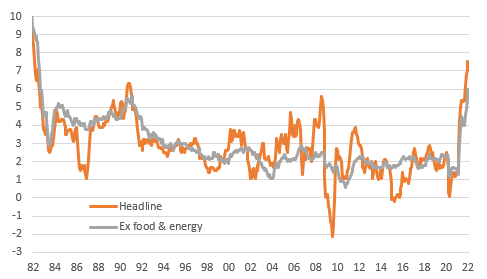

US consumer price inflation came in a fair bit stronger than expected in January, rising 0.6% month-on-month/7.5% year-on-year with core (ex food and energy) at 0.6%/6.0%. Consensus was for annual rates of 7.3% and 5.9% respectively. The last time we saw a higher inflation reading was February 1982 when it hit 7.6% and The J. Geils Band were riding high at the top of the Billboard Hot 100 with Centerfold.

US annual inflation rates back to 1980 (YoY%)

The breadth is just as worrying as the rate

There was broad-based strength with food up 0.9% MoM, used cars up 1.5%, medical care up 0.7%, recreation up 0.9% and apparel up 1.1%. Owners’ equivalent rent was up another 0.4% MoM and this was one of the weaker components! The breadth of price pressures was also underscored by the fact that Tuesday’s National Federation of Independent Business (NFIB) survey showed a record 61% of companies raising their prices in the past 3 months. During the past 48 years there have been periods of pretty intense inflation pressures, so for the survey to be at an all-time high shows that the Fed has got work to do.

Wage pressures also continue to build as the desperate hunt for suitable staff continues – remember there are 1.7 vacancies for every unemployed person in America. Given firms clearly have pricing power they can pass higher costs on, which risks keeping inflation much higher for much longer.

NFIB survey shows record proportion of companies increasing their prices

For inflation to average 2% – the Fed's target – we need MoM readings to trend around at 0.18% MoM. None of the major components are close to this (aside from education at 0.1%, but this only has a weight of 6.4%). As such the risk of a 50bp move is on the rise for March. We will have to wait to see how the individual members are seeing things, but after a strong jobs number last week the case for taking some steam out of the economy is getting stronger.

Political ramifications, but annual inflation should start to slow

We can see that elevated inflation is negatively impacting consumer confidence. In fact, University of Michigan sentiment is at lower levels than during the depths of the pandemic in 2Q 2020 when Covid containment measures were at their most intense. The rising cost of living is outpacing wage growth so spending power is being eroded. This is not only a problem for the Fed, but it has ramifications for the mid-terms in November as well. If the President’s policies are seen as being partially responsible, he and the Democrat party could face a voter backlash.

Inflation is primarily being caused by supply constraints in a strong demand environment. There is evidence of some of the microchip shortages easing, while the worker participation rate increased a fair bit in the January jobs numbers. The chart below shows the housing components of CPI, which have the largest weight within the CPI basket, will hopefully start to peak out during the summer, based on house price movements and the pick-up in mortgage borrowing costs. Meanwhile, second-hand car prices, which have risen 55% since June 2019, should fall sharply as production of autos is ramped up in response to improved supplier deliveries.

Housing impetus may soon peak

50:50 for 50bp

Despite this we expect the Federal Reserve to hike interest rates five times this year (with a clear risk that the first move is 50bp in March) and this will contribute to demand and supply starting to move into a better balance, but it of course comes at the price of lower growth rates. Moreover, we would still expect inflation to be in a 3-4% range ahead of the mid-term elections and so this could remain a challenge for President Biden and the Democrats.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article