New Money II: The fundamentals

The value of money is a “social construct”, a collective agreement between citizens that is always changing. As such, debates about alternative monetary systems are multi-layered, with questions about the impact on business and society at large

Money has value as long as we all agree on it

Why does money have value? Unlike the gold coins of the past, most forms of money we use today lack inherent value: they are just a piece of paper, some scraps of metal, or a few pixels on a screen representing some number. So it is clear that modern money does not derive its value from its physical, or otherwise objective, properties. In fact, the concept of “value” is a very human one. Would gold have value in a world without people? The value of money is based on its collective acceptance as a means of exchange. In other words, money is a “social construct”.

This means there is no fundamental difference between bitcoin and the euro. Both are accepted by their respective communities. Of course, there is an immense practical difference. The euro’s community is a lot bigger. Also, it certainly helps that eurozone governments are part of it, requiring their citizens to pay taxes in euro, while disallowing bitcoin tax payments. Yet governments, and the law designating the euro as the eurozone’s legal tender are themselves social constructs, implicit collective agreements between citizens that are evolving over time. In the end, most of the human world functions the way it does because we all collectively agree that it should function like this.

If money is a social construct, its physical or digital appearance really does not matter, as long as basic requirements about scarcity and reliability are met. Which is why cans of mackerel, pieces of paper, bits and bytes moved around by banks, as well as tokens logged on a blockchain can, in principle, all function as money.

The many different incarnations of money

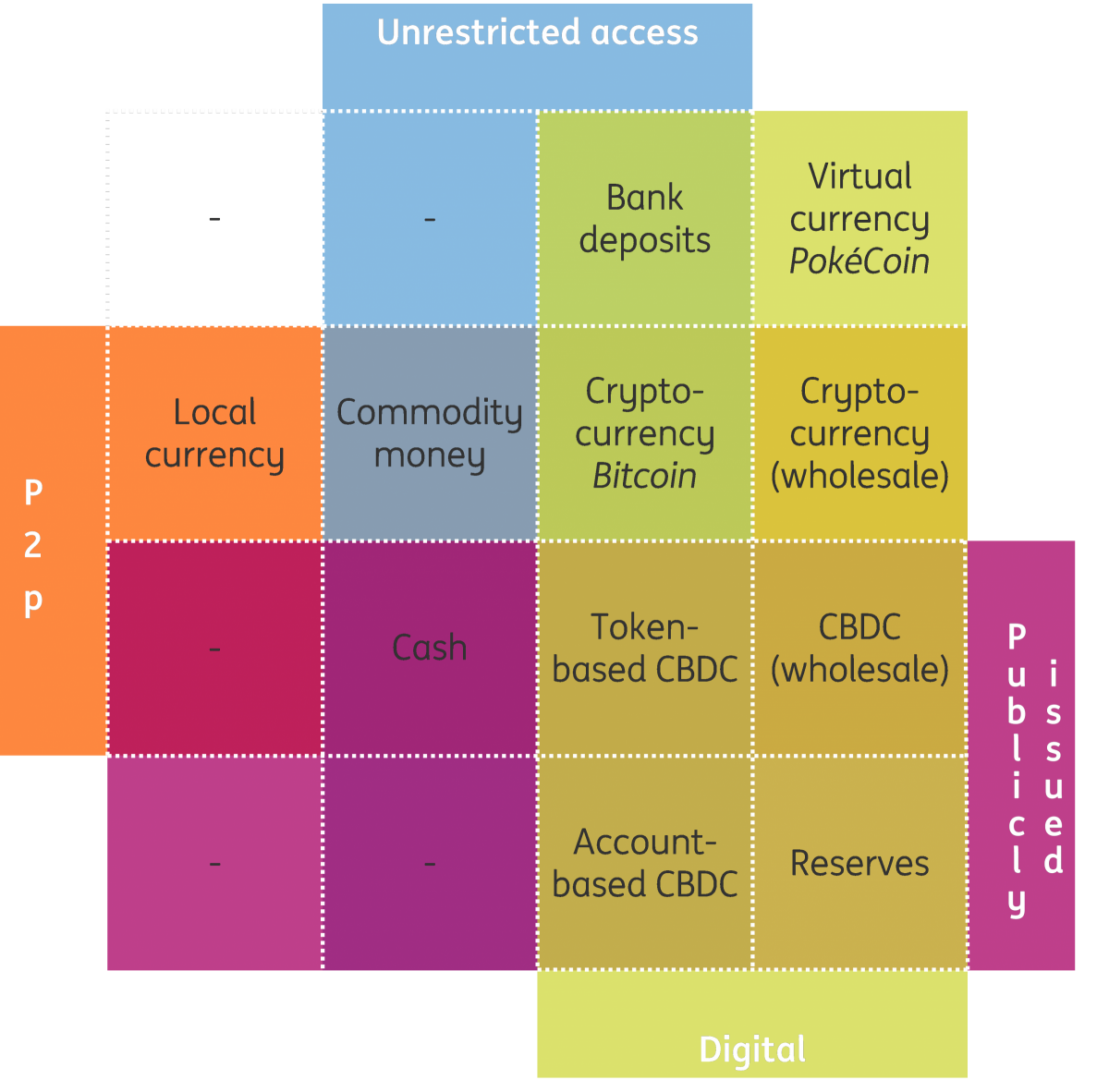

There are many ways to bring some order in the world of money. A useful one for our purpose is the “money flower” (BIS 2017). This uses four characteristics to distinguish different sorts of money:

- Governance and administration: Money issuance can be public (typically involving the central bank) or private (e.g. issuance by a commercial bank or on a decentralised blockchain);

- Accessibility: Access to money can be restricted (e.g. for wholesale parties only) or unrestricted;

- Form: Money can be physical or digital; and

- Transfer mechanism: money can be account-based (meaning the payer's balance is checked before a transaction is done) or peer-to-peer (meaning the money token itself is verified, as in physical cash and cryptocurrency transactions).

Combining these four characteristics yields a matrix with 16 cells. At least 11 of them can be populated with existing forms of money (though not always money from a legal perspective). So who thought the world of money was dull and boring?

The many incarnations of money

Disentangling current debates about money

Although we take the function of money for granted in our daily lives, there has always been debate about the setup of the monetary system. The recent intensification of this debate can be traced back to three developments:

- The Global Financial Crisis and its aftermath shook trust in the financial sector, and sparked fresh thinking about financial regulation, stability and the monetary system;

- The arrival of bitcoin and its blockchain technology in 2008 opened up technical possibilities to pursue libertarian ideals of financial transactions without the need for private nor public intermediaries;

- Other technological advances enabled fintech companies and platform businesses to enter and “disrupt” the financial sector, in particular the retail payment system.

All of these developments have cast doubt on the existing system and sparked debate on many levels. To facilitate the discussion, it is helpful to zoom into the relevant questions, moving from the abstract and all-encompassing to the concrete and specific:

- Social-philosophical angle.

- To what extent are citizens allowed to be able to safely transact in and hold “public”, “risk-free” money (that is not a liability of a private institution)?

- What are the redistributive consequences of different monetary systems? Who gets to decide on policies that produce these consequences? Examples are redistributive consequences of inflation, interest rate policies and of moving towards a cashless society.

- What is the trade-off between convenience (the ease of using money) versus privacy, data ownership and anonymity?

- What financial and non-financial risks are households exposed to, and what degree of protection should they receive?

- Financial stability angle: Discussion of the trade-offs between financial stability on the one hand and some of the other goals mentioned in the bullets here, such as privacy or disintermediation.

- Economic angle: Discussion of money supply and demand properties determining inflation, and of the trade-offs between, say, economic growth and the availability of credit to fund it, as well as other goals.

- Tech angle: What setup is feasible? What are the possibilities, limitations and trade-offs from a technical perspective? How about cybersecurity?

- Business model angle: What would be the effect of different monetary reforms on the business models of financial services providers, and of their clients?

Any alternative to the current monetary system will come with trade-offs compared to the current system. These trade-offs will present themselves at all levels, both in the alternative system and during the (hypothetical) transition towards it. What trade-offs will society be prepared to accept?

In the coming articles, we will discuss some alternative systems and the trade-offs they bring with them. Given that money and finance are the plumbing of the economy, any changes to the system, whether incremental or fundamental, should be considered carefully.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

New MoneyDownload

Download article

27 February 2019

New Money: A new chapter for central banks and capital markets This bundle contains 6 Articles