New environmental rules reshape global shipping

The global shipping industry emits 18% of all air pollutants. New regulations will lower the allowed sulphur exhaust of ships from the current maximum of 3.5% to 0.5% from 1 January 2020 onwards. This has major consequences for the global shipping industry.

- Analysts expect that 4,000 ships of the global merchant fleet will try to comply with the new regulations by fitting scrubbers by 1 January 2020 and about 5,500 ships by the end of 2020 (approximately 6% of the world fleet by vessel count). From our analysis, we conclude that this will mostly be among the largest ship types.

- We expect that the majority of ships and in particular smaller ships will switch to low sulphur fuels.

- The expected rise in prices for containerised shipping is up to 25%, assuming that the rise in fuel costs is fully passed on in higher shipping tariffs.

- If not fully priced on, competition and overcapacity may incentivise shipping companies to reduce speed to save on fuel costs. This will cut shipping capacity.

Environmental regulation is closing in on shipping

A few months from now, the new regulations by the International Maritime Organization (IMO) will take effect. Current sulphur exhaust is capped by the IMO at 3.5% of total exhaust by ships in most of the open seas, and 0.1% in the so-called Emission Control Areas (ECA’s) along the EU and US coasts. From 1 January 2020, the maximum share of sulphur exhaust is no longer allowed to be higher than 0.5%.

For shipping companies, the three most viable options to reduce their sulphur exhaust to 0.5% are: switching to very-low sulphur fuel oil (VLSFO), ultra-low sulphur fuel oil (ULSFO) or Marine Gas Oil (MGO); fitting an exhaust scrubber (a device that washes the exhaust gasses) or a switch to Liquid Natural Gas (LNG).

To ensure compliance it will be illegal for ships that are not fitted with scrubbers to have high sulphur fuel oil (HSFO) on board from 1 March 2020 onwards. The IMO is part of the United Nations and has no authority to enforce the new guidelines itself. Enforcement is delegated to national governments via annex VI of the MARPOL agreement of 1973. Till now, 59 countries have ratified this annex. Enforcement relies on these countries and is likely to be ensured by national Port State Control Inspections (PSCI's).

Smaller ports of countries that do not have the capacity or have not ratified annex VI, may not enforce the new regulations. In particular, ports along regional shipping routes between smaller countries may lack enforcement. Therefore, shipping companies along these routes have an incentive for non-compliance. Industry experts said that the expectation for non-compliance is about 10% of all shipping movements.

How to comply with the new rules

- Very-low sulphur fuel oils (VLSFO)

To meet the current restrictions, the majority of the shipping companies will switch to burning very low sulphur fuel oils with a maximum of 0.5% sulphur (after this VLSFO). Most ships already have a separate fuel tank and already burn ultra-low sulphur fuel oil (ULSFO) or marine gas oil (MGO) (both 0.1% compliant) when entering the ECA’s along the European and US coasts. The ports along these coasts facilitate ULSFO bunkering. But it remains a question of how much refiner capacity is available to facilitate the mass transition to VLSFO.

If low sulphur fuel is unavailable in a port, vessels can get a waiver and are allowed to bunker high sulphur fuels (HSFO). However, this is also quite costly for shipping firms as they will need to unbunker the high sulphur fuel and clean fuel tanks at the first next port that offers bunkering of low sulphur fuels.

- Scrubbers

The second option for compliance is fitting ships with so-called exhaust scrubbers. An exhaust scrubber is a device that cleans exhaust gasses with water. Ships with scrubber installations are allowed to run on HFSO under the new regulations. This means that they can benefit from the lower price of HSFO.

Most common are open-loop scrubbers that wash the exhaust with seawater and dispose of the wastewater after some cleaning back in the sea. This reduces the amount of chemicals to be disposed of onshore. Alternatively, there are closed-loop scrubbers that store the scrubbing waste on board. In addition, there are also hybrid scrubbers that can do both.

Closed-loop scrubbers require ship owners to dispose of the exhaust waste, which is difficult and costly. However, open-loop scrubbers are a source of environmental concerns. The chemicals and exhaust waste washed into the sea are reasons for large ports to prohibit the use of scrubbers in their waters. In addition, there are concerns about a possible future prohibition of open-loop scrubbers by the IMO. Although industry experts say that any regulation by the IMO will only target new scrubber installations and not existing ones, considerable uncertainty remains as to how long scrubbers will be allowed. This is especially the case given the IMO 2050 cut in carbon exhaust to 50% of 2008 levels.

- Liquid Natural Gas (LNG)

LNG is a particular type of low sulphur fuel. Switching to LNG requires a more intensive and costly conversion process compared to the other solutions. It requires a modification of the engine that may not be possible for every ship that is not LNG-ready. In addition, LNG bunkering infrastructure is lacking and unavailable in most ports. Therefore, a backup fuel tank needs to be present. The installation of a separate gas tank means that, often, transport capacity will be lost and that the ship, likely, will need to be rebalanced. This is a costly process to keep a ship idle for a while. On a large scale, LNG only seems a viable consideration for new-build ships. New ships will face the problem that few ports offer LNG bunkering infrastructure. LNG is environmentally the cleanest option, as carbon exhaust is about 20% less than with traditional fuels. Despite being momentarily the cleanest solution, LNG is not compatible with the IMO 2050 carbon cut of 50%.

The costs of very-low sulphur fuel oil (VLSFO)

In the months up to the imposition of the new sulphur limit, most ships will switch to burning VLSFO. After this switch, it will still take a couple of months before the sulphur exhaust by ships decreases to 0.5%. This is because it takes a while before the remains of high sulphur fuel oil (HSFO) in the tanks wash away. Switching too late to VLSFO will mean that shipping companies will need to have the fuel tank cleaned to meet the rules by 1 January, which is a costly process.

The cheapest option for compliant fuel will be 0.5% compliant VLSFO blends. Unfortunately, there are currently no reliable market forward rates[1] for these fuels yet. Therefore, we look at the forward rate of 0.1% compliant Marine Gas Oil (MGO), which is more expensive. Currently, 0.5% compliant VLSFO is trading US$90 per ton cheaper than 0.1% compliant MGO. Therefore, we assume that the spread between the forward rates of 0.5% compliant VLSFO and HSFO would be up to US$100 less than the forward spread between HFSO and MGO.

We expect that the price difference between MGO and 0.5% compliant VLSFO will initially become smaller as demand for 0.5% fuel oil will be higher since this is the cheapest option. As supply catches up with demand, the price difference will slide back to what we observe currently. Our estimated bandwidth for the 0.5% VLSFO – HSFO price spread is US$165 to US$300.

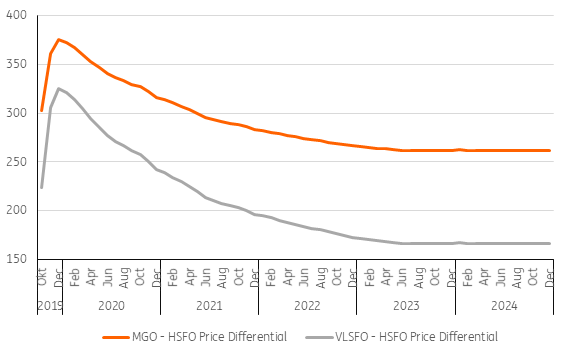

In anticipation of the regulation, most ships will switch to VLSFO in the last quarter of 2019. This is reflected in the steep widening of the price spread between the prices of low sulphur fuels and high sulphur fuel (Figure 1). On one hand, higher demand for VLSFO oils will push up its price. On the other hand, lower demand for HSFO will lead to lower prices of heavy fuels. In particular, because HSFO is a residual product with limited options for other use.

In the medium term, the price difference is expected to narrow again (Figure 1). As refineries are adjusting their supply to the increased demand, prices of VLSFO are expected to decrease a bit. On the other hand, as more refineries upgrade cracking capabilities (the ability to further refine HSFO), demand and prices of HSFO are expected to rise again.

[1] Forward rates are the implied prices for which one can secure a delivery of fuel oil at a specified future date.

Figure 1: Expected price difference in high sulfur fuels and IMO 2020 complaint fuels

How will the industry cope with higher fuel prices

It is expected that most container shipping firms will try to pass through the higher fuel costs to their clients. Depending on ship type and route, the increase in freight rates is expected to be up to 25% (see Annex ii). However, due to overcapacity, the use of scrubbers and competition, the increase may be less. Another way shipping companies could deal with higher fuel prices is by reducing speed. Since fuel consumption is an exponential function of speed, shipping firms will be able to cut their fuel bills considerably by reducing speed. Depending on the extent to which this may occur, reducing speed potentially reduces shipping capacity as well as the supply of containers.

Scrubber Economics

Scrubber installations allow the shipowner/operators to surf the spread between very low and ULSFOs. The spread between the two types of fuel can be considered as the gross-income of investing in a scrubber. The larger the price difference between VLSFO and HSFO, the more attractive scrubbers are.

The investment appraisal of a scrubber

The most important costs associated with scrubbers are:

- Investment costs, which are the costs of fitting the scrubber and the opportunity costs of the ship being idle during the installation works.

- Operating costs that are made up of additional fuel use to power the scrubber, maintenance costs, the costs of disposing of waste chemicals, and financing costs.

On the basis of this information a net present value (NPV)[1] of the investment in a scrubber can be computed for different ship types and a rough comparison can be made. The NPV of a scrubber varies with the spread between HSFO and VLSFO and per ship type.

We computed an expected NPV, using a bandwidth for the expected average fuel spread between HSFO and 0.5% compliant VLSFO of US$150 to US$300.

[1] The Net Present Value (NPV) is the sum of discounted free cashflows generated by an investment. A positive NPV means that the project is economically viable.

Box i: Objections to scrubbers

- Environmental concerns: Open-loop scrubbers wash exhaust gasses with seawater. Although the emitted sulphur may not be blasted into the air, it raises concerns about wastewater discharged in the seas. As of now, the environmental effects of open-loop scrubbers are not clear and more scientific studies are needed on the effects.

- Inefficiency and higher CO2 emissions: Scrubbing is argued to be an inefficient industry model. Instead of removing sulphur at the refinery stage with all the scale benefits, individual ships will be converted into small factories that isolate the sulphur. Since the desulphurization process is taking place less efficiently, the CO2 footprint of a ship fitted with a scrubber increases.

TEU stands for Twenty Feet Equivalent Unit, which is the common unit by which sea containers are counted

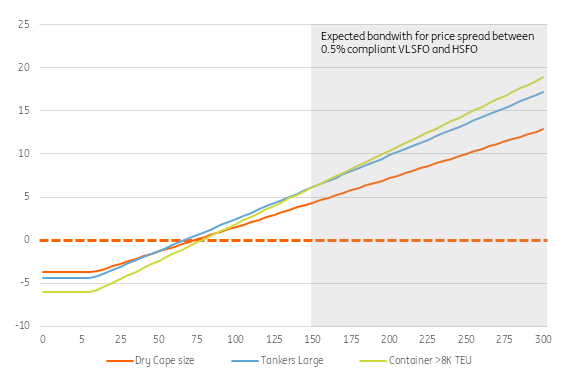

Figure 2: NPV for large vessels (five year investment horizon)

For the NPV we assume a Weighted Average Cost of Capital (WACC) of 8.08%[1], a five-year project horizon and no rest value or further use of the scrubber beyond that term. We find a NPV of US$5 million to US$20 million for the investment in scrubbers for larger ship types (Figure 2). Large ships can achieve a positive NPV investment within the first 2 years with a spread above US$150 and within the first 4 years with a spread above US$100.

[1] Global WACC for transport companies is 8.08% according to Stern-New York University.

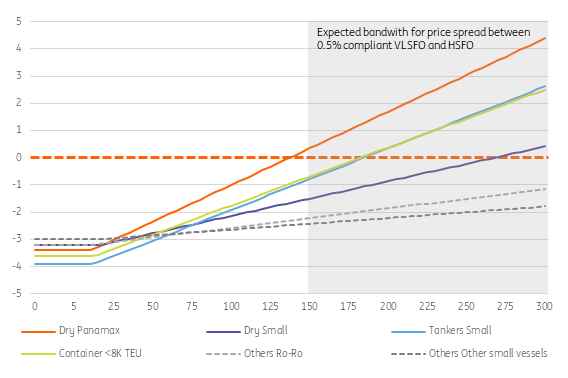

Figure 3: NPV for small vessels (five year investment horizon)

For smaller ships, the NPV’s are considerably lower. For most Panamax vessels and smaller, the NPV varies between -US$1 million and US$5 million. Small tankers and small container vessels only have positive NPV from a spread of US$185. If the spread were to be lower, there is the risk of a negative NPV for these ships over a planning horizon of five years. For Small dry bulk carriers, the NPV is negative for the majority of the expected spread. Roll on and roll off (Ro-Ro) vessels and other small ships show a negative NPV for any given spread (Figure 3).

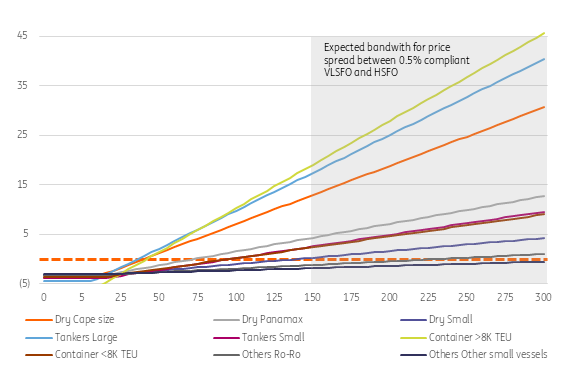

If we assume a longer life span of scrubbers we can easily get higher values for the NPV. Figure 4 shows that with a life span of 15 years scrubbers on smaller ship sizes become economically viable for lower spreads. However, there are two major uncertainties: It is unknown how the spread between HSFO and VLSFOs will develop and the uncertainty increases significantly with time. It can very well be that the spread between high and VLSFO becomes smaller over time due to new innovations by refineries. The second major uncertainty is future regulation that restricts the use of scrubbers. Although it has been said that new IMO regulations will not affect the use of existing scrubbers, there are no guarantees. Especially since attention for environmental standards and climate change is growing globally.

Figure 4: NPV of all vessels (planning horizon of 15 years)

Adoption of scrubbers

Figure 2 and Figure 4 show that especially for large ships, scrubbers are a yielding investment. If the spread remains between the US$150 and US$300, most Panamax size vessels and larger will install scrubbers (Panamax size vessels include container ships larger than 5K TEU and comparable tankers). Due to the uncertainty about the fuel spread between compliant fuel and ULSFOs, purchases of scrubbers are expected to remain limited for the smallest ship sizes.

If the spread remains high, more ships may invest in scrubbers. This fuels demand for HFSO and thereby reduces the price differential between VLSFO and HFSO.

Despite high returns, not all large vessels are switching to scrubbers at 1 January 2020. This is partly rooted in the wait-and-see mentality of the industry, the objections discussed in Box I and dry dock planning. But also at play, is the lack of capacity to install scrubbers. Even if shipping companies are willing to invest in scrubbers, there is a waiting list at the major suppliers. Some shipping companies will first switch to VLSFO before installing a scrubber later in 2020 or thereafter. Therefore, the use of scrubbers will continue to increase after 1 January 2020.

Box ii: Which side of a charter contract will reap the scrubbers’ profits?

Where ship owners charter-out ships with scrubbers to other parties, the question arises: who will reap the benefits from the scrubber installation? The answer to this will depend on the specific location and term for when the ship is chartered. If charterers can choose from multiple vessels with scrubbers from different owners for a particular location and term, some competition will arise. Competition between the shipping companies will drive down the charter rates of ships with scrubber installation below those of ships without scrubbers. For small ships, we expect that only a small share of the world’s fleet will be fitted with scrubbers. Therefore, competition between scrubber-fitted vessels (from different owners), will remain limited for smaller ships. This means that most of the time the ship owner will profit from the scrubber. However, for the large ship types, competition may drive down prices on some occasions.

Currently, the number of scrubbers on order is somewhere around 600 units and 3,500 scrubbers have already been installed. The view of analysts is that over 4,000 scrubbers will be installed by January 2020, which is approximately 11% of the global fleet by tonnage and 4.5% by vessel count. This is expected to increase to 15% of the global fleet by weight towards the end of 2020 (over 6% by vessel count). Following from the NPV analysis adoption will be the highest among the largest ship types.

All in all, on scrubbers can be a lucrative investment (also beyond 2020) if they are fitted on large vessels. Smaller vessels may be better off switching to VLSFO. Despite being a lucrative investment compared to having to switch to low sulphur fuels, scrubbers still imply a higher fuel bill, relative to the current situation. All else equal, this would also mean that vessels with scrubbers may sail at lower speeds to limit the rise in fuel costs.

The environmental road ahead – the next big thing

The IMO 2020 sulphur cap is a major step in improving the air quality of exhaust gasses. This has far-reaching implications for the industry as we have seen. From 2020 onwards, however, the focus in shipping will shift towards climate action. In 2018 member countries within the IMO agreed to cut carbon emissions by 50% in 2050 versus 2008. Although shipping lags other sectors in this goal-setting, this will even be much more challenging.

Maersk, one of the leading shipping companies, has the ambition to move even faster to catch up with the Paris climate goals. Currently, no realistic techniques are available yet to meet the IMO 2050 regulations. Improving fuel efficiency and ship design have potential and will be the first focus. Transition fuels blends of biofuel and LNG will probably be the next call. Finally, future replacement options might be: synthetic fuels, methanol and hydrogen. However, these options require a lot of research and innovation before they become technically and economically viable. Depending on the dominant solution, this will also require substantial investments in different ship configurations.

For the medium term, scrubbers can be a lucrative investment if they are fitted on larger vessels. Smaller vessels (smaller than Panamax) may be better off switching to VLSFO. The increased fuel bill resulting from the transition to scrubbers or VLSFO will drive up transport prices. However, shipping companies may reduce shipping speed in order to limit the price increase and save fuel costs. If this would happen on a large scale, this potentially restricts shipping capacity of the world’s fleet.

Annexes

Annex i.a: Assumptions for different ship types used in NPV calculation.

Annex i.b: Formula NPV calculation

Annex ii. Increase in transport costs

A price increase of up to 25% is a rough estimate. Assuming that a container ship caries about 12,000TEU from Shanghai to Rotterdam, being on route for 30 days, burning 400ton fuel per day. The extra fuel bill is approximately US$250 per container (assuming a spread of US$250, 400t*US$250*30days = US$ 3,000,000, 3,000,000/12,000teu = US$250). Assuming the price of shipping 20ft container from Shanghai to Rotterdam is about US$1000 per TEU, the increase in freight costs would be about 25% if the full price is fully billed to clients. Fuel consumption of 400ton per day on cruising speeds are common, but new, more energy-efficient vessels, are able to burn half or even less than half the fuel. These ships would also see halve the extra full costs per container.

Assumptions about fuel economy are taken from Transportation, Environment, and Society, by Dušan Teodorović, Milan Janić, in Transportation Engineering, 2017

Attributions:

For this study we spoke with various industry experts including Harry Vasse (BEBEKA), Ronald Backers (Port of Rotterdam), Nick Lurkin (KVNR), Stefan Engel (Structured finance, shipping, ING), and Warren Patterson (Commodity Analyst, ING)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article