The Netherlands: Not done growing yet

A less rosy global growth picture, fewer housing market transactions and increasing labour market tightness cause Dutch growth to fall to 2.0% in 2019. Domestic momentum remains strong enough to handle a small external shock, but major foreign risks remain. Wage growth finally increased. Inflation rises primarily due to higher VAT and energy taxes

The Netherlands not immune to (global) slowdown; gradual return to potential growth rate

Dutch GDP growth fell from a strong 0.8% QoQ in 2Q18 to a meagre 0.2% QoQ in 3Q18 while a wide range of survey indicators have clearly come off their peak in 2018. Yet, based on our estimate that the output gap is only mildly positive, the Dutch economy is still growing. Domestic demand continues to be self-sustaining, after eighteen quarters of positive growth in a row. We expect growth to have rebounded somewhat in 4Q18 and forecast it to slow from an annual figure of 2.6% in 2018 to 2.0% in 2019. In 2020, we forecast a return to the potential growth rate of around 1.7%.

| 2.0% |

Netherlands GDP growthING forecast for 2019 |

Soft indicators fell significantly, but still point to decent growth ahead

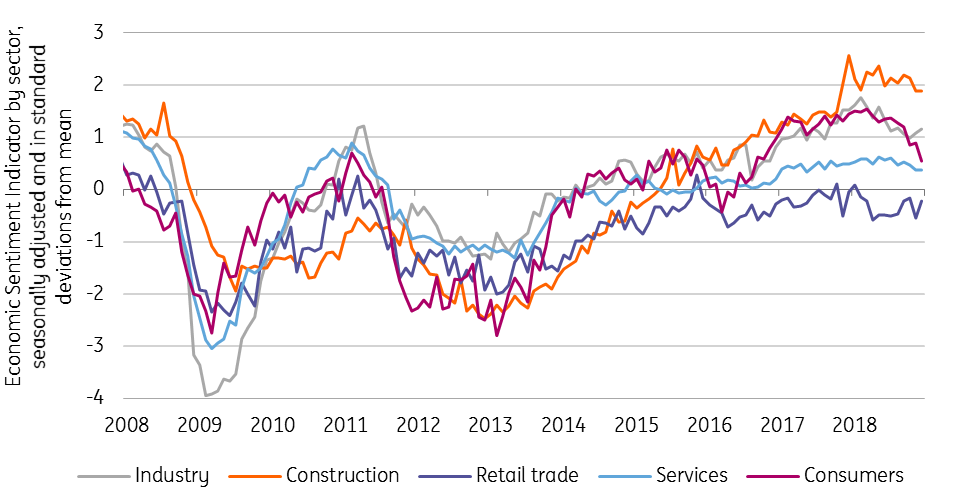

The mood of consumers and industry has turned less optimistic, for industry in relation to foreign activity in particular. Nevertheless, sentiment in general is still more positive than the historical average. Commercial services seem relatively steady in their judgement of the economic situation, while optimism remains mediocre in retail.

Survey indicators lower but still above historical average

Looming risks keep export growth at moderate pace

Export-oriented sectors are being impacted by uncertainty concerning the US trade war with China and Brexit and the consequences of a slowdown in the Eurozone. To date, the direct effect of the trade war on the Netherlands seems negligible, while the anticipated (potentially no deal) Brexit has already caused a fall in Dutch nominal exports to the UK via the depreciation of sterling. The total current account surplus is expected to remain around 10% of GDP. Export growth (3.5%) is projected to be slightly below the historical average in 2019, but somewhat stronger than in 2018 (due to exceptionally weak exports in 1Q18) and weaker than import growth. The yet to be published 2018 figures might show that the Netherlands has become a net importer of natural gas, after decades of surpluses. All in all, we project the net contribution of foreign trade to come in at nearly zero (using the simple method of subtracting the contribution of imports from the export contribution).

Main contributors to domestic demand

Moderating consumption growth, while purchasing power steps up the pace

Domestically, normalisation of the number of home sales resulting from limited supply and increasing tightness in the labour market is limiting (consumption) growth, while the fall in stock markets, the (also low interest-rate related) deterioration of the coverage ratio of a number of pension funds and the VAT hike might have affected consumers towards the end of 2018. Yet, we see real disposable income accelerating significantly in 2019. All in all, we believe consumption growth will moderate to a steady 1.8% in 2019.

Limits of labour market in sight, finally igniting higher wage growth

While the labour market has been a growth engine, it is increasingly becoming a limit to growth. Employment growth peaked in 2Q18, recording 2.5% year-on-year, but we still expect an increase in the number of people finding a job. For a large part, new vacancies have recently been filled by people (re)entering the labour force. As a result, the unemployment rate has fallen more slowly in recent months, to reach a level of 3.5% at the end of 2018. While this might be close to the frictional unemployment level, we forecast unemployment to remain at 3.5% in both 2019 and 2020. Growing businesses will continue to look to make additional hires and will find it increasingly difficult to do so. More than one in four businesses is already reporting a shortage of workers as the main factor limiting production. This increasing tightness in labour demand has finally started to show up in wages, with hourly collective wage (including bonuses) growth increasing from 1.4% in 2017 to 2.1% in 2018.

Policy boosts inflation in early-2019 while wage inflation slowly feeds trough

During the course of 2019, we believe wage pressures could become visible in inflation figures, while having been largely absent in previous years. Nevertheless, we expect CPI inflation to jump mainly as the result of an increase of the reduced VAT rate (from 6% to 9%) and higher energy taxes, from a moderate 1.7% in 2018 to a high 2.6% in 2019. Clothing and communication will put downward pressure one headline consumer price inflation, while food, energy, hospitality and housing will provide the main positive contributions, in our view.

Slowdown in almost all commercial industries

Almost all industries are growing at a slower pace than last year. Commercial services, including IT and job agencies, construction and healthcare are the sectors that we expect to grow at the highest rates again. Continuing above-average growth of commercial services strongly contributes to our moderately positive investment outlook (for 3.4% growth); investment in ICT-items, in particular, have been popular in recent years and are expected to remain so. The healthcare sector will step up its pace of growth as a result of both policy and demographics, while agricultural sector output will accelerate in the absence of the unfavourable weather conditions experienced in 2018. Gas production decreases and shaves 0.1ppt to 0.2ppt off GDP growth, similar to 2018. This results from the political goal to entirely shut off the gas tap in the Northern Province of Groningen in the medium term, in order to reduce further earthquake risks. Growth in housing investment falls strongly due to supply side restrictions reducing construction output growth.

Public debt low and falling despite fiscal expansion

Fiscal policy is largely in check, with continuing fiscal surpluses and rapidly falling government debt. For the long term, only a minor consolidation challenge remains. Government debt was close to 53% of GDP in 3Q18, clearly below the European norm of 60% GDP. It will continue to decrease and drop below 50% of GDP in 2019, on our forecasts. The four-party coalition government is, however, using cyclical tax revenues for procyclical spending, as well as tax cuts, and for offsetting falling gas revenues. In the first three quarters of 2018, however, the government failed to execute its spending intentions, in part because of difficulties in finding suitable personnel. It remains to be seen whether spending plans can be fully executed in 2019, constituting an upward risk to our fiscal balance projection. Fiscal plans have generally been implemented successfully. Most notable, labour taxes were lowered at the start of 2019, while energy taxes and healthcare premiums rose.

The Dutch economy in a nutshell (%YoY)

Download

Download article17 January 2019

ING’s Eurozone Quarterly: Tiptoeing around the ‘r’ word This bundle contains {bundle_entries}{/bundle_entries} articlesAuthor

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more