Netherlands: Still in sixth gear

The Dutch economy continues to grow above potential and the Eurozone average, but we think there is still ample room for more. Despite marginal wage rates finally accelerating, inflation remains moderate in 2018, before making a tax-induced jump in 2019

Despite the fact that some survey indicators have softened in recent months and a somewhat disappointing first-quarter GDP figure (0,5% quarter on quarter), possibly as the result of geopolitical tensions, the outlook for the Dutch economy for 2018 is still bright.

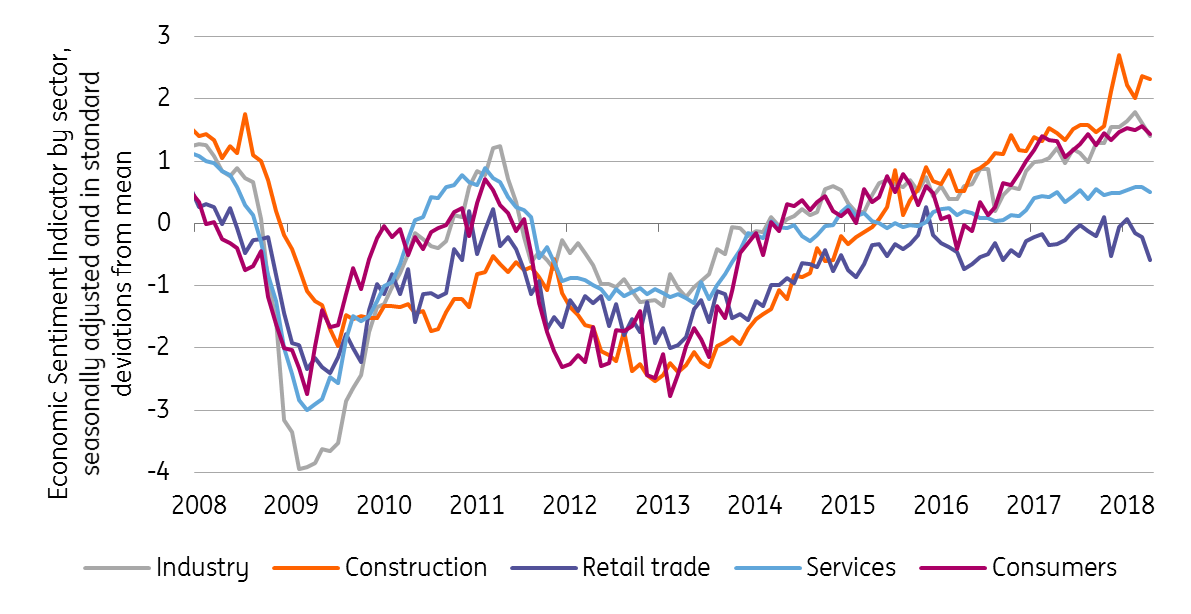

We forecast GDP growth of 2.8%, which means this will be the fifth year of growth above the Eurozone average and the fourth above the estimated potential rate. The drop in sentiment was seen especially in industry and retail in recent months, while confidence of consumers and commercial services hardly changed. While current production held up quite well, purchasing managers indices indicated that industry primarily turned less optimistic about export orders, pointing at downward risks for foreign demand.

Softening in survey indicators

| 2.8% |

GDP growth rateING forecast for 2018 (YoY) |

Consumers are finally spending again

Retail surveys signalled a more pessimistic view on the current business situation. The latter might have suggested that consumers traumatised by the crisis, might still be cautious to spend. As a share of disposable income, consumption of households was hardly rising until the end of 2017. But in fact, private consumption set the highest growth rate since 1998 in the first quarter of 2018 (1,7% quarter on quarter). Finally!

And since the labour market continues to tighten during 2018, we expect consumers to continue being less thrifty during the rest of this year.

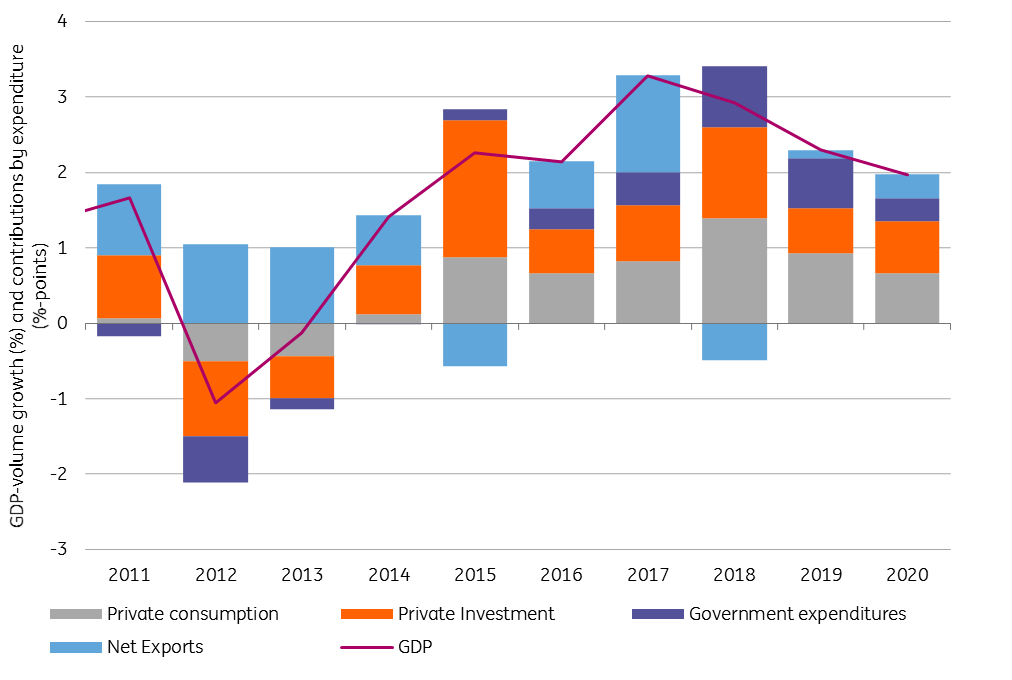

Domestic demand driving high growth

Import growth outpaces exports growth, large surplus remains

While Dutch exports are still expected to grow at the solid pace of 4.3% in 2018, the net contribution of foreign trade will decrease.

We project import growth to increase to 5.6%, as households spend more and the government restricts gas production in the earthquake-stricken province of Groningen.

All in all, exports will remain much higher than imports, maintaining a current account surplus of around 10% of GDP.

Unemployment drop continues

Rising output levels have encouraged businesses to hire more people and they will continue to do so.

Employment rose by 2.1% year-on-year in the first quarter of 2018, while unemployment fell to 3.9%. As a result, unemployment lies already dropped below the estimated natural rate. We forecast it to fall further during the year to 3.5%, reaching an annual average of 3.8% in 2018.

At the margin, wage growth finally starts to accelerate

The persisting labour demand growth and increasing shortages in the labour market are starting to show in wages at the margin.

While wage growth remained very modest in recent years, recently agreed collective wage agreement show an increasing trend in wage growth since the start of 2018. The construction sector agreed on one of the highest pay rises, amounting to an annualised rate of 3.1%, much higher than the actual average collective wage rise of 1.8% realised in March 2018.

Inflation remains subdued

Although labour shortages are rising and finally starting to affect wages, this is only the beginning. As a result, price pressure will increase, but with a considerable lag.

At 1.4%, consumer price inflation will remain subdued in 2018 and is very much in line with Eurozone inflation rates. Food, clothing and communication prices are expected to keep headline inflation at moderate levels.

All industries growing, except gas

Sector-wise, growth has become broad-based, with only gas production declining. Gas production shaves off 0.1 to 0.2% points of growth in 2018, in line with previous forecasts.

Ambitions to further shut off the gas tap may cost between 0.5 and 1% of GDP beyond our forecast horizon. Commercial services, including IT and job agencies, construction and health care are the sectors that grow at the highest rates. The solid growth in commercial services, which is responsible for more than half of capital formation, contributes to the steady investment outlook of 6.2%.

Public finances in line with European norms despite expansionary stance

After the fiscal balance improved to 1.1% of GDP in 2017, it will remain in surplus in 2018 for the third year in a row.

In years to come, the fiscal balance will continue to hover around 1% of GDP. The Rutte-III government uses additional cyclical tax revenues to offset falling gas revenues as well as to spend more and cut taxes rather than improving the primary balance. The procyclical additional spending on defence, education, R&D, civil service and infrastructure provides a contribution to GDP-growth of about half a percentage point in 2018. Government debt was 56.7% of GDP at the end of 2017, below the European norm of 60% GDP. It will continue to decrease as a result of cumulating surpluses and the assumed continuation of the sale of the ABN AMRO bank.

Why we expect above potential growth in 2019

Beyond 2018, there is still ample room for the Dutch economy to grow for a number of years, considering the size of the output gap in previous business cycles.

We expect GDP growth in 2019 to come in around 2.4% and slowly normalise in the direction of the estimated potential annual rate of 1.7%. Fiscal policy will remain expansionary in 2019, mainly via decreasing labour taxes, boosting GDP-growth by roughly 0.3%-point. CPI inflation will be much higher in 2019, projected at 2.6%. This is mainly due to an increase of the reduced VAT-rate (from 6% to 9%), which most notably will affect prices of food items and some services almost one-to-one. Furthermore, cumulating wage pressure might start to affect prices in 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 May 2018

ING’s Eurozone Quarterly: A slower cruising speed This bundle contains 12 Articles