Natural gas supply concerns ease – but only for this winter

Day ahead European natural gas prices have fallen by as much as 82% this month. Milder weather and the continued filling up of storage have eased immediate supply concerns. However, 2023 will be a tougher year for European gas markets, particularly over the 2023/24 winter

Prompt natural gas prices collapse

European gas prices are collapsing as we head into the winter season. TTF day-ahead prices have fallen as much as 91% from their peak in August, trading to their lowest levels since June 2021. TTF next-hour prices fell briefly into negative territory recently, reflecting a very well-supplied spot market. Weaker prices will come as a relief to consumers and politicians in the EU.

Milder than usual weather for this time of year has meant that heating demand has been lower, whilst also allowing EU gas storage to continue to fill up. According to data from Gas Infrastructure Europe, EU gas storage is now more than 94% full. Not only is this above the five-year average, but it is also well above the EU’s initial target of having storage at 80% full by 1 November this year. Meanwhile, German storage is almost 98% full.

While the weakness in prices provides some relief to consumers, a concern is whether lower prices will stimulate demand once again. European fertiliser producers have already started to bring back curtailed capacity, following the recent weakness in prices. If we see this happening on a larger scale, clearly Europe’s efforts to refill storage next year will be more difficult.

There are still concerns for Europe over the longer term, particularly through 2023 and into 2024. The front end of the TTF forward curve is in significant contango with Feb-23 TTF futures trading in excess of EUR140/MWh (vs. day-ahead at between EUR40-45/MWh). The forward curve through 2023 until early 2024 remains fairly flat at these elevated levels.

EU gas storage % full

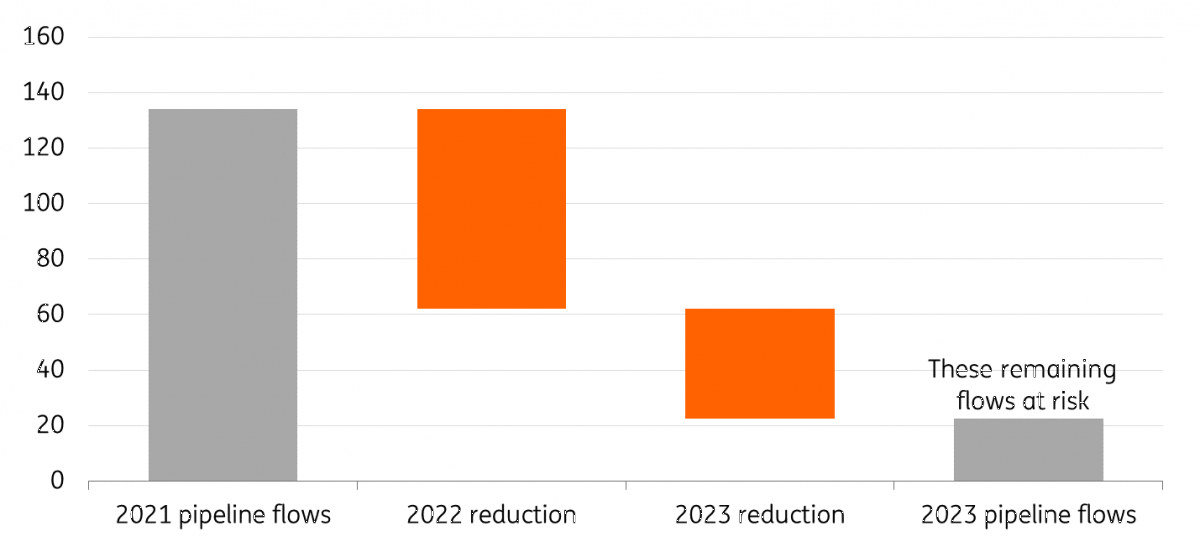

Russian annual gas flows will be significantly lower in 2023

A significant increase in liquefied natural gas (LNG) flows and demand destruction (due to the high price environment) has ensured that the EU has built inventories at a good pace this year and also allowed the region to exceed initial targets. This has come at a time when Russian pipeline gas flows have fallen significantly. The latest data shows that year-to-date pipeline flows from Russia to Europe have fallen by around 50% year-to-year to roughly 58bcm. And, obviously, these flows have declined progressively as we have moved through the year with reduced flows via Ukraine and Nord Stream. Daily Russian gas flows to the EU are down around 80% YoY at the moment.

So, if we assume no change in Russian volumes from the current environment (via Ukraine and TurkStream only), annual Russian pipeline gas to the EU could fall by a further 60% YoY to around 23bcm in 2023. And clearly, there is a very real risk that the remaining flows via Ukraine and TurkStream are halted.

Russian pipeline flows to the EU (bcm)

Not enough LNG to fill the shortfall

The LNG market has helped Europe significantly this year. LNG imports in August made up 41% of total EU imports, a significant increase from 19% in August last year.

However, there are constraints to how much more LNG Europe can import. There are reports that LNG carriers are queuing waiting for spots at regasification units. This highlights the lack of regas capacity in Europe at the moment. Although this queue of LNG carriers could also be partly due to market players wanting to take advantage of the significant contango in the front end of the TTF curve.

The EU has seen the start-up of a fair amount of regasification capacity in the form of floating storage regasification units (FSRUs) over 2H22. The Netherlands, Germany, Finland/Estonia have or are in the process of starting up operations at these FSRUs with a combined capacity in the region of 23-27bcm. Whilst Germany is expected to bring a further 15bcm of regas capacity online early next year. This will help with some of the infrastructure constraints Europe is facing, but the issue is also around global LNG supply and the limited capacity which is expected to start up next year.

Global LNG export capacity was set to grow by around 19bcm in 2023, driven by the US, Russia and Mauritania. However, following Russia’s invasion of Ukraine and the sanctions which have followed, it is likely that the start-up of Russian capacity will likely be delayed. The Russian capacity makes up for 46% of the total new capacity expected next year. Therefore, we could see just 10.5bcm of new supply capacity.

The other issue for the EU is competition for LNG. This year, weak Chinese LNG demand has been a blessing for Europe. LNG imports from the world’s largest buyer were down 21% YoY over the first nine months of the year. This would have been due to the higher price environment as well as the demand impact from Covid-related lockdowns throughout the year. However, if we see a recovery in Chinese demand next year, Europe will have to compete more aggressively for supply.

2023 will be tight for Europe

The pace of inventory builds during the 2023 injection season will be much more modest compared to what we have seen this year, given the reductions in Russian supply. The ability of the EU to turn completely to other sources is just not possible. Therefore, Europe is likely to go into the 2023/24 winter with tight storage, which will leave the region vulnerable next winter.

In order to get through the 2023/24 winter comfortably, we will have to see continued demand destruction. This will have to be either a result of market forces (prices needing to trade higher to reduce demand) or EU-mandated demand cuts (the 15% voluntary demand cut at the moment ends in March 2023). While Europe should be able to scrape through the 2023/24 winter if current Russian gas flows continue, it is much more challenging if remaining Russian gas flows come to a full stop.

Therefore, we believe that there is an upside to current 2023 forward values, particularly those towards the end of 2023. Although much will depend on how much storage the EU drawdowns this winter, which obviously will depend on heating demand through the peak of winter.

What could see prices trade lower over 2023?

Firstly, if the mild weather we are currently seeing across large parts of Europe continues further into this winter, it would take some pressure off the market for next year. This could see Europe starting the injection season with already seasonally high storage.

Secondly, a pick-up in Russian gas flows. However, in the current climate it is difficult to see this. Even if there was a will amongst parties to restore flows, operationally this would be difficult at least through Nord Stream, given the damage following the sabotage.

Finally, government intervention is a risk. Although, in a market which is in structurally short supply, intervention will have limited success, in the absence of mandated demand cuts. Gas price caps which continue to be discussed will do little to help resolve the tightness in the European market, if anything they could add further tightness.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

27 October 2022

Scream if you want to go faster This bundle contains 7 Articles