Natural gas rallies from the lows

Natural gas markets have staged quite the recovery over the last couple of months, with prices in Europe, Asia and the US all trading higher. A recovery in demand as economies re-open, along with reduced LNG inflows into Asia and Europe has helped

Europe rallies as flows slow

European gas prices have rallied from their recent lows, with TTF trading back above EUR13/MWh, up from sub-EUR4/MWh back at the end of May, helped out by the re-opening of economies in the region following Covid-19 related lockdowns.

Supply has also had a key role in the market rally. The low prices that we have seen for much of the year meant it made little sense for buyers to take delivery of LNG cargoes, and so we saw a number of buyers in the region cancelling US cargoes. In July, buyers globally cancelled around 45 US cargoes. At times through the year, TTF has traded at a discount to Henry Hub in the US. Between January and May, Europe saw total LNG imports of 46.31mt, up 23% YoY. However, imports between June and August this year totalled 17.64mt, down 10% year-on-year, according to IHS Markit data.

Looking ahead these flows are likely to pick up once again, with the recent price strength, and the fact that cancellations appear to have peaked- for October it is looking as though just 10 US cargoes will be cancelled. TTF is now trading at a premium of around US$2/MMBtu to Henry Hub, compared to discounts we saw at times over 2Q20 and early 3Q20.

Pipeline gas flows also decline

While the market has done its job in reducing LNG inflows, we have also seen lower pipeline flows into Europe.

Russian exports via both the Nordstream and Yamal-Europe pipelines have been lower due to maintenance, with Gazprom likely using the low price environment to do necessary work, and instead meet obligations from storage withdrawals within Europe. Russian gas production hit a low of 48bcm in June, down 12% YoY and the lowest monthly production number since August 2016. Cumulative output over the first eight months of the year totalled 444bcm, down 9% YoY.

Meanwhile, Norwegian flows to the UK and continental Europe have also declined much of this year, likely a reflection of producers using a strategy of value over volume, with them taking advantage of the flexibility they have with some fields. Meanwhile, maintenance would have also had an impact on flows. Latest numbers from the Norwegian Petroleum Directorate shows that cumulative natural gas output over the first eight months of the year totalled around 75bcm, down around 5% YoY.

European storage builds slows

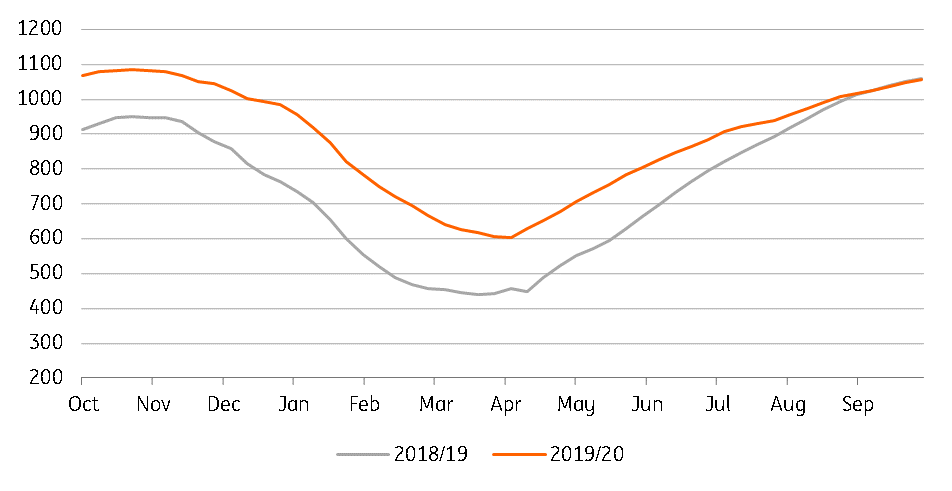

Moving into injection season, it appeared that EU gas stocks would have hit storage capacity well before the start of the new gas season. At the end of March, gas inventories in Europe were around 35% higher YoY, however through the summer, and despite poorer demand in 2Q20, this gap has narrowed significantly, with inventories currently in line with the levels we saw last year heading into the new gas season.

At the moment gas storage in Europe is a little over 94% full according to GIE data. Had it not been for the reduced LNG inflows and pipeline flows, Europe would have likely hit storage capacity well before the new gas season.

EU natural gas inventories (TWh)

Asian LNG price revival

The price strength in the Asian LNG market has also been impressive, with the market trading back above US$5/MMBtu, having traded sub US$2/MMBtu in 2Q20. This has seen the premium that Asian LNG trades to TTF, increase to a little over US$1/MMBtu recently, levels that we last saw back in January.

Like we have seen with US cargoes to Europe, we would have seen cancellations into Asia as a result of weaker demand and prices. In addition to these cancellations and US storm-related disruptions in the US Gulf, concerns over LNG flows from Australia has also been supportive for the Asian market. Maintenance work at Gorgon’s train 2 in Australia has been extended through until early October, meanwhile, inspections will need to be carried out for trains 1 and 3. Although these will be staggered inspections, so as to avoid shutting down the whole facility, with train 1 scheduled to shut down for inspection in early October, whilst train 3 is scheduled to be shut down in January. The shutdown of these two trains could last anywhere between 45 and 90 days each.

Meanwhile, we are also starting to see a recovery in demand in Asia. Between April and August, demand had been sluggish, with it in fact down 1% YoY over the period, to total 98.5mt. However, for September, it looks as though imports into the region will grow by at least 10% YoY, according to IHS Markit data.

Demand should continue to improve as we move deeper into the winter months. NOAA is currently forecasting a 75% chance that La Nina weather conditions occur through the Northern Hemisphere winter, which could mean the potential for colder than usual weather in Northern Asia. If we look at Japan, the largest LNG importer, nuclear power availability is expected to be lower this winter, and so if we do indeed see a colder than usual winter, this should be supportive for LNG demand over the winter months.

La Nina weather impact

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article