Natural gas: deflating times ahead

Natural gas prices have been well supported of late, largely thanks to strong Asian demand, and a generally stronger energy complex has certainly helped. However, we expect European prices to trade lower while Asian LNG prices are likely to remain well supported as long as China demand is robust

Russia drives strong EU injections

The Beast from the East cold weather snap earlier in the year led to a significant drawdown in EU gas inventories, as a result of increased heating demand. In fact, stocks in the region fell below the 5 year low, and to the lowest levels seen at least since 2011. Since then, injections have been strong, which has helped push inventory levels back up towards the 5-year average fairly quickly. This stronger injection rate, and a return to more comfortable stock levels should see European prices ease.

Russia is one of the reasons for these stronger injections, with a pick up in flows, driven by stronger production. Russian natural gas output hit a record 365bcm in the first 6 months of 2018, up more than 6% YoY. However saying that, a brief slowdown in flows from Russia is expected. At the moment the 32.9bcm per year Yamal-Europe pipeline is shut for maintenance, and is expected to remain so until the July 14th. Then the 55bcm per year Nord Stream pipeline is set to close for two- weeks of maintenance starting on the 17th July.

Turning to Norway, and gas production over both May and June fell short of what the Norwegian Petroleum Directorate (NPD) was forecasting. Actual production over the 2 months averaged almost 312mcm/d, compared to a forecast of almost 324mcm/d. There were a number of unplanned outages, which led to output falling short of expectations. Looking ahead, Norwegian output for the remainder of 2018 is expected to average a little over 340mcm/d, leaving it largely flat from 2017 levels.

Russian gas output continues to climb YoY (bcm)

EU power generators seek to continue burning coal

While carbon prices in the EU have rallied almost 100% since the start of the year, it is still more profitable for power generators to burn coal rather than natural gas, and therefore power generators are unlikely to offer much support to gas prices.

In northwest Europe, the dark-spark spread is around EUR2.70/MWh, and so no incentive for generators to make the switch to natural gas. In the UK however it makes sense to burn natural gas, with the spread at a discount of GBP7.50/MWh. The advantage of burning gas over coal in the UK comes down to the carbon tax that the UK has in place, something which is largely absent in other parts of Europe.

EU gas inventories return to 5 year average (TWh)

European LNG reloading

There has been a widening spread between Asian LNG and European natural gas prices. Strong demand from China continues to support prices in the region, and this has supported increased reloading from European ports to Asia, and the spread between Asia and Europe supports prospects for further reloadings moving forward. Additionally LNG from Yamal, Russia is now able to go via the Northern Sea route directly to Asia, rather than shipped via Europe.

Asian LNG demand

Asian LNG prices have been supported by strong demand from China. Latest data through until the end of May shows that YTD imports in 2018 total 19.97mt, up 55% YoY. This has seen China become the world’s second-largest LNG importer, overtaking South Korea, and with only Japan importing more. A large part of this increase has been driven by China’s continued drive to switch from coal to natural gas for heating. However the heating season is now behind us, yet imports remain strong, which suggests the broader move by the government to reduce pollution is proving supportive for demand, be it residential or industrial.

Many had previously expected the global market to be awash with LNG, with the start-up of a number of LNG export terminals, however strong demand growth from China suggests that the global LNG market will, in fact, be tighter than what the market was anticipating. Although this will largely depend on how Chinese demand evolves moving forward.

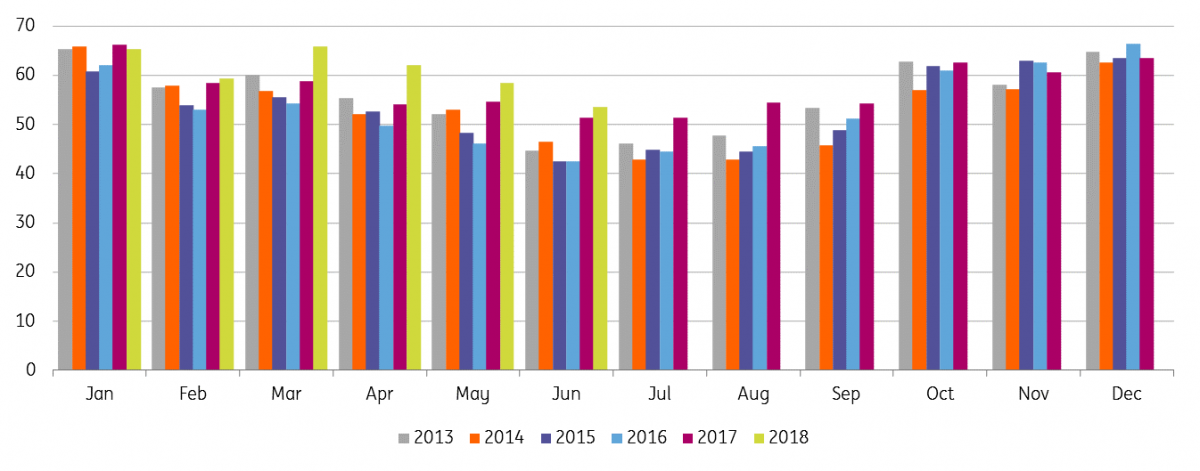

China LNG imports skyrocket (m tonnes)

The only way is up for US supply

US natural gas production continues to trend higher, marketed production hit a record 2.65Tcf in March 2018, up more than 11% YoY. Meanwhile, cumulative production through until the end of April stands at 10.16Tcf, up 10.7% YoY. Expectations are that natural gas production in the US will continue to grow. Output over 2018 is forecast to total 31.9Tcf, and 33.3Tcf in 2019, this compares to 28.8Tcf in 2017.

Strong demand from US power generators

The EIA estimates that natural gas will make up 37% of total US power generation over the 2018 summer, which is basically near the record level that they reached over 2016. Natural gas is set to make up a bigger share of the power mix, with 5.4GW of gas-powered capacity added in the first four months of 2018, whilst the EIA estimate that a further 15GW of capacity will start up by the end of this year. Meanwhile, in the first four months of 2018, 8GW of coal powered capacity was shut, more than the 6.9GW of capacity that was shut over the whole of 2017.

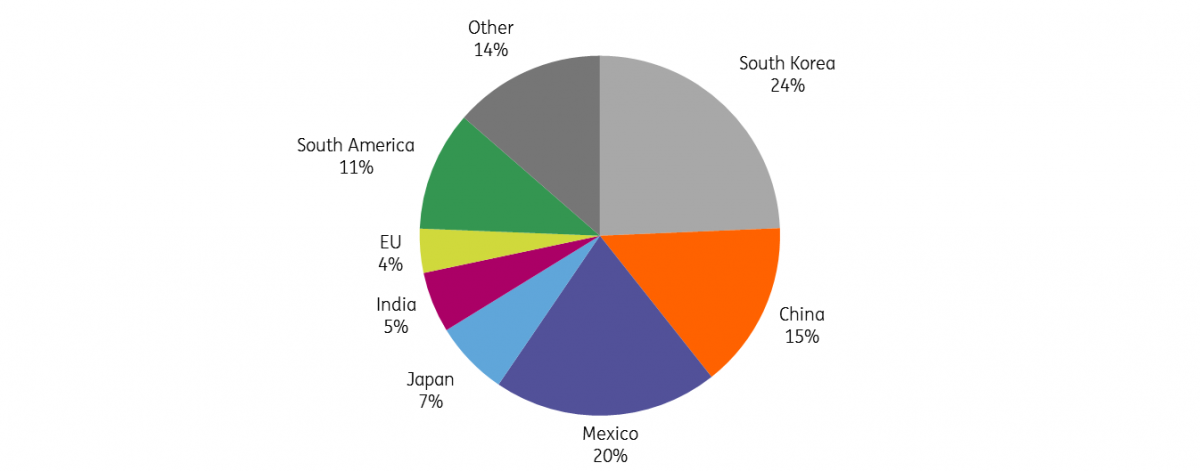

YTD US LNG exports by destinations (Bcf)

US natural gas exports continue to grow

US natural gas exports continued to grow over 2018, YTD exports through to the end of April total 1.14Tcf, up 9.5% YoY. The increase so far this year has been driven entirely by LNG exports, with pipeline exports actually falling by a little over 3% YoY.

However pipeline flows still make up the majority of exports, over the first four months of the year, 821Bcf were exported via pipeline to Mexico and Canada. Over the same period, LNG exports totalled 323Bcf.

So far this year Asia unsurprisingly is the largest buyer of US LNG, making up 54% of the exported volume, with South Korea followed by China the largest buyers within the region. Growing trade tensions between the US and China may raise concerns over future flows of US LNG into China, however at the moment US LNG is not in scope for additional tariffs, and so this flow at least for now should remain largely unaffected we believe.

With the ramp up of further LNG export capacity through 2018 and into 2019, LNG exports are only expected to grow. Over 2018 exports are forecast to total 1.08Tcf, and 1.85Tcf in 2019, compared to 708Bcf in 2017.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more