National Bank of Hungary Preview: Waiting for more clarity

The second half of the year brought a new playbook, with a pause also introduced as an option. We expect the central bank to leave rates unchanged at the July meeting, but the latest communication suggests that further rate cuts seem inevitable. As a result, we are lowering our 2024 terminal rate call by 50bp to 6.50%

Central bank slows pace of rate cuts to 25bp in June

The National Bank of Hungary (NBH) cut its key interest rate by 25bp to 7.00% in June while at the same time unveiling a new playbook for the second half of the year. This means that after sequential rate cuts during the first half of the year, now ‘the Bank will have a substantially smaller room for manoeuvre to lower the base rate’ in the second half of 2024, as we discussed in our previous NBH Review.

The main interest rates (%)

The structure of inflation might warrant a pause in the easing cycle

Headline inflation fell by 0.3ppt to 3.7% year-on-year in June, but the stronger-than-expected repricing of core items led to an upside surprise in the core inflation measure. As a result, this is the first time in 18 months that core inflation is moving higher, while the central bank’s sticky price measure hasn’t fallen further. We can, therefore, conclude that – despite the subdued repricing of the headline rate – underlying inflation indicators signal that Hungary still has an underlying inflation problem.

Not to mention the fact that corporate wage growth is still running hot at 11.6%, which limits the room for services inflation to cool down. At the same time, the phasing out of ‘mandatory discount sales’ could lead to some food price increases, although the impact could be spread over the coming months.

In addition, the recently announced fiscal measures will certainly help the revenue side, but they also have a pro-inflationary aspect as these austerity measures may eventually find their way to the consumers. We, therefore, believe that despite a relatively favourable headline inflation print in June, the overall picture is not nearly as rosy.

Headline and underlying inflation measures (% YoY)

The start of the expected Fed easing cycle could be a relief for the NBH

At the May meeting, the NBH focused on the divergence between Federal Reserve and European Central Bank policy, which could lead to increased volatility in emerging markets. Since then, we've seen a 25bp rate cut from the ECB in early June, so the divergence has officially begun. However, with the latest promising US inflation report, the market has started to price in around 68bp of Fed easing in 2024, an increase of 23bp since the June NBH meeting.

With September increasingly looking like a done deal for the Fed and further rate cuts on the horizon, we suspect that the NBH has regained some confidence that the external interest rate environment may not remain as high as previously expected. In our view, this is one of the main reasons for the NBH's more dovish tone. In this regard, we can highlight the latest communication, which now sees a third rate cut in the second half of 2024 as realistic, compared to the previous communication which only saw two more rate cuts as realistic.

Container freight benchmark rate per 40 foot box (USD)

Despite a more favourable expected Fed rate path, not everything is rosy. It's been a long time since we've written about shipping costs, but that doesn't mean the issue has been resolved. On the contrary, after a significant decline in freight prices between the end of January and April, the tide has turned, with the latest shipping costs rapidly approaching $6,000 by mid-July. In our view, this only further complicates the medium-term inflation outlook and increases the likelihood that goods disinflation will eventually abate and possibly reverse.

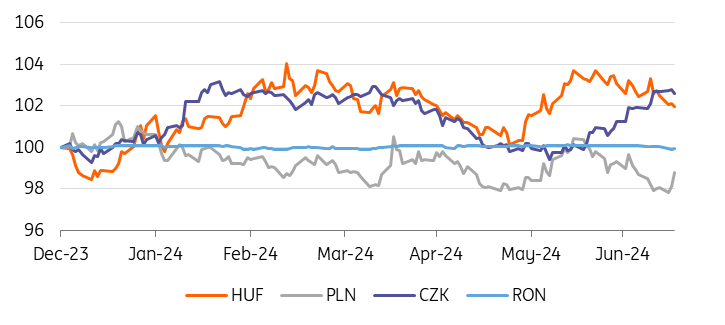

Market stability has largely prevailed since June, but the HUF remains vulnerable

Since the June rate-setting meeting, EUR/HUF has moved lower by around 1% mainly on the back of favourable international developments, coupled with the news of budgetary measures, which reduces the risk of slippage. Despite this, we believe that the forint remains in a vulnerable position as the risk premium needs to be carefully managed.

“The NBH doesn’t overreact to positive data coming in”

This quote is from the latest presentation by Barnabas Virag, Deputy Governor of the NBH, who gave a keynote speech at a panel discussion on 15 July. In our view, the cautious and patient approach of the central bank was reflected yet again, as the Deputy Governor added that:

"The better-than-expected inflation data and improving global risk sentiment in recent weeks do not change the assessment of the monetary policy stance, but may allow earlier implementation of interest rate cuts. The NBH doesn’t overreact to positive data coming in: neither on domestic inflation nor on global risk appetite."

In our view, these comments were deliberate, and we are therefore leaning towards calling for a no-cut at the July meeting – although we acknowledge that it remains a close call between a no-cut and a 25bp cut scenario.

Performance of CEE FX versus EUR (end-2023 = 100%)

Our call

All in all, we see the National Bank of Hungary leaving rates unchanged on 23 July. This means that the key rate would likely remain at 7.00% after the rate-setting meeting, while we expect the Monetary Council to also leave both ends of the rate corridor unchanged.

We lower our 2024 terminal rate call by 50bp to 6.50%

As the first round of reflation brought a lower-than-expected repricing, we lower our year-end inflation forecast for December to the range of 5.0-5.5% YoY from the previous range of 5.5-6.0% YoY. As much uncertainty surrounds the repricing manners of companies in the post-Covid era, we believe that the monthly repricing during the second half of the year will be higher than pre-Covid norms would indicate. This is why we see both headline and core inflation rising above 5% by the end of the year, with elevated wage growth dynamics, the side-effects of tax measures and rising shipping costs further increasing the chances that monthly repricing in the second half of the year will not normalise to pre-Covid norms.

However, given that we have lowered our inflation forecast range by 50bp, and given the increasing likelihood that the Fed is firmly on a rate-cutting path, we believe that the space for further rate cuts by the NBH in 2024 has opened up. In this regard, our alternative scenario has now become our base case. Therefore, we now expect two more rate cuts of 25bp over the rest of the year (the timing of which are highly uncertain), which would bring the key rate down to 6.50% in our view.

Nevertheless, we believe that it may be too early to frontload rate cuts during the summer, and that it would make more sense to wait until at least the beginning of the third quarter of 2024. By the time of the September meeting, external interest rate developments will be much clearer and there will be greater confidence regarding the repricing patterns in the second half of the year.

Therefore, we believe that the NBH is likely to wait cautiously until the September meeting to assess all these developments, and with the release of a new inflation report, it could justify a further rate cut to a greater extent. As such, we do not expect the NBH to make a second rate cut until December, when a new inflation report will be published and the outcome of the US election (which would have a greater impact on the dollar in the event of a Trump presidency) will be known.

Our market views

EUR/HUF is trading this week at its lowest levels since mid-June. We see the reasons for the strong HUF mainly on the global side with a weaker US dollar and dovish news from the Fed. On the local side, we have also seen some improvement on the fiscal side but for us the main story here is the massive rally in the rates market, which has knocked down the rate differential vs EUR significantly. Therefore, we believe HUF has its current strength built on fragile legs and the NBH decision and communication may be a trigger for a recoupling of FX and rates relationship and a reason for HUF weakness. With the market pricing roughly even odds for next week's meeting between no change and a 25bp rate cut, the FX market is likely to be volatile and we lean more towards a weaker HUF either way. If rates remain unchanged, which is our baseline, we can expect central bank rhetoric to be on the dovish side, opening the door for the next meeting's cut. In the case of a rate cut, it is clear that the market would take the current bets on further cuts seriously, and the HUF could no longer ignore the significantly lower rate differential.

HUF rates and bonds have seen the biggest rally among CEE peers over the past two weeks with a flattening bias in recent days. Here, we see both a downside inflation surprise and dovish NBH but also a global rally. While the short end of the curve seems to be on the edge with rate cuts pricing, the longer end still has some room to fall in our view. For this year, the market is pricing in three 25bp rate cuts, which is more than we expect but at the same time not an impossible scenario. The terminal rate for 2025 has also moved down to just under 5.25%, which is still close to our forecast. On the other hand, a 5y5y IRS around 6.50% still indicates room for a decline in our view, regardless of next week's decision.

In the Hungarian government bond (HGBs) space, following the announcement of fiscal measures to keep the government deficit under control at 4.5% of GDP, HGBs are getting into a very attractive situation. The central bank is displaying openness to rate cuts, fiscal policy is showing efforts to keep the budget under control, and at the same time the debt agency has already frontloaded about 70% of HGBs issuance. We see a small problem here in the slower issuance of retail bonds (45% of the plan), which make up about a third of the entire funding plan. However, the other sources of funding are rather above plan, and in addition the debt agency can improve the parameters of the retail bonds if needed. Demand for HGBs in primary auctions remains the highest among CEE peers in July, and although it's declining elsewhere, it remains stable here. Of course, after the rally over the last two weeks, HGBs are less attractive with the 10y yield around 6.50%, but ASWs have widened and we still see good value here.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article